NZDUSD Analysis – November 20

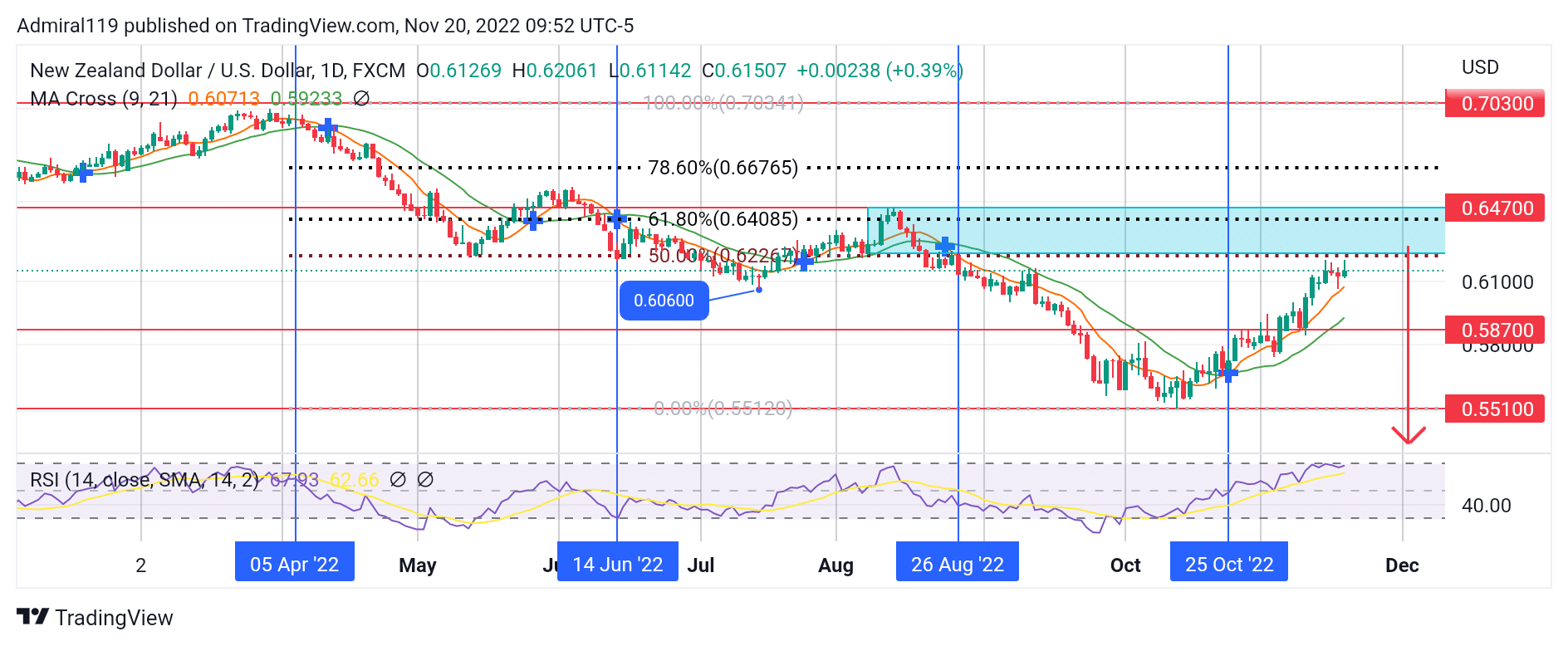

NZDUSD enters the supply zone at 0.6470 to execute sell orders. In anticipation of the market entering the supply zone, the bears had already placed sell orders at the 0.6470 zone. A bearish order block transpired on both the weekly and the daily time frames after a price delivery to the downside on August 26, 2022.

NZDUSD Significant Zones

Demand Zones: 0.5870, 0.5510

Supply Zones: 0.6470, 0.7030

NZDUSD Long-term Trend: Bullish

The market’s direction is downward on higher time frames. The price has been moving from internal liquidity within a trading range to external liquidity below the previous low. NZDUSD has never returned to the 0.7030 supply zone since it was retested on April 5, 2022. Price continued downward, breaking the previous 0.6470 support and gyrating below it for two months before resuming the downtrend. The gyration below the previous support level of 0.6470 led to the emergence of five consecutive bullish candlesticks, which became an order block when the price got delivered to the downside.

