NZDUSD Analysis – October 16

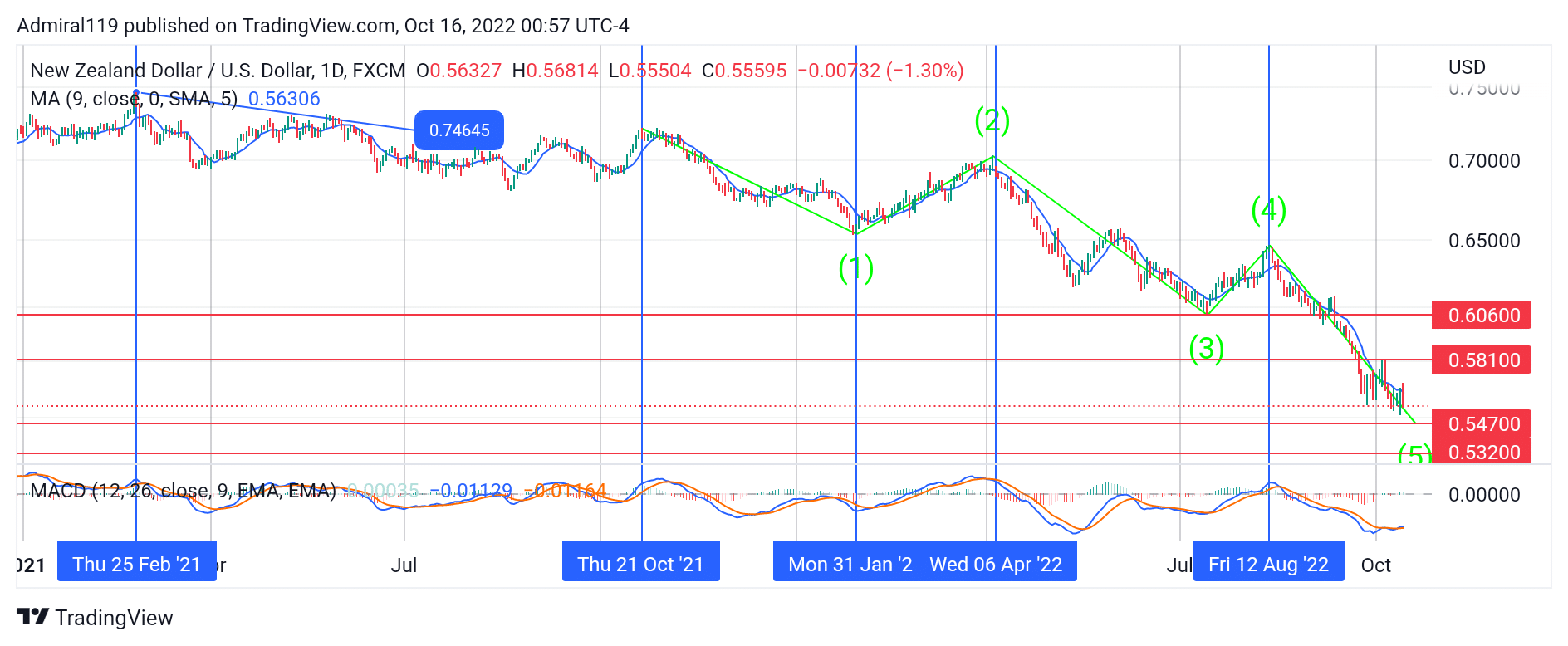

NZDUSD sellers drive the market into a demand zone. On February 25, 2021, the 0.74645 price level marked the current two-year high. Towards October 2021, the market was ranging within a boundary. The NZDUSD sellers have been in total control ever since the range got broken.

NZDUSD Significant Zones

Demand Zones: 0.5470, 0.5320

Supply Zones: 0.5810, 0.6060

NZDUSD Long Term Trend: Bearish

On the 21st of October, 2021, a new motive wave began as prices crashed to the downside. The first impulse swing drove the last quarter of 2021 into a new local low. This new local low was attained on the last day of January 2022. The month of February 2022 saw a bit of an appreciation in New Zealand currency value. The NZDUSD sellers took a break from the market until the year’s high was reached on the 6th of April, 2022. The swift reversal demonstrated by the moving average and the MACD indicators reveals that the bears are completely back in the market.

