Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

NZDUSD Analysis – November 20

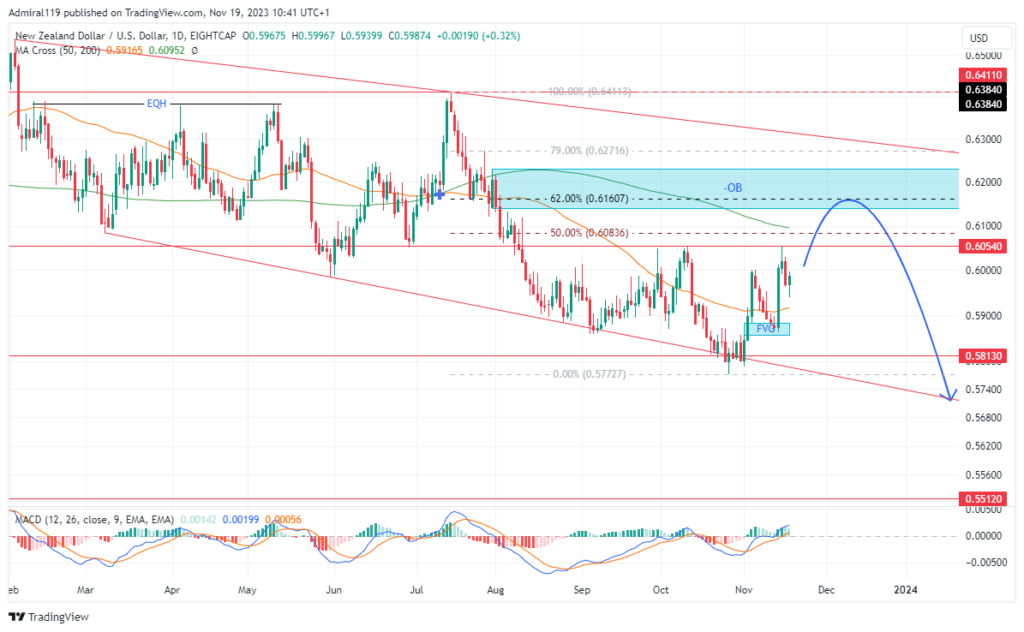

NZDUSD continues its upward correction as the price leaves the discount zone. According to MA Cross Periods 50 and 200, the market’s overall trend is negative. In an attempt to break out of the discount zone, the market is going through a significant positive retracement. Upon reaching the premium zone, the negative trend is probably going to pick back up.

NZDUSD Key Levels

Demand Zones: $0.58130, $0.55120

Supply Zones: $0.60540, $0.64110

NZDUSD Long-Term Trend: Bearish

The market is in a bearish channel due to the long-term decline in the value of NZDUSD. The price has been falling since early this year as it left the premium zone. From the $0.64110 supply zone, the market crashed algorithmically, clearing minor supports along its path. In the second quarter of the year, a relatively equal high formed at $0.63840. The decline continued into the discount zone until the $0.60540 support was breached.

At first, the selling pressure was unable to breach the $0.60540 support level. The price exploded higher, hitting a roughly similar high of $0.63840. NZDUSD rebounded from the resistance level of $0.64110 and continued its downward trend.

On August 1, 2023, a bearish order block emerged as the negative trend continued. In the discount zone, the negative trend persisted until a new bottom developed at $0.57730. The MACD, or moving average convergence divergence, is currently crossing above the zero line, indicating that the market is correcting to the upside.

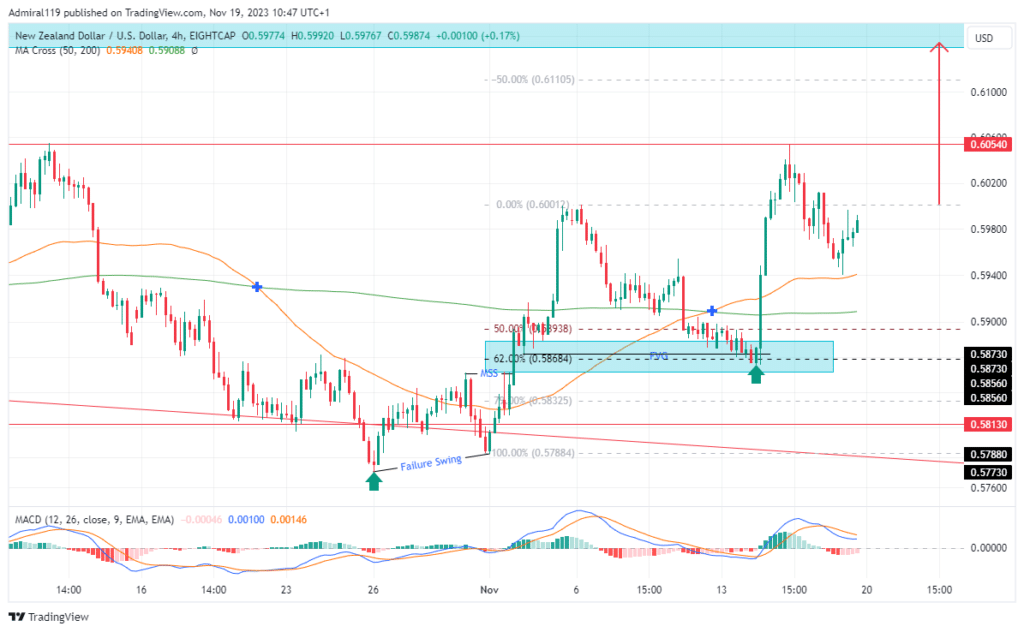

NZDUSD Short-Term Trend: Bullish

A change in the market structure occurred in November 2023 as a result of the price’s recent inability to make a lower low following the $0.57730 low. Based on the four-hour chart, the market is now in a positive trend. It is anticipated that NZDUSD will keep rising until it reaches the daily bearish order block at the premium.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.