NZDUSD Analysis – October 23

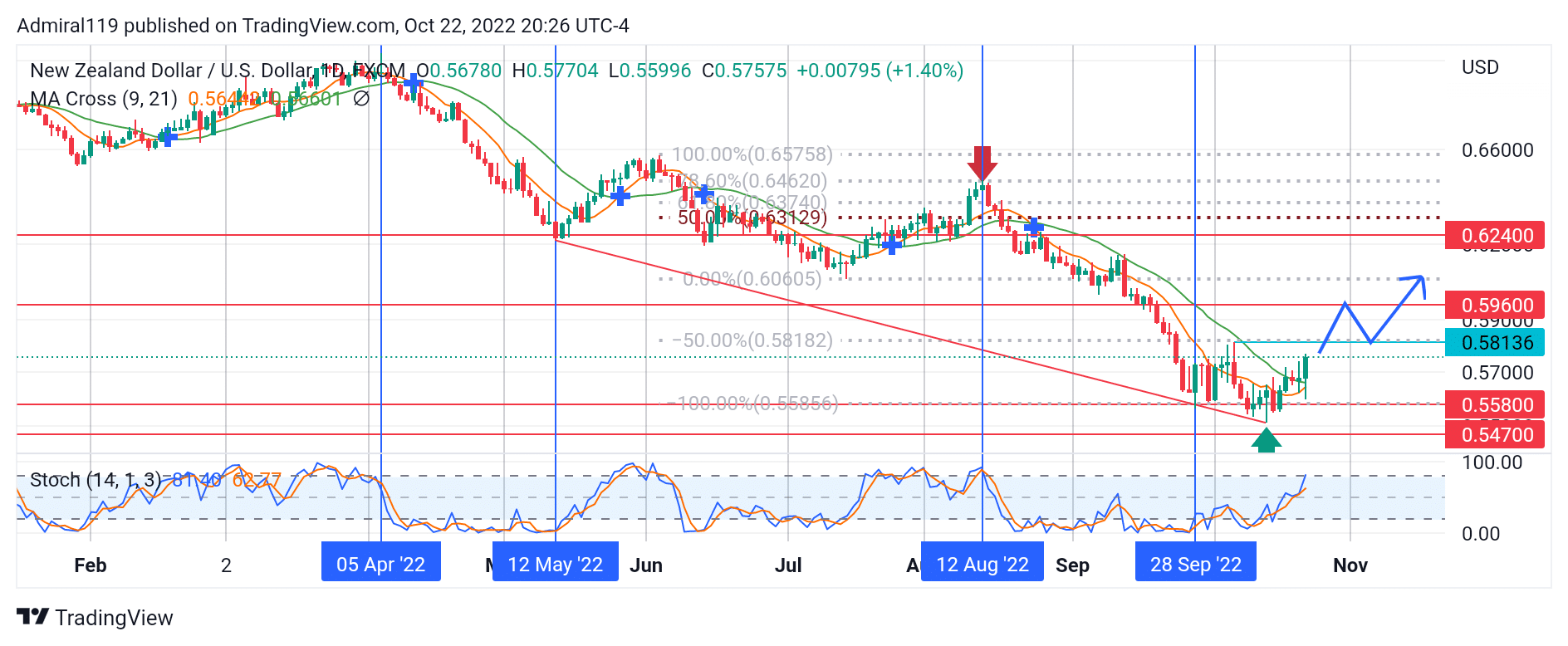

NZDUSD changes direction as the market hits the demand zone. The demand zone at $0.5580 coincides with the four-hour rejection block. This rejection block also happened to be nested in the monthly rejection block at the previous low. The market has been in a bearish phase since the 5th of April, 2022.

NZDUSD Significant Zones

Demand Zones: 0.5580, 0.5470

Supply Zones: 0.5960, 0.6240

NZDUSD Long-term Trend: Bearish

The market experienced a massive crash into the oscillator’s oversold region throughout April 2022. On the 12th of May, 2022, NZDUSD hit previous support and bounced upward for a short period. The market continued to plunge lower in its bearish phase until a new swing low was created. This swing impulse became a very important leg in the market as the 61.8% and –100% retracement levels became critical levels in the market. The NZDUSD sellers found re-entry at the 61.8% Fibonacci retracement level, while the NZDUSD buyers found entry around the –100% Fibonacci retracement level.

