Market Analysis – January 18

The NZD/USD pair remains under pressure as strong US economic data and the Federal Reserve’s cautious stance on rate cuts continue to support the US Dollar, while weak New Zealand fundamentals weigh on the Kiwi. Disappointing GDP and labor market data have pushed the Reserve Bank of New Zealand toward a more accommodative policy stance, including a 25-basis-point rate cut in late 2025, widening the policy divergence with the Fed. Additional pressure comes from renewed US–China trade tensions, which hurt risk sentiment and disproportionately impact New Zealand due to its close trade ties with China. Together, these factors have kept the pair largely range-bound as traders await clearer policy and macroeconomic signals.

NZD/USD Key Levels

Supply Levels: 0.5800 , 0.58500, 0.5900

Demand Levels: 0.57000, 0.56500, 0.5600

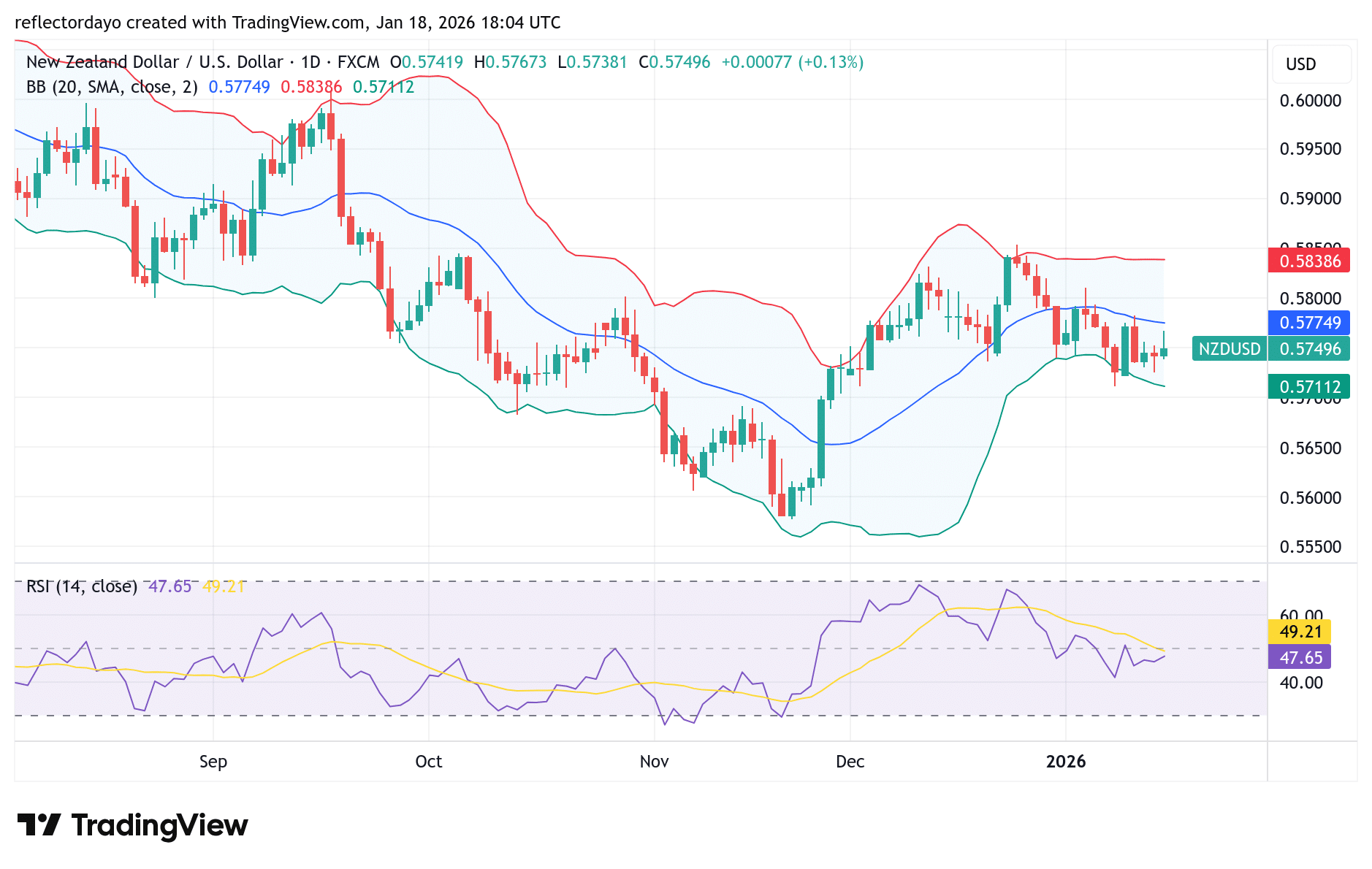

NZD/USD Daily Outlook

The NZD/USD pair held steady on January 16, with price action showing resilience despite persistent headwinds. Bulls have demonstrated enough strength to keep the market consolidating around the 0.57500 level. The Bollinger Bands reflect this sideways movement, confirming a range-bound market structure. However, price action remains positioned near the lower band of the indicator, and trading below the 20-day moving average suggests that sellers are still exerting pressure, increasing the risk of a potential downside move.

