NAS100 Analysis – October 5

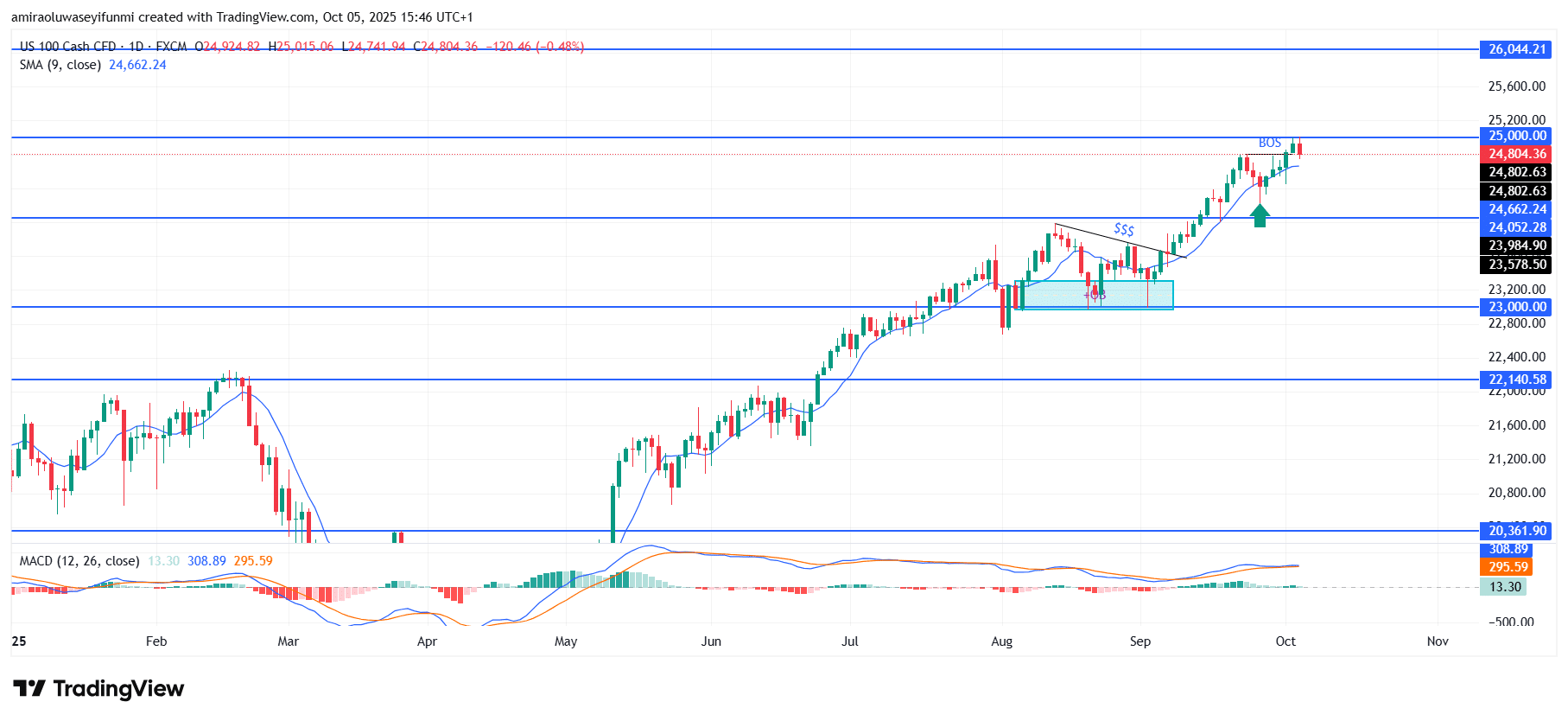

NAS100 maintains a strong upward trajectory with solid technical backing. The NAS100 Index continues to demonstrate a clear bullish bias as prices trade comfortably above the 9-day Simple Moving Average (SMA) near $24,660, indicating persistent demand and firm market confidence. Momentum indicators, including the MACD, remain supportive, with the histogram holding positive and the signal line advancing—both reinforcing sustained upward momentum. Overall sentiment remains optimistic, as institutional and retail traders continue to fuel the uptrend through steady accumulation and breakout participation.

NAS100 Key Levels

Resistance Levels: $25000, $26040, $27000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

From a technical standpoint, the recent structural break above $24,660 confirmed ongoing bullish control following the rebound from the $23,000–$23,600 support area. The breakout from prior consolidation signaled the end of short-term supply pressure and the beginning of a renewed expansion phase. Price movement now exhibits a consistent sequence of higher highs and higher lows, with immediate resistance emerging around $25,000, where short-term selling interest could momentarily stall the upward advance before continuation.