The mid-term high, at 61.8%, was created on the 12th of August, 2022. The PD Arrays within the high and the current daily low could be used for potential entries as the price heads upward into the premium. On the 28th of September, 2022, prices hit both the diagonal support as well as the 0.5580 demand zone. But the market later came down to clear out this low to gain momentum for the new trend to the upside. NZDUSD is projected to break the previous high and take out buy-side liquidity for the bull run.

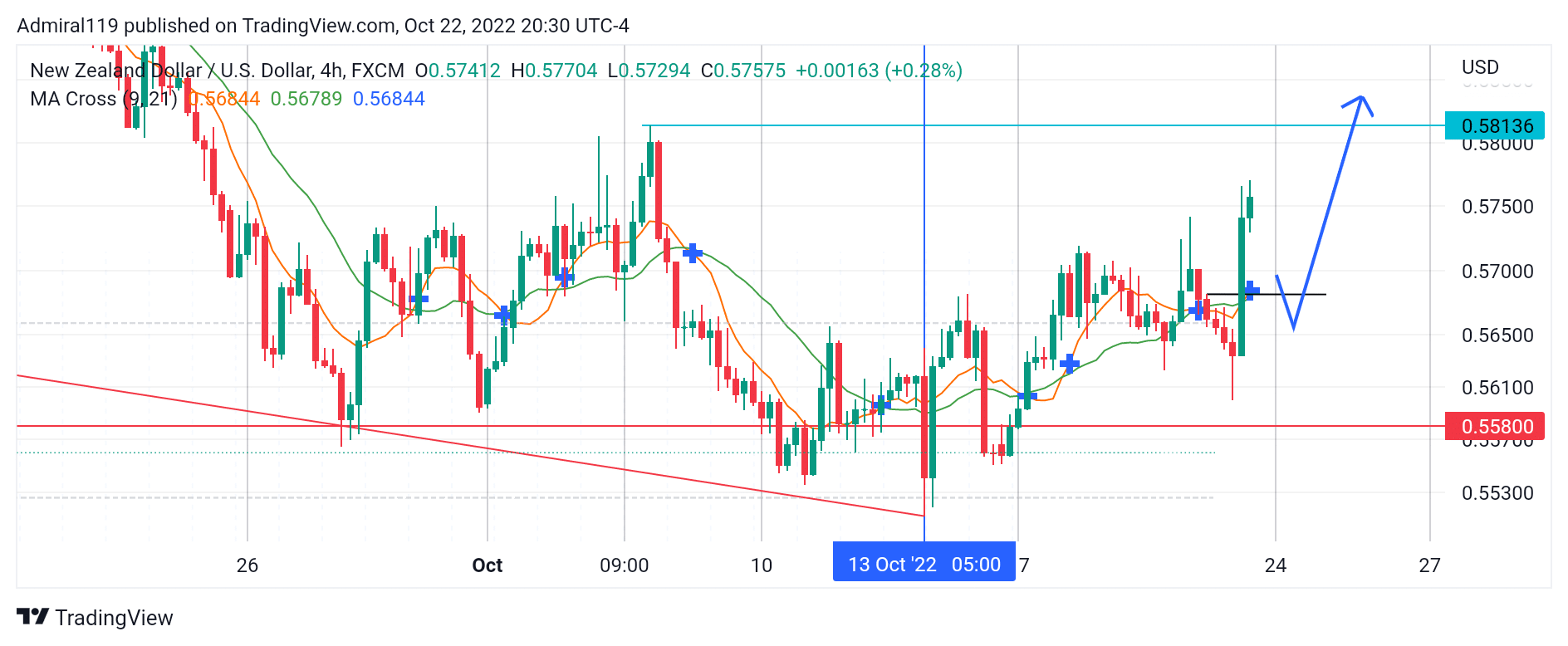

NZDUSD Short-term Trend: Bullish

The market’s environment has changed on the four-hour chart. NZDUSD has been in an uptrend since October 13th, 2022. The price is currently expected to make a short correction into the four-hour order block before or after breaking the previous daily high at 0.58136.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.