In a significant move, financial giant Morgan Stanley has disclosed a substantial investment in U.S. spot bitcoin exchange-traded funds (ETFs), totaling over $270 million as of March 31. This disclosure, part of a quarterly 13F filing with the Securities and Exchange Commission, highlights the growing interest in cryptocurrency as a legitimate asset class.

Morgan Stanley’s Bitcoin ETF Investment Breakdown

Morgan Stanley’s investment includes $269.9 million in Grayscale’s converted spot bitcoin ETF, making the bank the third-largest holder of GBTC shares. This investment is only surpassed by Susquehanna’s $1.1 billion and Horizon Kinetics’s $946 million holdings. Additionally, the bank has allocated $2.3 million to Ark Invest’s spot bitcoin ETF, placing it among the top 20 ARKB holders.

13F filings, which are mandatory for institutional investment managers with equity assets exceeding $100 million, provide insights into their stock holdings at the end of a quarter. However, they do not reveal short positions, giving only a snapshot of a manager’s portfolio strategy.

Morgan Stanley’s move into bitcoin ETFs has been anticipated. In January, Andrew Peel, the Head of Digital Asset Markets at Morgan Stanley, hinted at the launch of U.S. spot bitcoin ETFs as a potential game-changer for digital assets’ global perception and utilization.

A February SEC filing by a Morgan Stanley fund also suggested a possible move to gain exposure to spot bitcoin ETFs. The firm has set risk management protocols that could enable its 15,000 brokers to recommend Bitcoin ETFs to clients.

This investment by Morgan Stanley is part of a broader trend, with many institutional investors reporting U.S. spot bitcoin ETFs in their first-quarter 13F filings.

Record Inflows for Spot Bitcoin ETFs

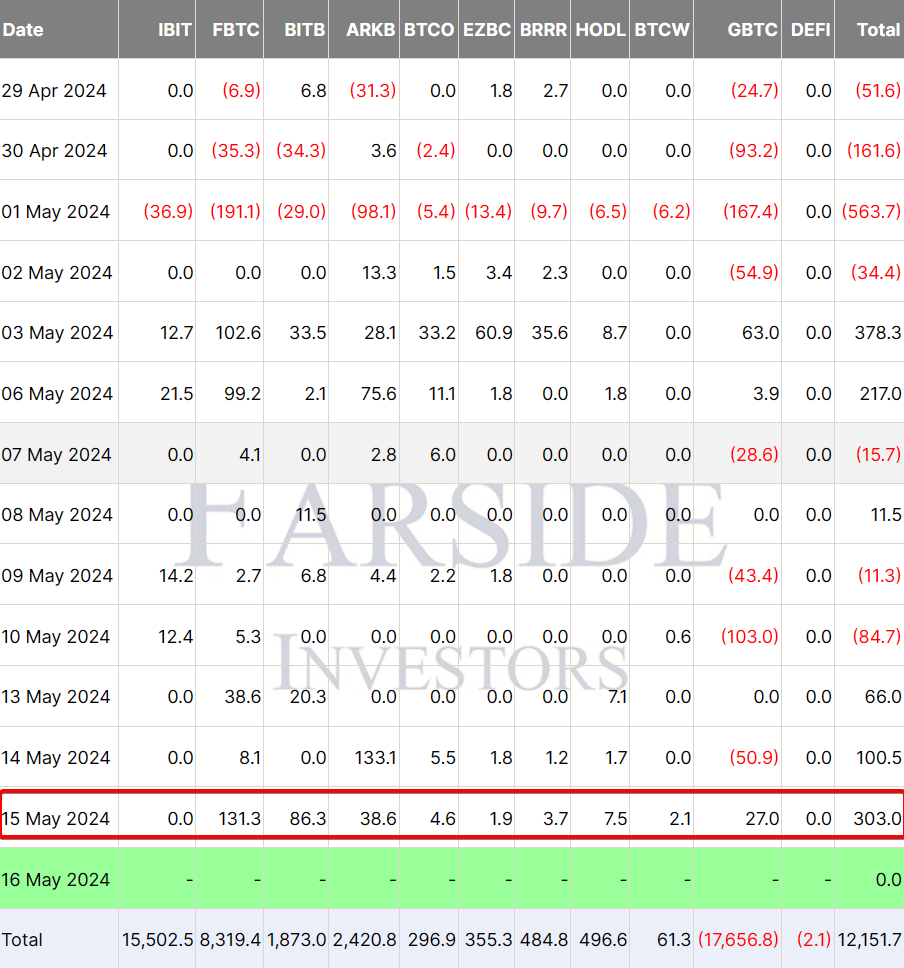

In a related development, U.S. spot bitcoin ETFs saw a record surge in inflows, with a net inflow of $303 million in a single day, the highest since early May. Leading this surge was Fidelity’s FBTC, with $131.3 million in daily inflows, followed by Bitwise Fund’s $86.3 million. Ark Invest and 21Shares’ ARKB also saw significant inflows of $38.6 million.

In contrast, Grayscale’s GBTC, the largest spot bitcoin fund by net asset value, experienced its third-ever net inflow, adding $27 million to its coffers. Meanwhile, BlackRock reported no new inflows.

The total inflow into the 11 U.S. spot bitcoin ETFs now stands at a staggering $12.15 billion, indicating a strong appetite for cryptocurrency investments among institutional players.

The influx of institutional money into bitcoin ETFs represents a significant milestone in the acceptance and integration of cryptocurrencies into mainstream finance, setting the stage for new investment opportunities. With Morgan Stanley leading the way, the landscape of digital asset investment is poised for a transformative change.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.