The Federal Reserve’s decision to switch their inflation policy from a fixed 2% target to an average could open the doors to inflation numbers above 2% for extended periods. That said, lower interest rates may also remain as inflation rises.

The aim of this is to create room for unemployment to decrease while inflation rises. Meanwhile, extended periods of low-interest rates may continue to bolster the risk appetite in the US equities market. However, some analysts worry that this could be negatively consequential in the long run.

The NDX has grown by about 35% in the year-to-date despite the pandemic and the upcoming US Presidential election. Given that the Fed is firmly behind them, many stocks—especially NASDAQ’s basket of high rising tech stocks—have scaled record-breaking hurdles and some analysts have cautioned that this growth is not organic but artificially stimulated by the central bank.

With its recent price action, it can be seen that Nasdaq 100 bulls are quite comfortable and will continue steering the prospects for the index in the near-term while bears remain in the ‘back seat.’

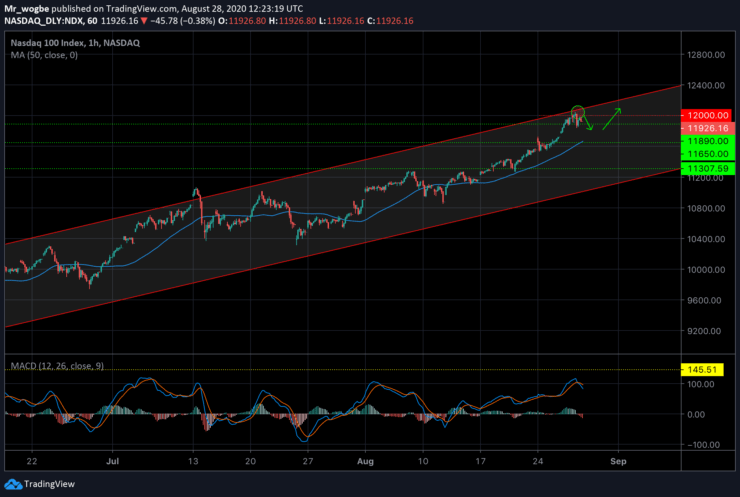

Nasdaq 100 (NDX) Value Forecast — August 28

NDX Major Bias: Bullish

Supply Levels: 12000, 12150, and 12350.

Demand Levels: 11890, 11650, and 11500.

The NDX has displayed exceptional performance in the past few days, clearing most of our main resistance levels effortlessly. Just yesterday, the index tested the long-awaited 12000 area and the top of our ascending channel. However, it was immediately met with a fresh supply, which sent it on a modest correction to the 11890 support.

That said, a retest of the strong resistance is underway and failure to clear this level could send it on a full correction to the 11650 where a confluence of indicators lay (strong support zone and 50 SMA). This level will likely facilitate a strong bounce for the index to clear the hurdle if it comes to that.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.