Looking ahead, sustained strength above $24,660 is likely to propel the index toward $26,040, aligning with a key resistance level from previous market cycles. A short-term retracement into the $24,000–$24,050 zone may offer fresh buying opportunities within the broader bullish outlook. Overall, NAS100 remains structurally strong, with momentum indicators supporting further appreciation as long as the current trend structure holds.

NAS100 Short-Term Trend: Bullish

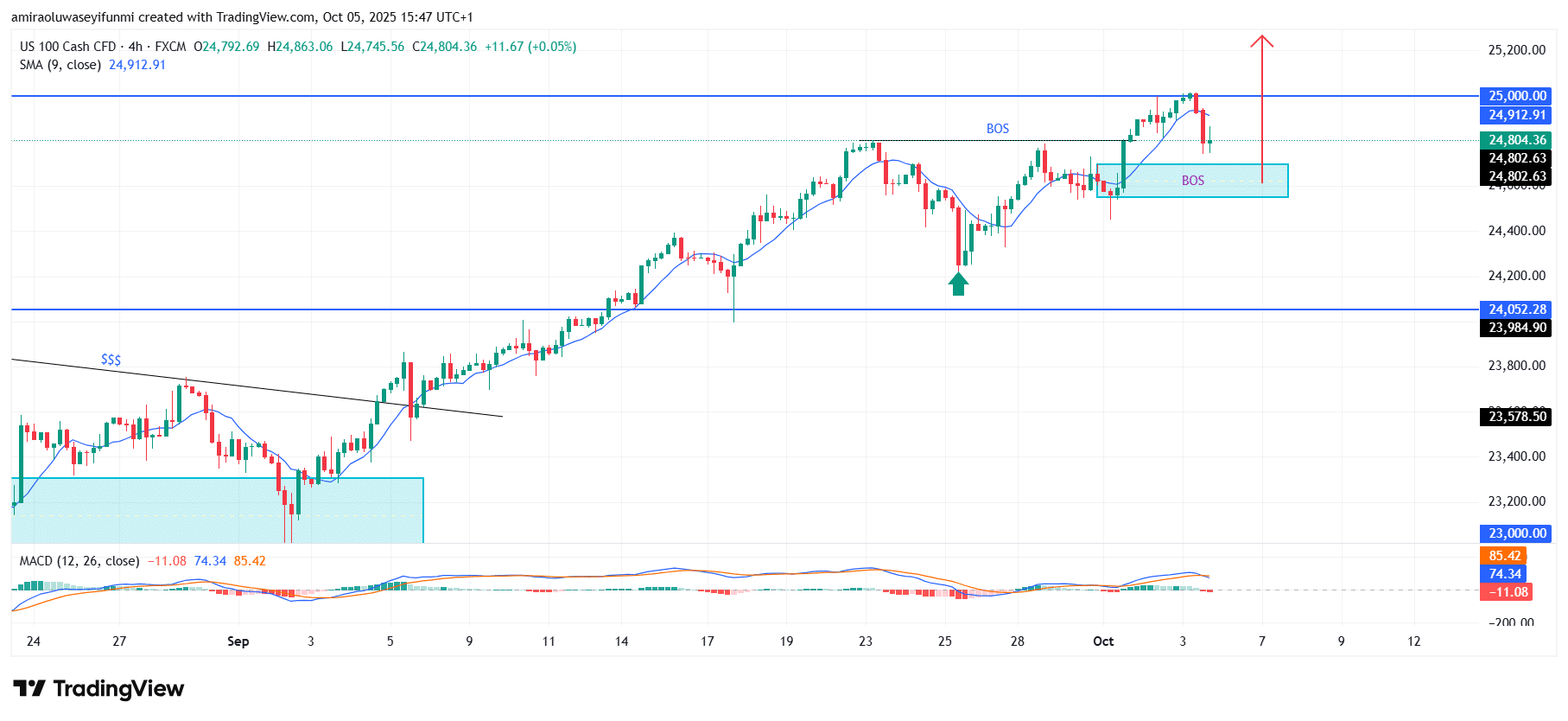

The NAS100 is currently consolidating above the $24,660–$24,800 demand area after a minor correction from the $25,000 resistance zone. The overall structure remains bullish, with price action maintaining higher lows while staying positioned above the 9-period SMA. The MACD indicates a slight slowdown in momentum, hinting at a possible accumulation phase before the next move upward.

A sustained rebound from the current support zone could drive prices toward $25,200 in the next bullish advance, providing traders with a potential forex signals opportunity to track renewed upward momentum within the prevailing trend.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.