NZDUSD Analysis – October 2

NZDUSD buyers stormed the market on October 2, 2021, as they re-entered the uptrend at the bullish order block. The bias of most participants in the market remains bearish, as it was until the confirmation of the market structure shift in the fourth quarter of last year.

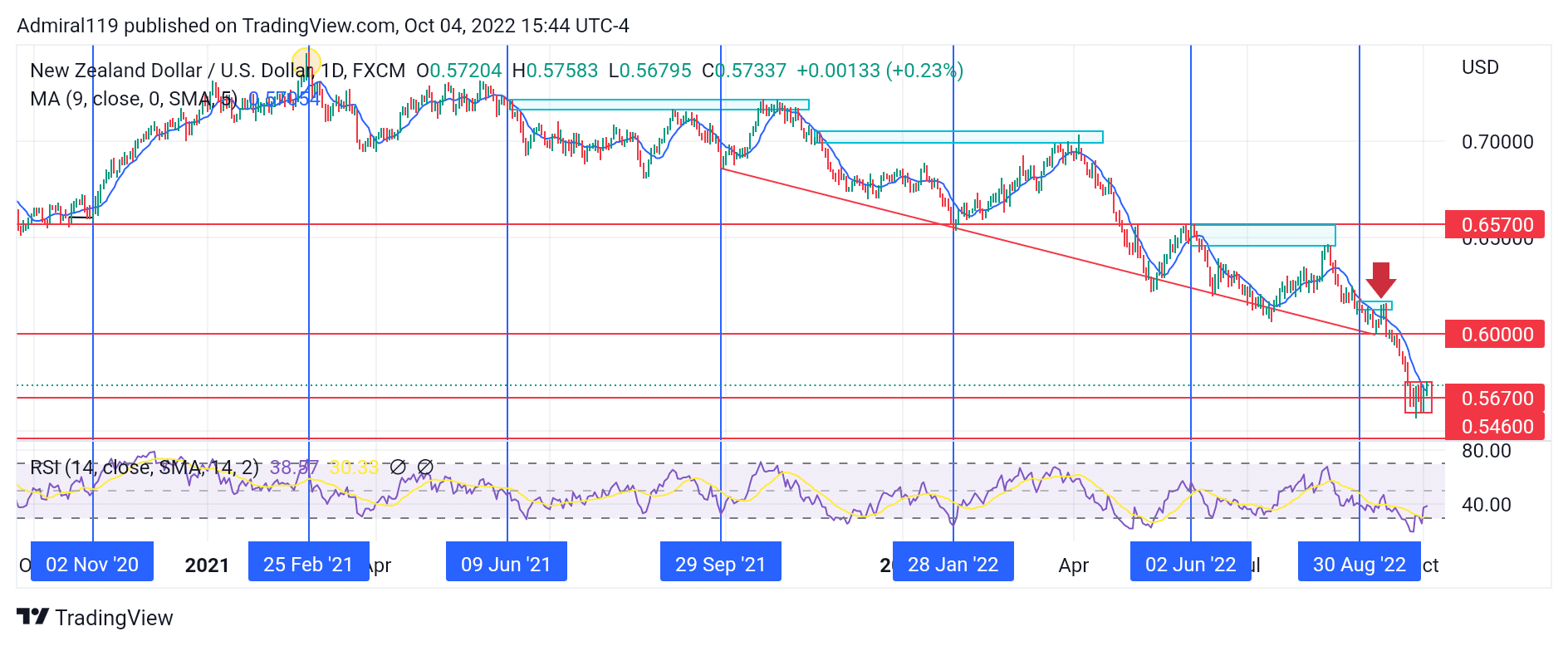

NZDUSD Significant Zones

Demand Zones: 0.5670, 0.5460

Supply Zones: 0.6000, 0.6570

NZDUSD Long-Term Trend: Bearish

The market’s two-year high was formed on February 25, 2021. As the market crashed down away from the local high, a bearish order block was formed on the 10th of June, 2021. This bearish order block was later used to reject prices to the downside, weeks after its formation. On the 29th of September, 2021, before the massive crash was caused by the bearish order block, prices began to respect new diagonal support. The diagonal support was used by the NZDUSD sellers to ride the price to the downside. On the 28th of January, the diagonal support and the previous demand zone were used by the market participants to drive the price upward into the bearish order block. This bearish order block caused a massive downward crash.

