NAS100 Analysis – June 16

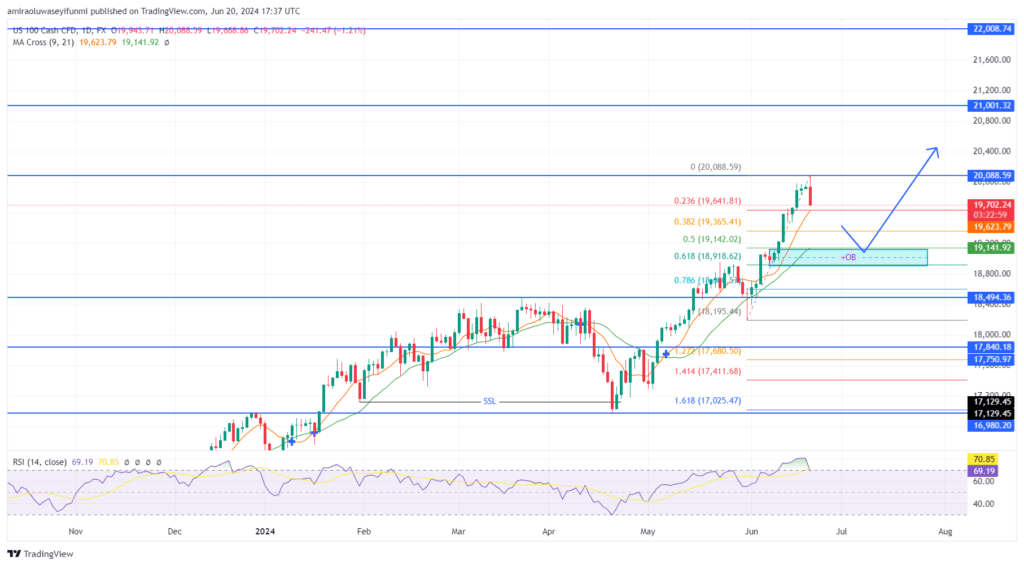

NAS100 begins a bearish pullback as the market becomes overbought. The moving averages (MA Cross 9, 21) are currently positioned at approximately 19,620.0 and 19,140.0, respectively. The price is trading above both moving averages, indicating a bullish trend. The Relative Strength Index (RSI) is at 70.80, which is close to the overbought territory, suggesting potential for a short-term pullback or consolidation before further upward movement.

NAS100 Key Levels

Resistance Levels: $20,089.0, $21,000.0

Support Levels: $18,494.0, $17,750.0

The price action on the chart indicates a strong upward trend since early June, with the current price around 19,710. This rally has broken through multiple resistance levels, including 19,140 (0.5 Fibonacci retracement level) and 19,365 (0.382 Fibonacci retracement level), before reaching a recent high of 20,090. The bullish momentum seems to have paused, leading to a minor pullback to the current price level. Notably, the price is forming a higher low pattern, indicating that buyers are still in control. The recent formation of an order block (OB) around 19,140 suggests a potential area of strong buying interest, which may act as a support if the price pulls back further.

Based on the current technical setup, the projection in the direction of the arrow indicates a bullish continuation. After a potential pullback to the key support area around 19,140, which coincides with the 0.5 Fibonacci retracement level and the order block, the price is likely to resume its upward trajectory. The next significant resistance level to watch is around 20,090. If the price breaks above this level, the next target would be around 21,000, a psychological level and a previous area of resistance. Overall, the indicators and price action suggest a bullish outlook, with the expectation of higher highs in the coming weeks, provided that the support levels hold. Traders can also enhance their strategies by incorporating crypto signals to navigate these movements effectively.

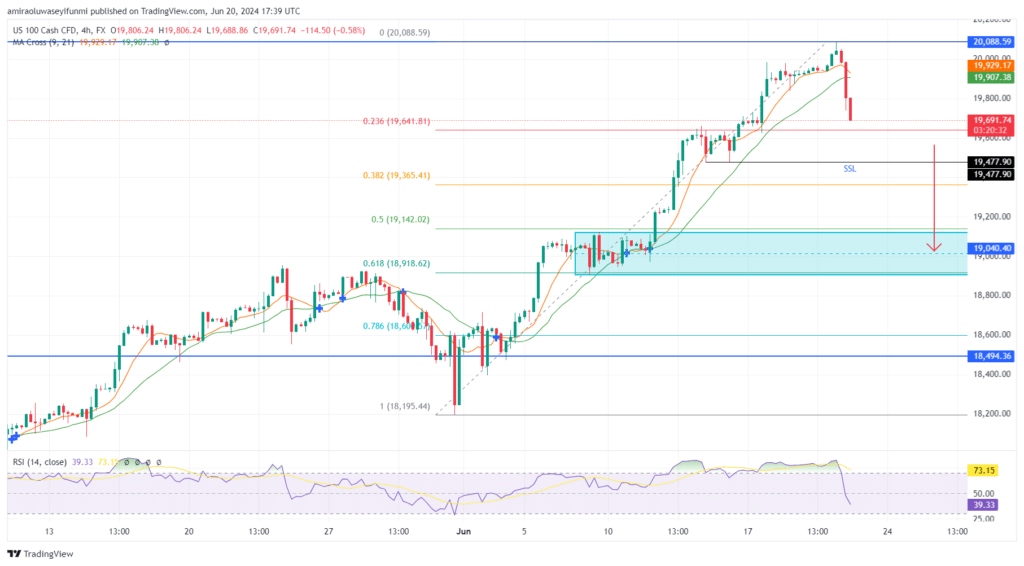

NAS100 Short-Term Trend: Bearish

On the four-hour chart, the market seems to be experiencing a major pullback to the downside. The bearish pullback began after the price hit the major resistance of $20,089.0.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.