This week, Wall Street traded at the mercy of reports surrounding stimulus talks. The CBOE Market Volatility Index (VIX) increased for the eighth time in the ninth consecutive session and was last spotted at +2.8%.

Meanwhile, the final debate between US President Donald Trump and his Democratic opponent Joe Biden on Thursday provided little surprises for election watchers but reinforced investors’ caution ahead of the November 3 elections.

While Biden plans on increasing taxes on corporate and capital gains if he becomes president, the pledge by Democrats to provide large stimulus reliefs is regarded as a decent compromise to the tax increase.

Also, the ‘green’ energy sector will be a potential winner against traditional energy firms under a Biden presidency. The Dow Jones (DJIA) oil and gas sector is currently at -49% YTD. Biden reaffirmed that his presidency will usher-in net zero-emissions by 2050.

Meanwhile, the Nasdaq 100 (NDX) has also lost about 1.4% this week alone on the worries of the Democrats’ hard stance on big tech firms. That said, investors could decide to cash-out their profits before any increase in capital gains tax.

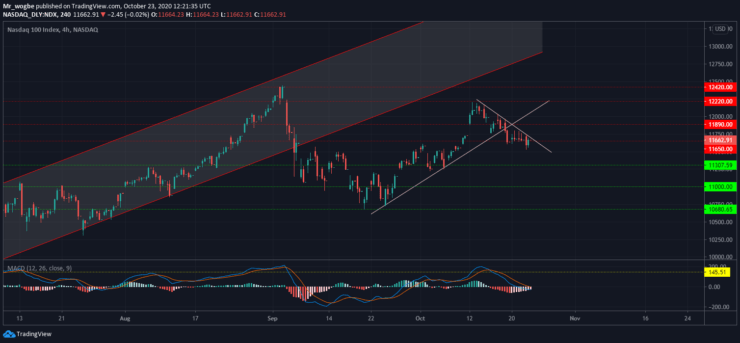

Nasdaq 100 (NDX) Value Forecast — October 23

NDX Major Bias: Bearish

Supply Levels: 11890, 12000, and 12220.

Demand Levels: 11307, 11000, and 10680.

The NDX remains under an intense downwards bias as the US Presidential election draws near. The index has now traded on a consolidation pattern for the fourth consecutive session, as it continues to descend with our downward-facing trendline.

Meanwhile, this bearishness is likely a reprieve from the recent entry into overbought territory on our 4-hour MACD indicator. In the meantime, the index is likely to continue on its current consolidation.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.