Key Resistance Zones: 14000, 14100, 14200

Key Support Zones: 13400, 13300, 13200

NASDAQ 100 (NAS100) Long-term Trend: Bullish

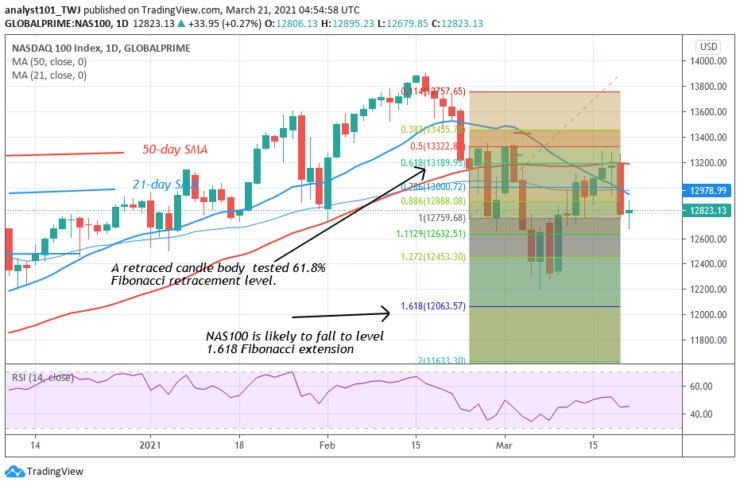

NAS100 index is in an uptrend but it is currently retracing. The index may further decline. On February 23 downtrend, a retraced candle body tested the 61.8 % Fibonacci retracement level. The retracement indicates that the NAS100 index will fall to level 1.618 Fibonacci extensions or level 12063.57.

Daily Chart Indicators Reading:

Presently, the SMAs are sloping upward indicating the uptrend. NAS100 is at level 43 of the Relative Strength Index period 14. It is in the downtrend zone below the centerline 50.

NASDAQ 100 (NAS100) Medium-term Trend: Bearish

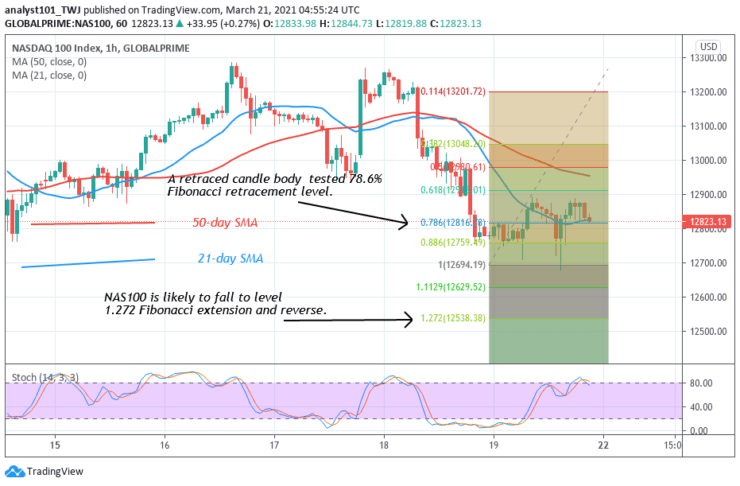

On the 1- hour chart, the index is in a downward move. On March 18 downtrend; a retraced candle body tested the 78.6% Fibonacci retracement level. The retracement indicates that the NAS100 index will fall to level 1.272 Fibonacci extensions. That is the low of level 12538.38.

1-hour Chart Indicators Reading

The market is below the 80% range of the daily stochastic. It indicates that the index is in a bearish momentum. Meanwhile, the 50-day SMA and the 21-day SMA are sloping downward indicating the downtrend.

General Outlook for NASDAQ 100 (NAS100)

NAS100 index has been falling after its rejection from the level 14000 resistance zone. At the lower time frame, the Fibonacci tool has indicated a possible reversal at level 1.272 or level 12538.38. The price has broken below the moving averages which indicate a further downward move.

You can purchase crypto coins here: Buy Coins

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.