That said, investors are wary about the current September trade season and the erratic volatility and liquidity it brings. This heightened volatility increases the risk of abrupt directional changes in the markets.

While we can see the prevailing effects of the “season” in Tesla (NASDAQ: TSLA), Apple (NASDAQ: APPL), Amazon (NASDAQ: AMZN), other top tech players, Nasdaq 100’s -11% decline through Tuesday followed by the sudden 3% recovery yesterday, followed by yet another wipeout. This makes it difficult to pinpoint the market’s directional bias.

This has thrown further uncertainty and worry over the prospects of a V-shaped global economic recovery. Some analysts worry that the risk tone of the season could cause the floor under the equities industry to cave.

Furthermore, the recent development in the US Congress of a “slimmed-down” fiscal stimulus package failing to get out of the Senate has bolstered the budding risk-off sentiment.

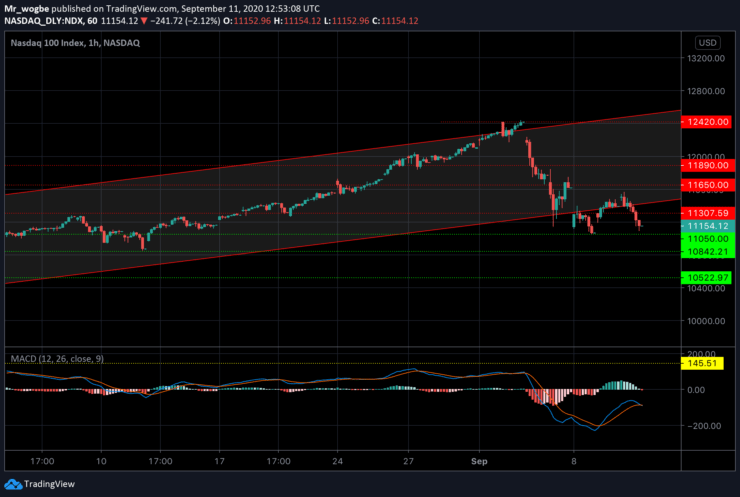

Nasdaq 100 (NDX) Value Forecast — September 11

NDX Major Bias: Sideways

Supply Levels: 11307, 11650, and 11890.

Demand Levels: 11050, 10840, and 10520.

The NDX has been thrown into a state of uncertainty since Tuesday and has remained in a wide consolidation range between 11650 and 11050. The index appears to have broken out of our longstanding ascending channel and is struggling with the 11050 support level.

The index has to fight to stay above this support area in the near-term so it doesn’t fall to the 10840-500 support area. Also, given the uncertainty of the times, it is not clear what the NDX will do next.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.