However, with the incoming US Presidential election, many expected this to be a possibility given the frequency of attacks on Beijing by the US President. That said, it appears the markets are choosing not to react to the trade-related headlines.

Meanwhile, President Trump is currently lagging behind his Democratic opponent by 8% in the national polls, as 50.4% of Americans are in favor of a Biden presidency. However, the “decoupling” of the two world powers could become a likely scenario considering that the President has been closing in on the gap in recent weeks. A Sino-US trade-decoupling would be very devastating on regional risk assets.

That said, trade-related headlines could begin to hold major significance for the Nasdaq 100 and the Dow Jone (DJIA) in the near-term, with the current retaliatory attacks between the world powers capping any significant gains for the tech-heavy index.

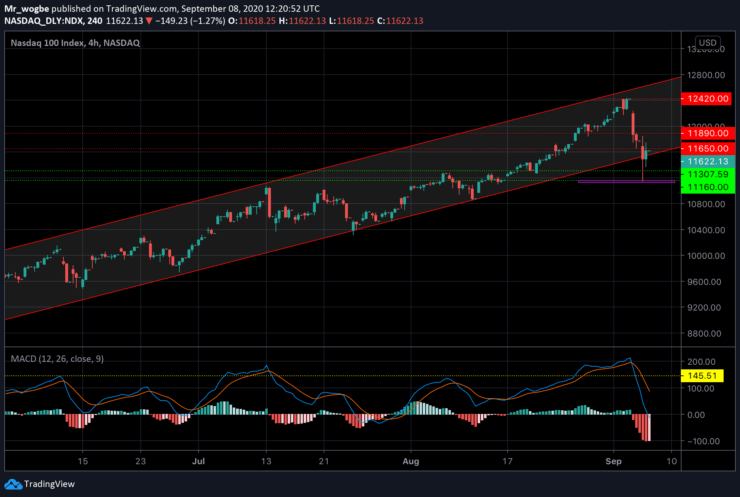

Nasdaq 100 (NDX) Value Forecast — September 8

NDX Major Bias: Bearish

Supply Levels: 11890, 12000, and 12330.

Demand Levels: 11307, 11160, and 11000.

The NDX continued on its retreat from its recent all-time high (12439.5) for its third consecutive day yesterday. The index appeared to have found bullish support at the 11160 support level, which facilitated a strong bounce for it after it approached that level on Friday. The bounce helped the index get back into the 7-month old ascending channel.

At press time, the NDX is faced with the 11890 strong resistance. Given the current issues surrounding the markets, it doesn’t seem likely that the index will comfortably break above this line in the near-term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.