Usually, the markets are very calm in August and other months in the summer. While the start of the season was largely dominated by the Coronavirus crisis-induced volatility, recent price actions indicate that longer-term trends have re-emerged as the markets have been fairly quiet in August—except for last Tuesday. Furthermore, the upcoming FOMC minutes report might suppress any significant price movement this week.

There are certain factors in the market today responsible for the slowdown in price action. However, this is not to say that the fundamental factors that influenced strong market runs in the past have suddenly ‘disappeared.’ Regardless the charts still show that the bull trend is still intact.

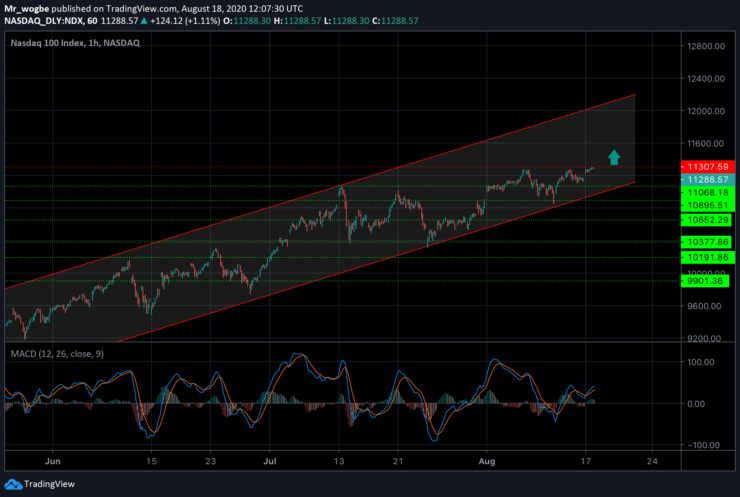

Nasdaq 100 (NDX) Value Forecast — August 18

NDX Major Bias: Bullish

Supply Levels: 11307, 11400, and 11500.

Demand Levels: 11150, 11068, and 10895.

The NDX continues to struggle with the 11307 resistance despite favorable market conditions. Regardless, we expect to see a clean break above that line and new record highs in the near-term. A break above that level could quickly send NDX to 11400 before any correction will be seen.

On the flip side, a fall from this level would be strongly supported around the 11068 area. A sustained fall below this level appears unlikely at this point.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.