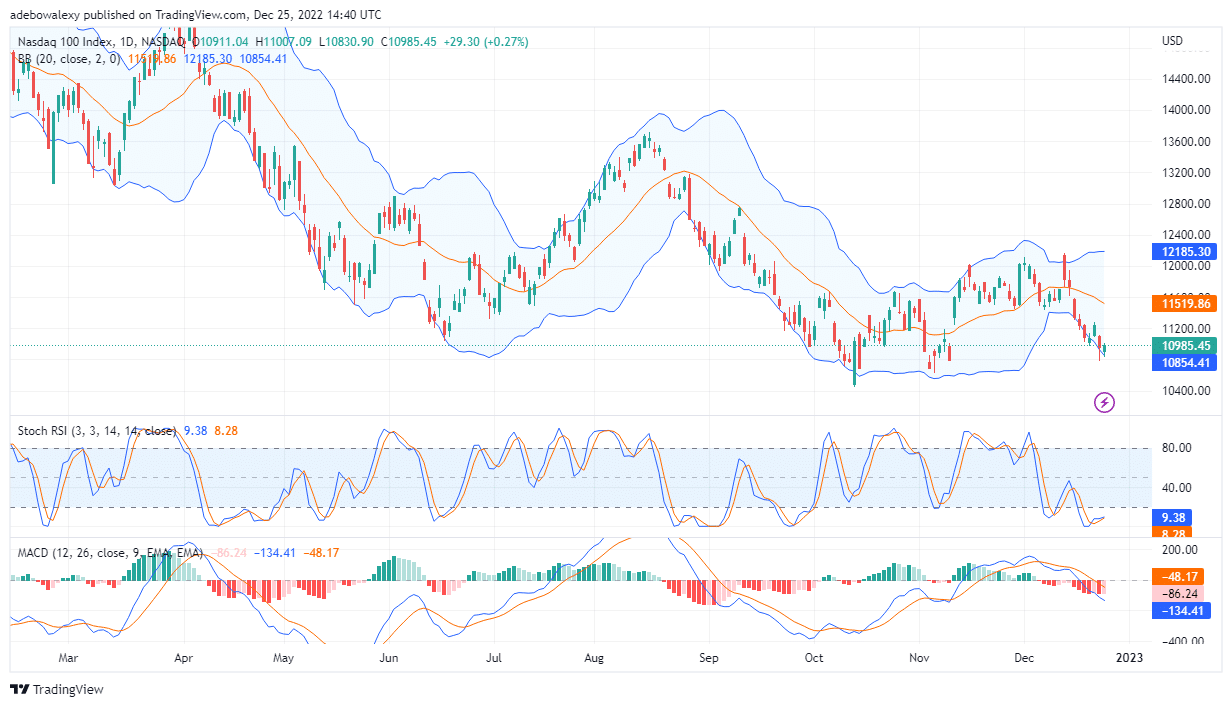

The Nasdaq 100 price action managed to gather some profits near the $10,854 mark last Friday to end the week’s trading activities at $10,985. Consequently, this seems to hint at the possibility of Nasdaq 100 claiming some early profits once the market opens for the week.

Major Price Levels:

Top Levels: $10,985, $11,000, $11,150

Floor Levels: $10,920, $10,840, $10,800

Nasdaq 100 Appears Ready to Claim More Profits

Price action on the Nasdaq 100 market appears to have taken a bounce off support around $10,854. Consequently, the price activity has moved upward to $10,985 and is just inches away from claiming the $11,000 mark. Furthermore, the applied Stochastic RSI curve has aborted its bearish reversal move. Subsequently, the lines of this indicator look as if they are traveling upward to indicate a gain in upside momentum. Meanwhile, the MACD is showing that the downward momentum is weakening. This could be seen as the histogram below the equilibrium level has started to grow pale in appearance. Technically, we can assume that this market may stay in the green.

Nasdaq 100 Price Stays Fairly Focused On More Upward Moves

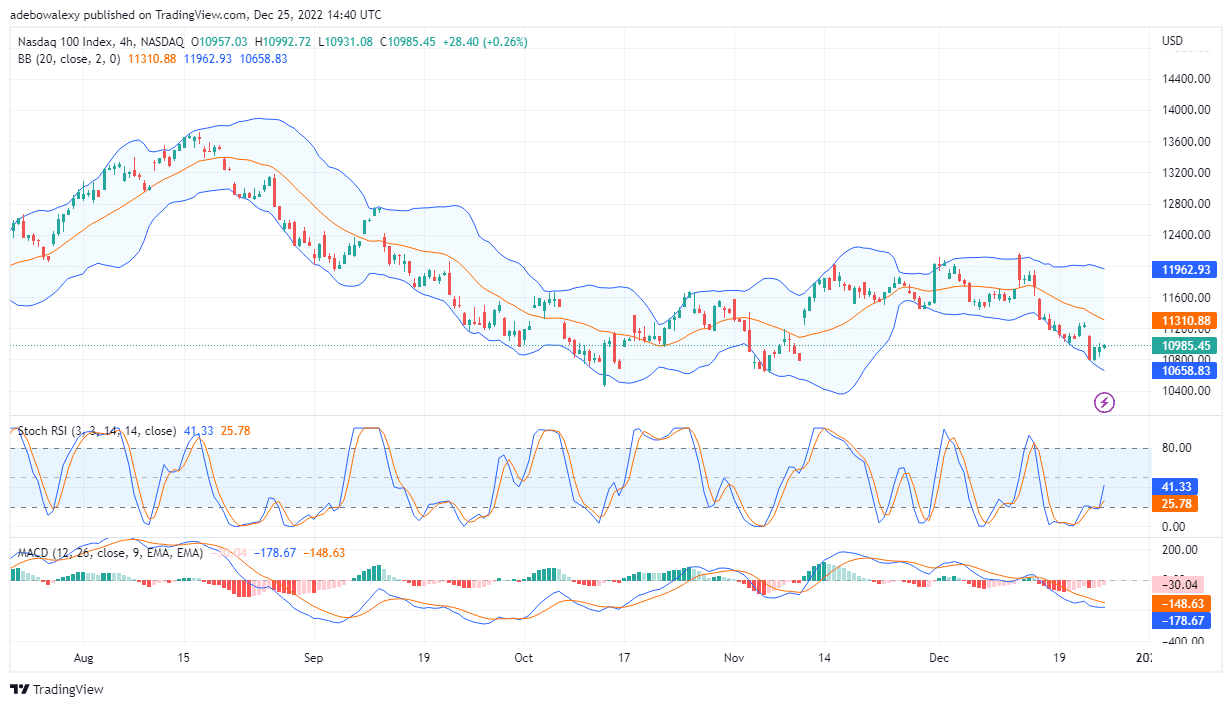

Moving to the Nasdaq 100 four-hour market, we can better see how things are developing. The recorded losses incurred from the past four trading sessions recovered has been 60% recovered. Additionally, technical indicators are also showing that prices may climb higher. This could be perceived as the curve on the RSI indicator has given a bullish crossover and has since moved sharply upwards. Also, the MACD indicator stays consistent with indications of a gradual decrease in downward momentum. Additionally, the line of the MACD indicator is now moving closer for what will most likely be a bullish crossover. Consequently, traders may soon see prices reaching above the $11,000 price level.

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.