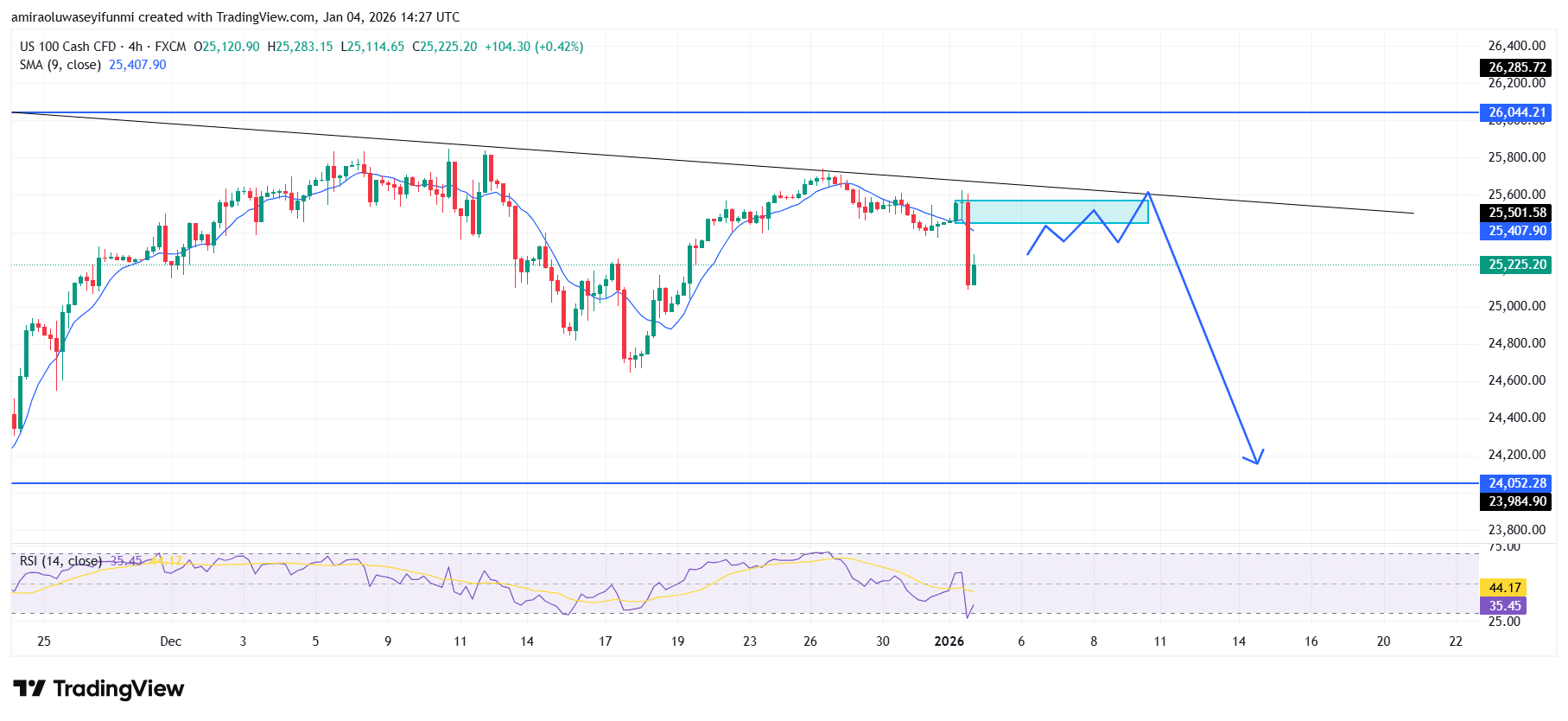

NAS100 Analysis – January 4

NAS100 develops a clear downside bias beneath structural resistance. NAS100 is showing weakening directional quality as price remains capped below the short-term average near $25,500, highlighting fading bullish engagement. Momentum conditions remain subdued, with RSI fluctuating below equilibrium around 47, signaling that buying pressure lacks conviction and follow-through. This indicator setup reflects a market shifting from prior trend expansion into a phase of controlled distribution.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bearish

From a technical perspective, price continues to respect a declining resistance structure extending from the November high, preserving the broader bearish framework. Repeated failures within the $25,500–$25,700 region confirm the presence of active supply, while recent candlestick formations reflect rejection rather than consolidation at higher levels. The inability to sustain acceptance above $25,200 further increases downside vulnerability.

Looking ahead, a decisive breakdown below the $25,000 threshold would likely trigger a rotation toward the $24,050 support area, with additional downside risk toward $23,000 if selling pressure accelerates. A loss of intermediate structure could expose a deeper retracement toward the $22,140 zone, where historical demand previously emerged. Until price can convincingly reclaim and hold above $25,700, downside risk remains the dominant technical theme, in line with prevailing forex signals.

NAS100 Short-Term Trend: Bearish

NAS100 remains technically bearish on the four-hour chart as price trades below both the descending trendline and the short-term moving average near $25,410. Repeated rejection within the $25,500 supply zone highlights strong seller participation and limited upside acceptance.

Momentum conditions remain weak, with RSI holding below 45 and failing to re-enter bullish territory. A break below $25,200 would likely expose the $24,050 support level as the next downside objective, reinforcing the prevailing bearish continuation bias.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.