NZDUSD Analysis – November 13

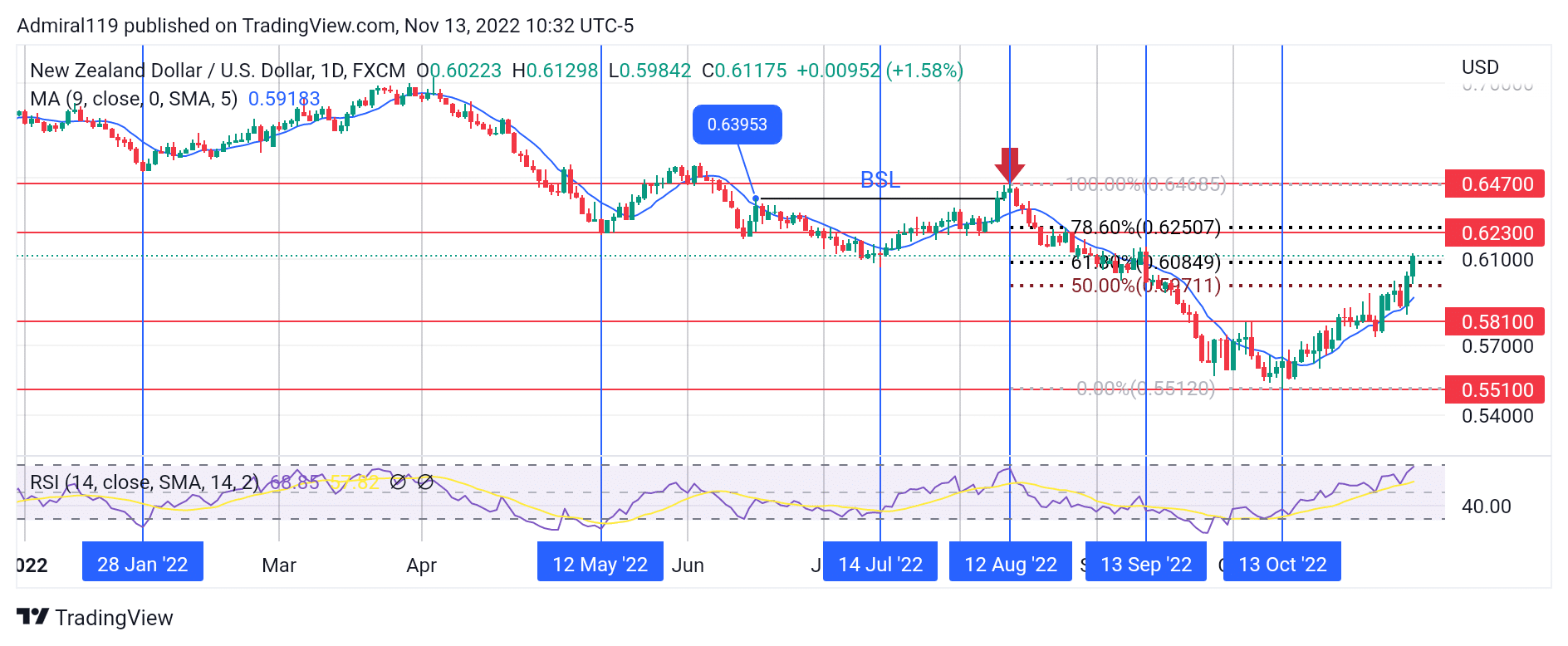

NZDUSD is preparing for a retracement to the downside after hitting the 61.8% retracement level. Until the 13th of last month, the market was clearly in a downtrend. Though the NZDUSD buyers were privileged to make some successful trades as the market retraced upward, for a very long time, the market has been flowing algorithmically as it moves from premium arrays to discount arrays and vice versa.

NZDUSD Significant Zones

Demand Zones: 0.5810, 0.5510

Supply Zones: 0.6230, 0.6470

Until the 0.5810 price level was broken from the downside to the upside, the market’s order flow was typically bearish. The breakout to the upside after bouncing off the 0.5510 demand level confirmed the change of character. On the 28th of January, 2022, the market created a low at 0.6470; this low was later invalidated but retested on the 12th of August, 2022, thereby rendering the level significant.

