Market Analysis – March 18

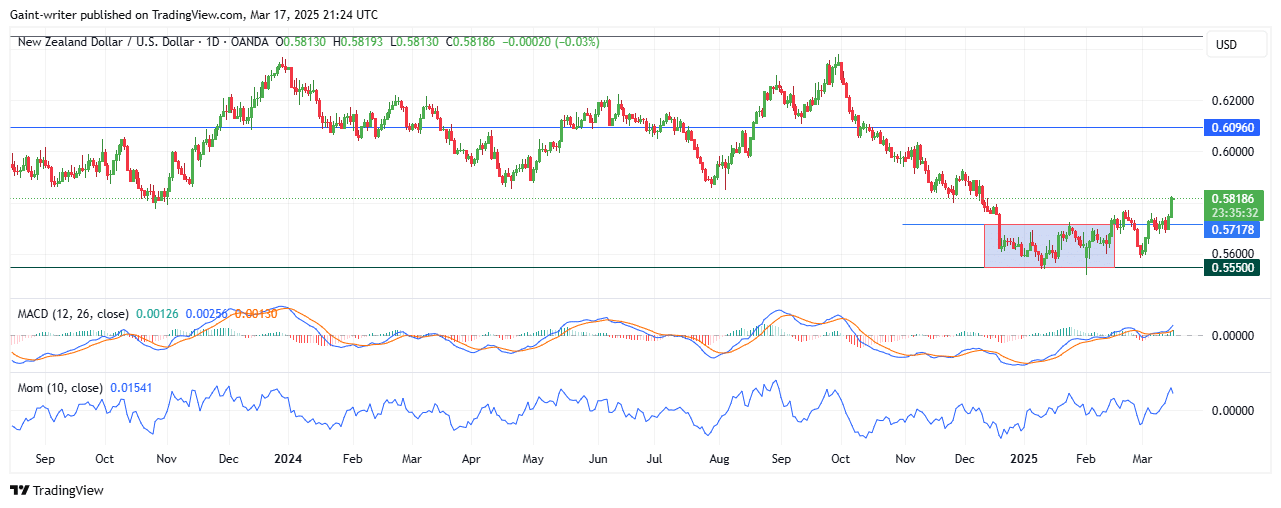

NZDUSD bulls gain momentum beyond the 0.57170 key level. The New Zealand Dollar is gaining strength, as buyers successfully breach the 0.57170 resistance level and push toward 0.58100. After months of consolidation between 0.57170 and 0.55600, the bulls have finally taken control, signalling the potential for further upside movement.

NZDUSD Key Levels:

Support Levels: 0.57170, 0.55600

Resistance Levels: 0.58100, 0.59000

NZDUSD Long-Term Trend: Bullish

With strong buying participation, NZDUSD may target new highs, but sellers could still attempt to resist the breakout. The bullish breakout above 0.57170 confirms increasing buyer confidence. The MACD indicator shows strong bullish participation, indicating growing momentum in favour of buyers. The Momentum indicator also reflects an upward trajectory, confirming buying pressure.

.

For NZDUSD to continue higher, it must hold above 0.57170 and gain traction toward the 0.59000 resistance zone. The current bullish breakout signals the potential for further upside movement. If buyers maintain control above 0.57170, they could push NZDUSD toward 0.59000, reinforcing strong market sentiment. If sellers re-enter the market, the price could retest 0.57170 before attempting another breakout. The next price movement will determine whether NZDUSD continues its bullish expansion or faces a pullback before resuming upward.

NZDUSD Medium-Term Trend: Bullish (4-Hour Chart)

NZDUSD Medium-Term Trend: Bullish (4-Hour Chart)

On the 4-hour chart, the price continues to gain bullish momentum, with buyers actively holding their position. The MACD shows a consistent rise, reinforcing strong buyer interest.

As long as the price remains above 0.57170, further gains toward 0.59000 are possible.

A break above 0.58100 could trigger further buying pressure, while a failure to sustain momentum could lead to short-term consolidation.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

9.8

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

9

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

9

Learn to Trade

Never Miss A Trade Again

step 1

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

step 2

Get Alerts

Immediate alerts to your email and mobile phone.

step 3

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

NZDUSD Medium-Term Trend: Bullish (4-Hour Chart)

NZDUSD Medium-Term Trend: Bullish (4-Hour Chart)