With the NZDUSD sellers still riding the diagonal support downward, prices continued to form lower highs and lower lows. On the 2nd of June, 2022, a bearish order block was used to repel the bullish movement on one bounce to the downside. The current impulse wave began after the price filled in the bearish order block that was formed on the 30th of August, 2022. The market is currently in a consolidation phase as the RSI indicator reveals that the market is currently oversold. A correction upward is probable when the price breaks out of the range.

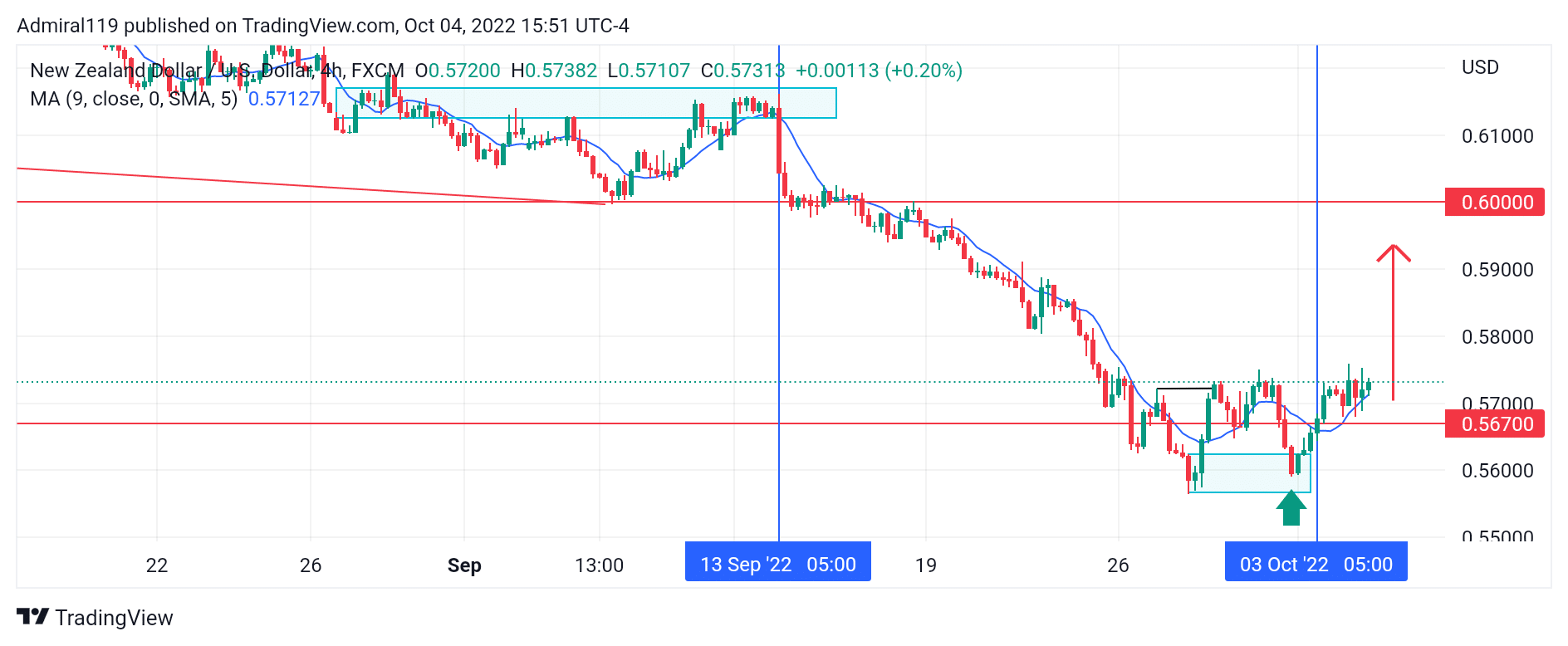

NZDUSD Short Term Trend: Bearish

After the reaction of the price towards the daily order block, the NZDUSD sellers have been relentlessly crashing the market downward. The four-hour chart confirms a shift in the market structure, as prices have broken through the previous high. Due to the shift in market structure to the upside, more buyers are expected to continue to drive the market upward until a higher timeframe PD array is reached.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.