The third impulse swing, which began on the 6th of April, 2022, happened to be the longest impulse swing so far. With smaller fractals keeping the wave downward, prices crashed toward the 0.6060 level, the previous support level. The short rebuff at support signaled the start of the fourth impulse swing, which lasted until August 2022. On the 12th of August, 2022, the current impulse swing began. NZDUSD sellers seem to have so much confidence in this swing as they drive prices down aggressively.

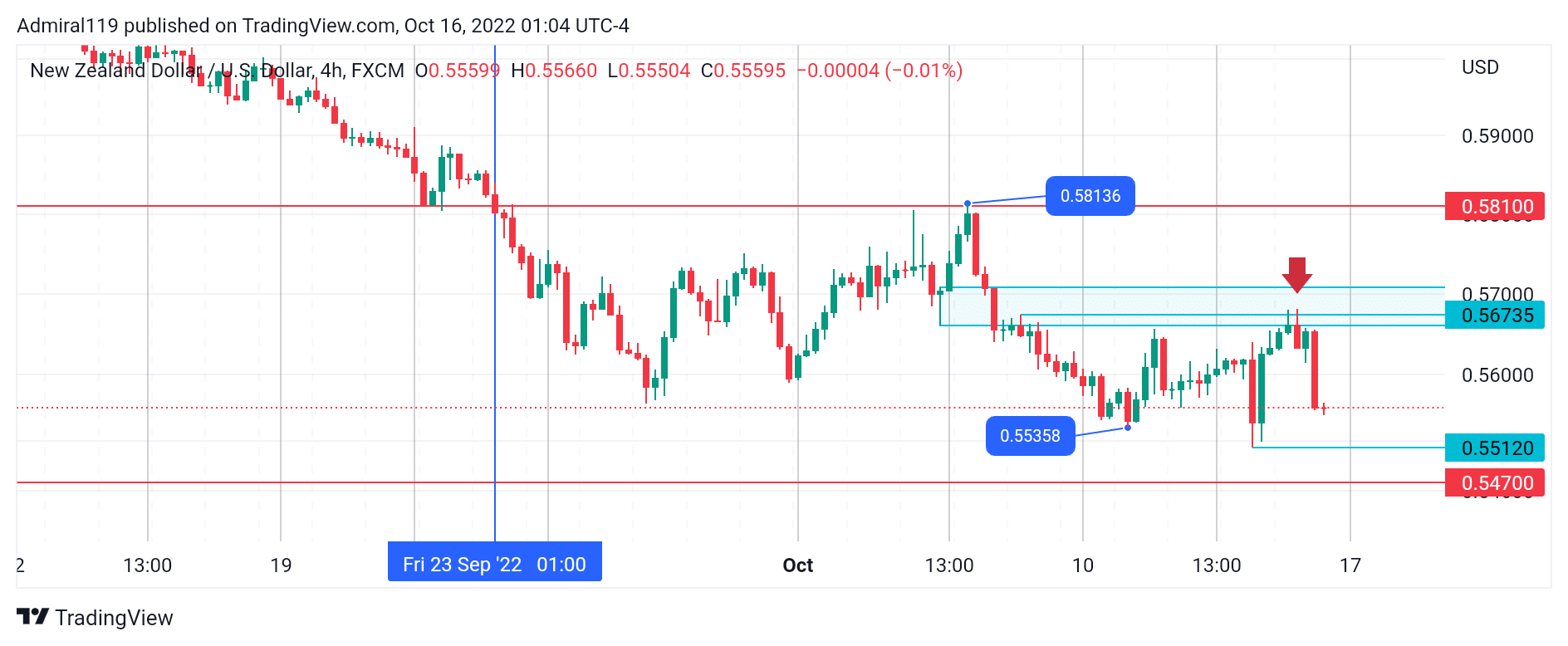

NZDUSD Short Term Trend: Bearish

The price delivery to the downside on the 23rd of September, 2022 confirmed the formation of the order block. The 0.58136 and 0.55358 price levels marked the trading range for the current movement. Following a successful liquidity sweep below the 0.55358 low, the price moved into the trading range to absorb internal liquidity. The NZDUSD sellers are expected to keep driving the price down toward the 0.5470 demand zone.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.