Prior to this retest on August 12, 2022, the price was seen reacting to the 0.6470 price level. On the 12th of May, 2022, after NZDUSD had stayed in an oversold region for days as revealed by the Relative Strength Index indicator, some short positions were closed in favor of the bulls.

On the 14th of June, the bulls once again took advantage of the overbought indication. Price surged up to strike the 0.6470 resistance and was then submerged aggressively downward. This downtrend continued earnestly into an oversold region in the demand zone of 0.5510.

On the 13th of September, 2022, the price was delivered to the downside after a period of consolidation at the 0.6100 price level. The NZDUSD’s current trading range is defined by the 0.6470 and 0.5510 price levels. The 0.6100 price level also coincides with the 61.8% retracement level, from which a correction to the downside is expected to begin.

Market Expectation

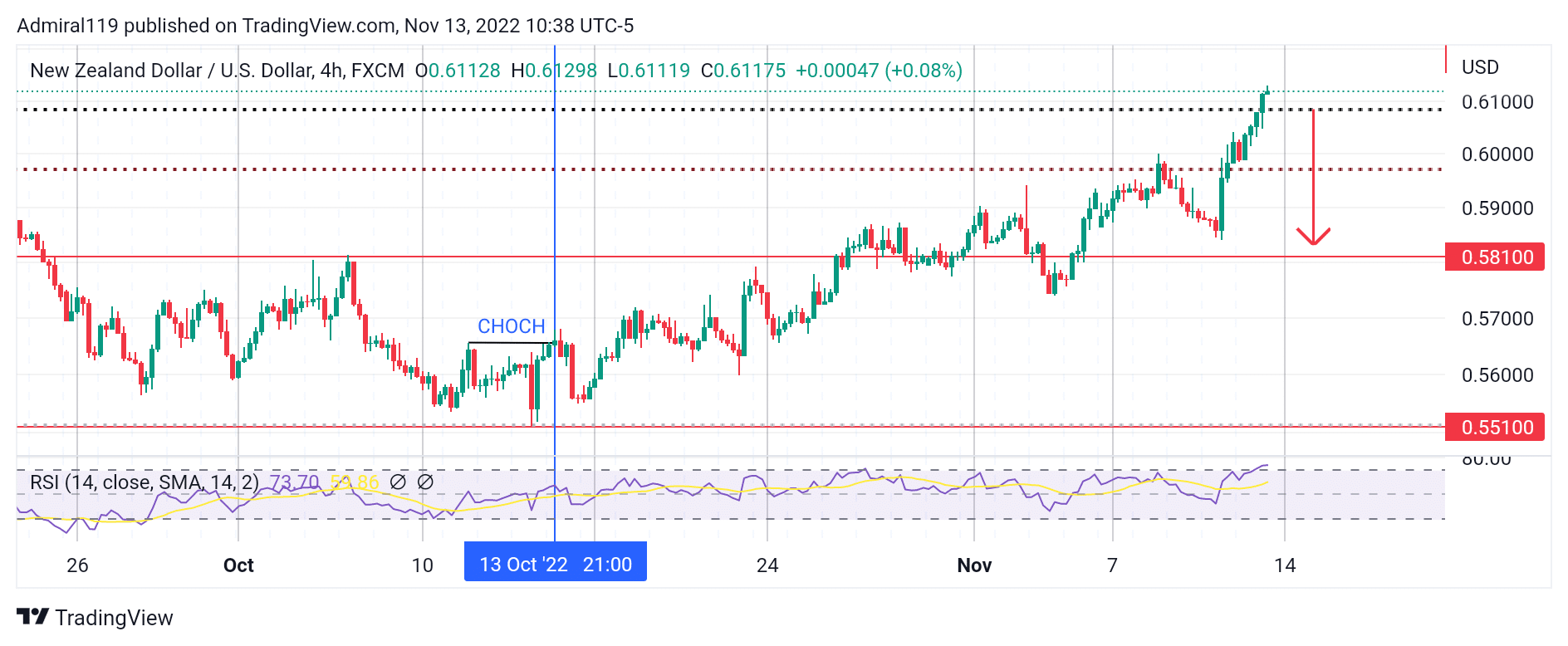

Following the change of character (CHOCH) to the upside, NZDUSD has been bullish on the four-hour chart. At the 61.8% retracement level, the price is expected to correct to the downside, probably towards the 0.5810 support.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.