NZD/USD continues to stay near the downtrend line, at 0.7030 level. An upside breakout could signal an upside reversal.

The pair may continue to increase if the US Dollar Index resumes its downside movement after its temporary rebound. The United States inflation data could be decisive tomorrow. The CPI is expected to increase by 0.5%, while the Core CPI may increase by 0.2%.

In line with expectations data or better could help the USD to recover and dominate the currency market again. On the other hand, some poor figures could ruin the dollar and could send NZD/USD higher.

NZD/USD H4 Chart Analysis!

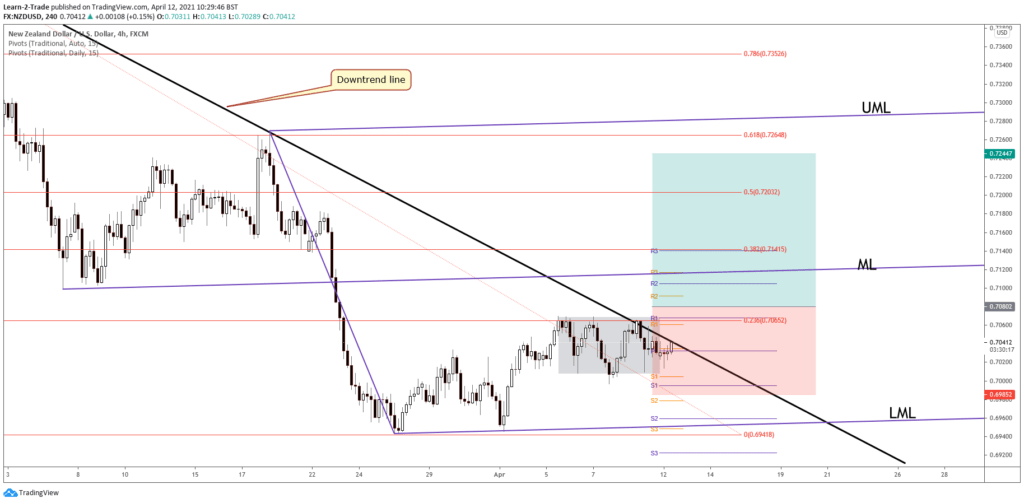

NZD/USD is pressuring the downtrend line after failing to come back towards the former lower lows. It’s traded at 0.7040 at the time of writing, a valid breakout above the downtrend line signals reversal.

The pair have confirmed the ascending pitchfork by retesting the lower median line (LML). So, a valid breakout above the downtrend line and a new higher high is seen as buying opportunity.

The support is seen at the weekly S1 (0.6995), while the resistance stands at the weekly R1 (0.7068).

Conclusion!

An upside breakout above the downtrend line and through the R1 could represent a buying signal.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.