Market Analysis – February 5

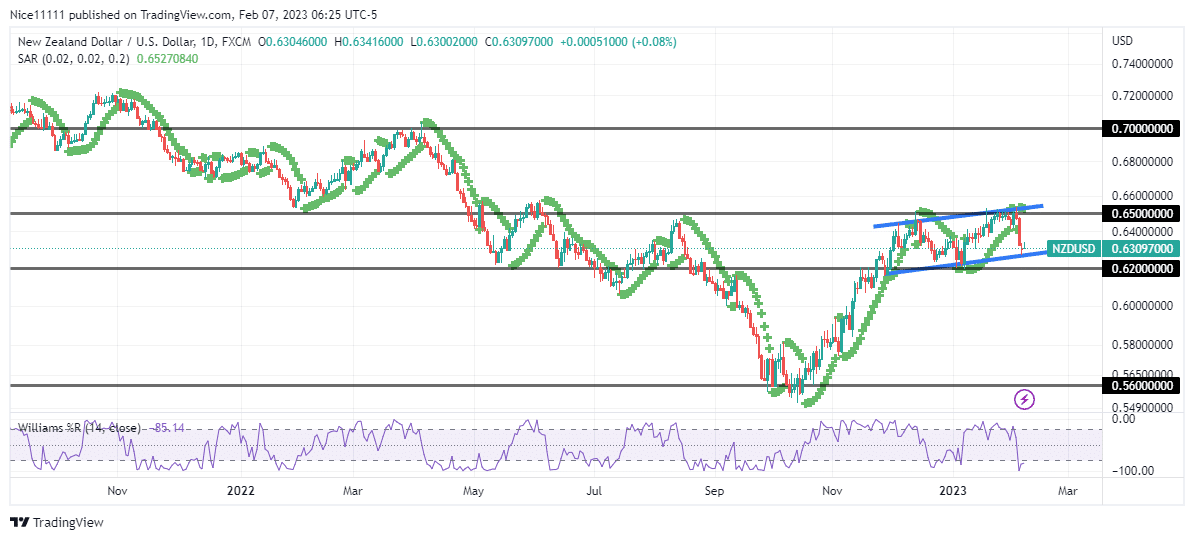

NZDUSD market structure turned bullish after the market reversal at 0.560. The market has ascended to 0.650, where the buyers are experiencing difficulty pushing higher.

NZDUSD Key Levels

Demand Levels: 0.620, 0.580, 0.560

Supply Levels: 0.650, 0.700, 0.750

NZDUSD Long-term Trend: Ranging

NZDUSD experienced two major impulsive bearish waves during the last year. The first downward displacement was delivered in March from the 0.700 supply zone. The market was overbought at the resistance level. The selloff from the resistance level was halted at the 0.620 demand zone.

The major consolidation in the previous year occurred between 0.650 and 0.620. during July. The Parabolic SAR (Stop and Reverse) signaled a downward trend at the second strike of 0.650 in September. This prompted the delivery of the second bearish wave. The market is currently oversold as it approaches the support level. The bulls are expected to launch from the 0.620 level to continue the bullish ride.

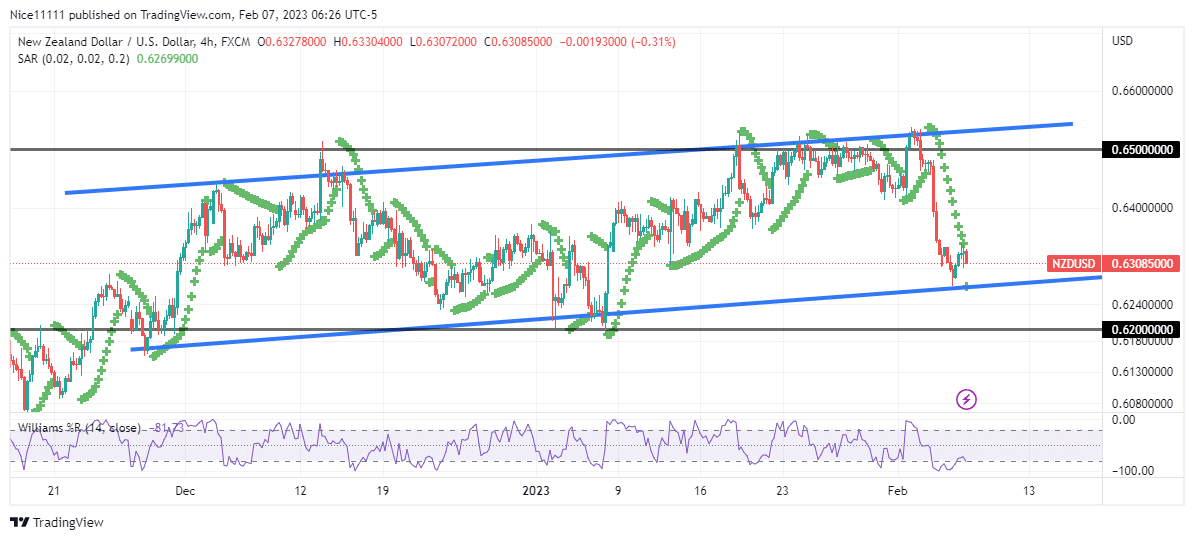

NZDUSD Short-term Trend: Bearish

The market is currently in consolidation within the same region where it formed a range the previous year. The market is bouncing back and forth between 0.650 and 0.620. A breakout is currently anticipated to propel the bulls to the resistance level of 0.700.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.