Exactly thirty days after the price delivery to the downside, the Moving Average Cross signaled a buy as it crossed upward accordingly. However, before the signal of the Moving Average Cross, NZDUSD had entered an oversold region, as revealed by the Relative Strength Index. From late September 2022 to early October 2022, the bears struggled inside the oversold region before finally handing over the market to the bulls. Another reason for the handover is the existence of enormous buying pressure in the 0.5510 demand zone.

NZDUSD Short-term Trend: Bullish

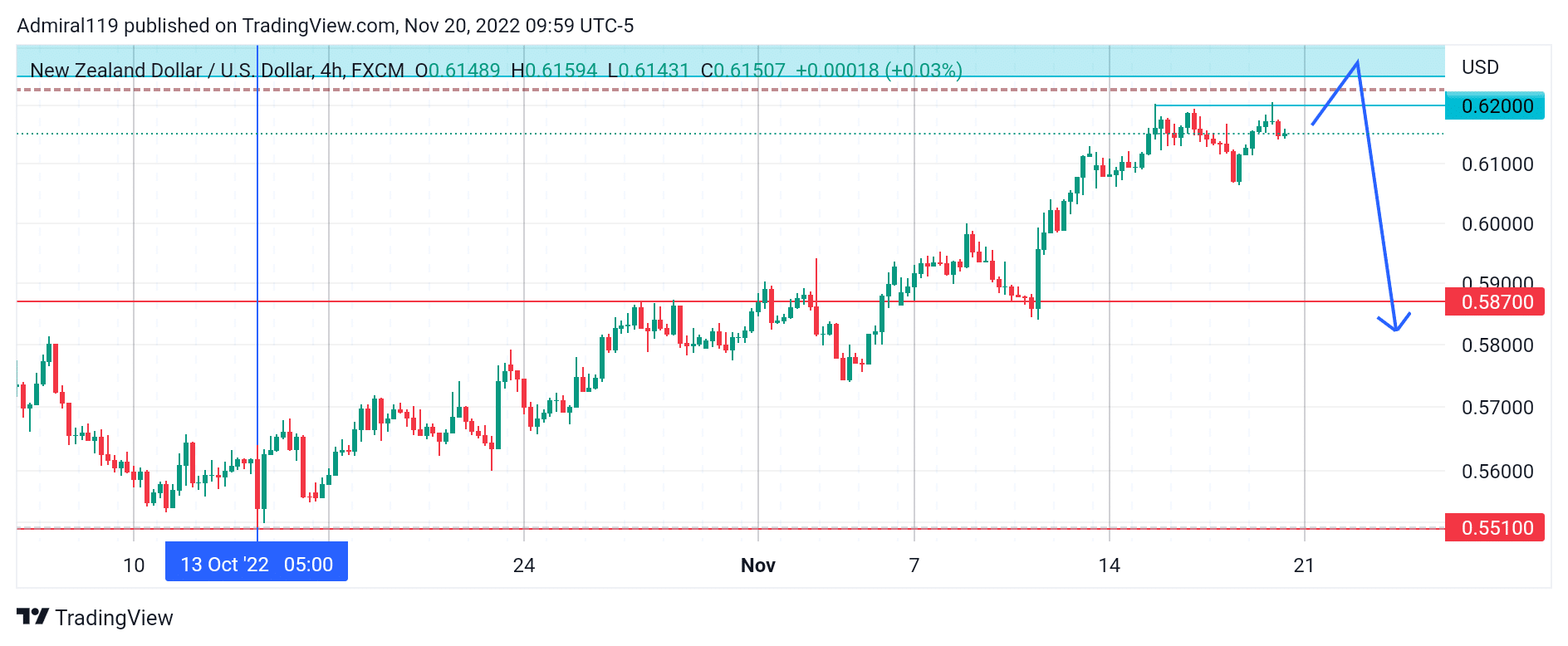

While the market remains bullish on the four-hour time frame, NZDUSD has begun to show some signs of a change in market direction. The recent double top is expected to be cleared as buy-side liquidity is grabbed. Once the price enters the supply zone, the bears might eventually resume their market trend to the downside.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.