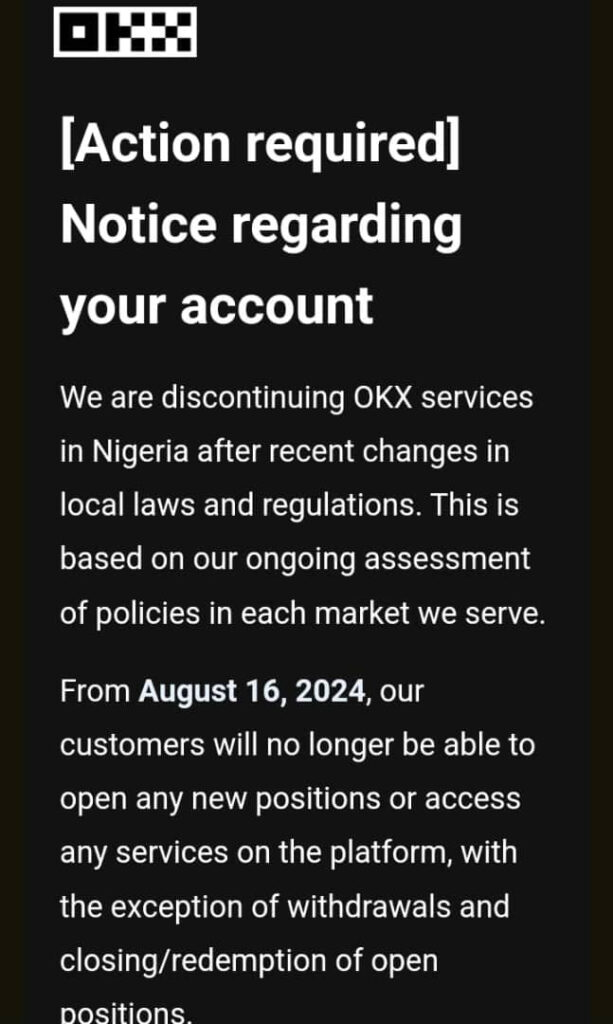

In a surprising move that has sent ripples through the cryptocurrency community, OKX, one of the world’s leading digital asset exchanges, announced its exit from Nigeria. This decision, set to take effect on August 16, 2024, marks a significant shift in the crypto landscape of Africa’s most populous nation.

Understanding the OKX Exit Decision

OKX, formerly known as OKEx, cited “recent changes in local laws and regulations” as the primary reason for its departure from Nigeria. This isn’t the first time OKX has faced regulatory hurdles in the country. In May 2024, the exchange suspended Naira withdrawals, hinting at the growing regulatory pressure on crypto platforms in Nigeria.

But what exactly are these regulatory changes?

While the specifics remain unclear, it’s important to note that Nigeria has been tightening its grip on cryptocurrency operations for some time now. The Nigerian government has expressed concerns about the potential use of digital currencies for money laundering and other illicit activities.

For Nigerian crypto enthusiasts, OKX’s exit is more than just a minor inconvenience. The exchange has given users until August 16 to access the platform’s features. After this deadline, Nigerian customers will only be able to withdraw funds or close out positions. This sudden change leaves many users scrambling to find alternative platforms for their crypto trading needs.

The Bigger Picture: Crypto Regulation in Nigeria

OKX’s departure is part of a larger trend of increased scrutiny on cryptocurrency exchanges in Nigeria.

Earlier in 2024, the Nigerian government accused Binance, another major crypto exchange, of manipulating the country’s currency, money laundering, and tax evasion. This led to Binance ceasing its Naira services in Nigeria and giving users a short window to withdraw funds or convert to dollar-denominated stablecoins.

The Nigerian government’s actions against Binance went further, with the Economic and Financial Crimes Commission (EFCC) demanding that Binance disclose user information for every individual who used the platform to trade.

This aggressive stance has undoubtedly contributed to the challenging regulatory environment that prompted OKX’s exit.

Concerns from the Crypto Community

The crypto community in Nigeria has not taken these developments lightly. Speaking with Cointelegraph, Rume Ophi, a local crypto stakeholder, expressed frustration over the sudden exits of several crypto exchanges from Nigeria. He questioned how these exchanges entered the country and are now swiftly leaving, highlighting the lack of clear regulatory guidelines.

Ophi’s concerns reflect a broader sentiment within the Nigerian crypto community. Many feel that the government’s approach to regulation is hampering the growth of a promising industry. They argue that Nigeria is missing out on opportunities that other countries, like South Africa, are seizing in the cryptocurrency market.

Cointelegraph also reported that Obinna Uzoije, a data and policy expert, emphasized the need for a quicker, more transparent, and more welcoming regulatory framework. He pointed out that the crypto industry has the potential to create numerous employment opportunities for Nigerian youths.

Uzoije argued that the current regulatory approach is not just about cryptocurrency but affects an entire industry of marketers, community managers, developers, and traders.

Global Context and Future Outlook

It’s worth noting that while OKX is exiting Nigeria, it’s not abandoning the global market. In fact, the exchange announced on July 18 that Malta will serve as its MiCA hub to ensure compliance with regulatory requirements in the European Union. This move highlights the importance of clear and supportive regulations in attracting and retaining cryptocurrency businesses.

For Nigeria, the departure of OKX and other exchanges represents a missed opportunity. The country, which has one of the highest rates of cryptocurrency adoption in Africa, risks falling behind in the global digital economy. However, this setback could also serve as a wake-up call for Nigerian regulators to develop more balanced and forward-thinking crypto policies.

Conclusion

OKX’s exit from Nigeria is more than just a business decision; it’s a reflection of the complex relationship between cryptocurrencies and traditional financial systems. As Nigeria grapples with these challenges, the outcome will likely shape the future of digital currencies, not just in the country but across Africa.

For Nigerian crypto users, the immediate future may be uncertain. But in the long run, this situation could lead to more robust and clear regulations that balance innovation with consumer protection.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.