Price activities in the Nasdaq 100 market stayed mostly bullish during the past week. At this point, it appears as if price action may continue to move upwards, considering signs coming from trading indicators. So, let’s zoom in to get a closer look.

Major Price Levels:

Top Levels: $11,541.50, $11,600, $11,600

Floor Levels: $11,500, $11,450, $11, 400

Price Action in the Nasdaq 100 Market Breaks the Fib 78.60 Resistance

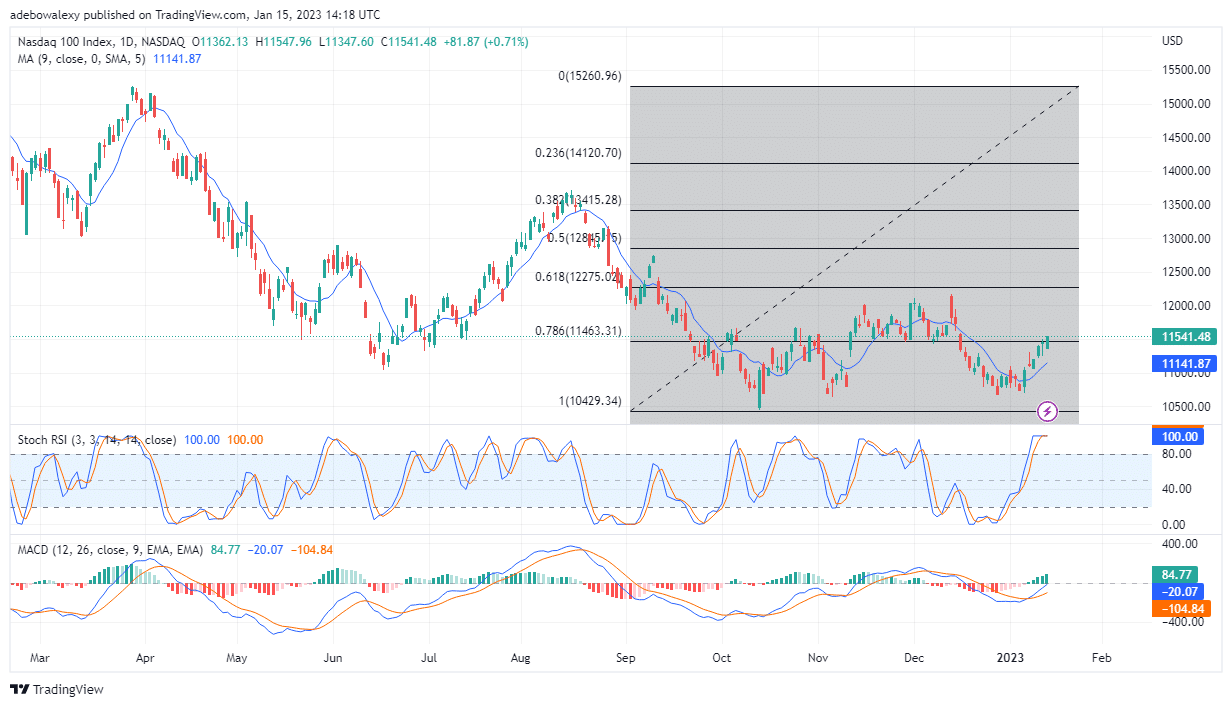

Price action in the Nasdaq 100 market has poked through the Fibonacci resistance level of 78.60 at $11,463. And, on a more positive note, price action has also broken the $11,500 mark. At this point, price candles from about five trading sessions ago have been forming above the 9-day MA curve. At the same time, the Stochastic RSI curves have reached the peak of the overbought region, and both the leading and lagging lines are now flat out in the overbought area. It looks like the lines of the RSI may remain flat in the overbought area; this opinion comes from the signs on the MACD. The MACD’s curves can be seen rising vigorously upward following a crossover. Therefore, this current price move seems strong, and traders may still benefit from it.

The Nasdaq 100 Market Remains Optimistic About a Continuous Price Increase

Even on the 4-hour market, price action continues to show upside promise. Price candles are still above the MA line, with the last price candle here pushing the price level higher and away from the MA line. Also, the Stochastic RSI curves remain flat in the overbought area. Likewise, the curves of the MACD indicator have risen above the equilibrium line and may still rise further. However, traders should take note of the histogram bars of the MACD, as they are now looking pale green. Consequently, traders should wisely prepare a good risk management plan as they place trades with the expectation that the price may rise to $11,750.

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.