Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – September 19

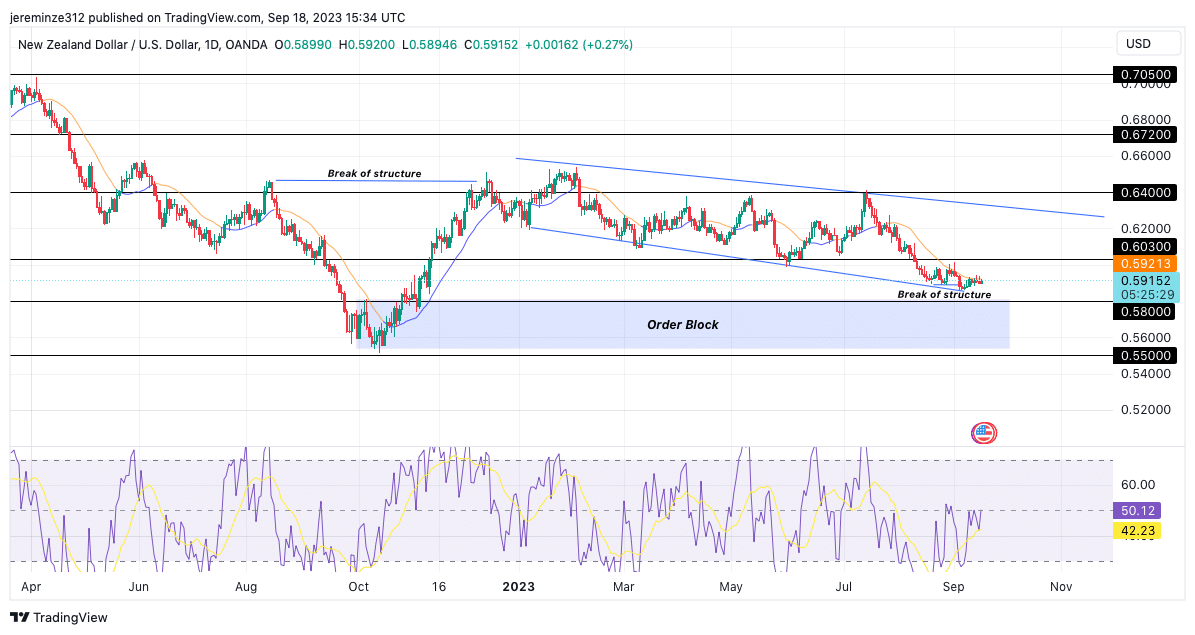

NZDUSD bearish sentiment has continued to persist recently. NZDUSD price has experienced a significant decline, breaking below the initial support level at 0.60300. It is crucial to monitor the Order Block zone next to see a continuation of the positive trend.

NZDUSD Key Levels

Demand Levels: 0.60000, 0.550000, 0.52000

Supply Levels: 0.65200, 0.69800, 0.72000

NZDUSD Long-Term Trend: Bullish

The market break in mid-December 2022 marked the end of the initial bearish trend. However, despite the potential for the trend to continue with a higher high, it failed to do so as a lower low was established in early March 2023.

i

Since then, the price action has been predominantly bearish. The support level at 0.603000 was expected to halt further downward movement, but it proved ineffective. This indicates a strong negative bias in the market.

i

The bear market remains active with the price currently below the moving average and the recent structural break. For the price, the Order Block zone is meant to act as a potential turning point. This will happen when the 0.55000 level is respected.

NZDUSD Short-Term Trend: Bearish

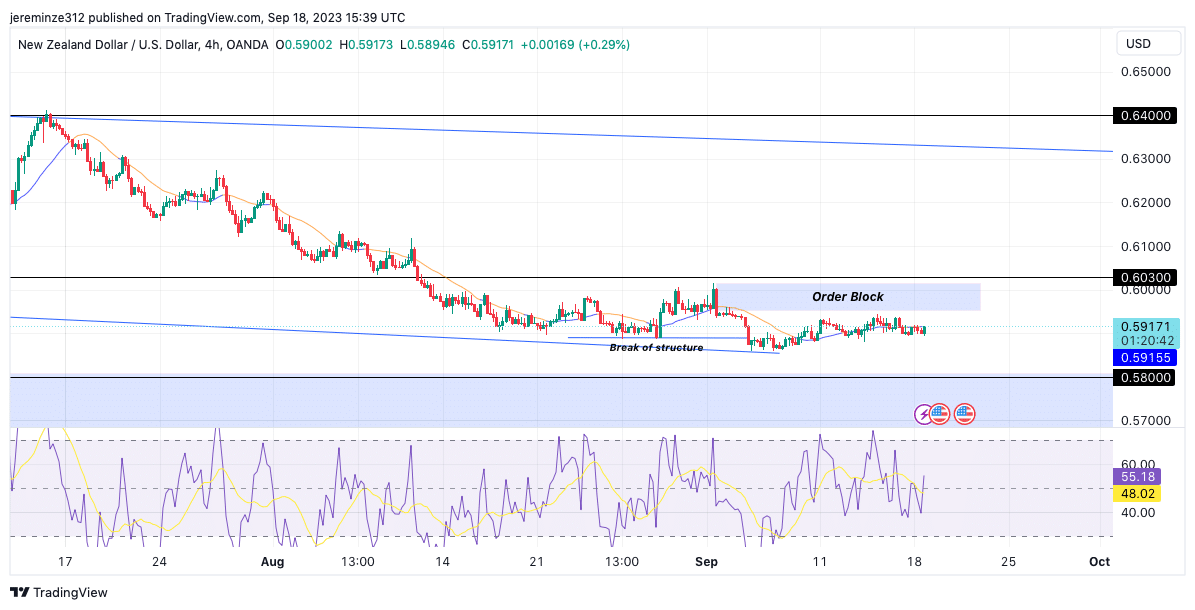

On the 4-hour chart, there is a bearish structure break and a price decline, as indicated by the downward movement suggested by the Moving Average. Additionally, the Relative Strength Index is crossing below the 70.0 level, indicating that the price is moving out of the overbought area.

i

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.