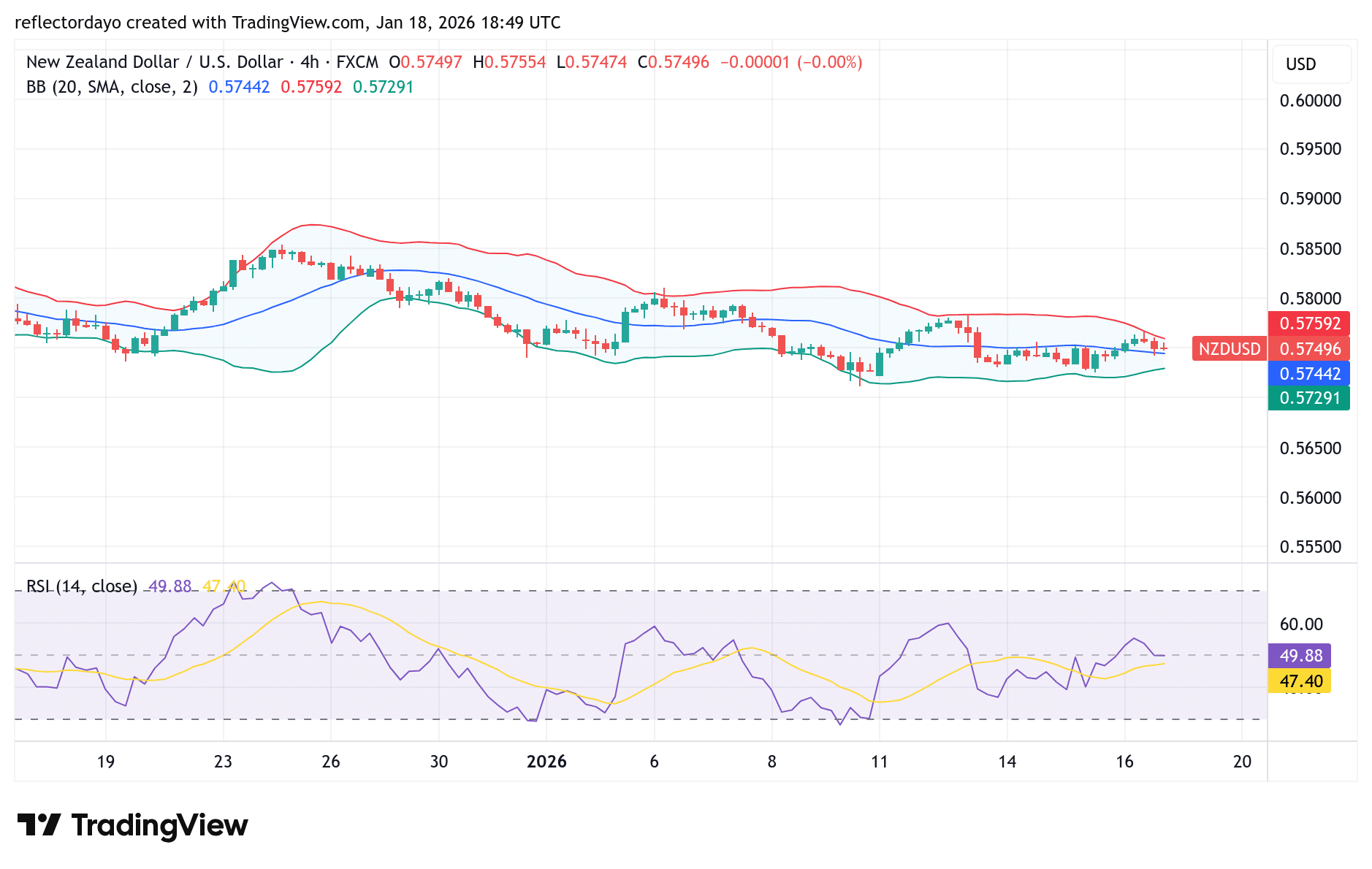

NZD/USD Short-Term Trend

Within the range, bearish pressure remains strong, with price firmly resting at the key support level of 0.57211. In recent trading sessions, bullish intervention around this support has triggered slight rebounds. However, as market sentiment continues to lean in favor of the bears, a decisive breakdown below 0.57211 would likely invite stronger bearish price action.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.