Monero – Guide, Tips & Insights | Learn 2 Trade (XMR) Price Analysis: August 29

In case the bears increase their momentum, the support level of $142 may be penetrated downside, which may extend bearish trend to the low of $124 and $108. When there is a breakup at $169 resistance level, Monero – Guide, Tips & Insights | Learn 2 Trade price will increase towards $185 and $203 levels.

Key Levels:

Resistance Levels: $169, $185, $203

Support Levels: $142, $124, $108

XMRUSD Long-term Trend: Bearish

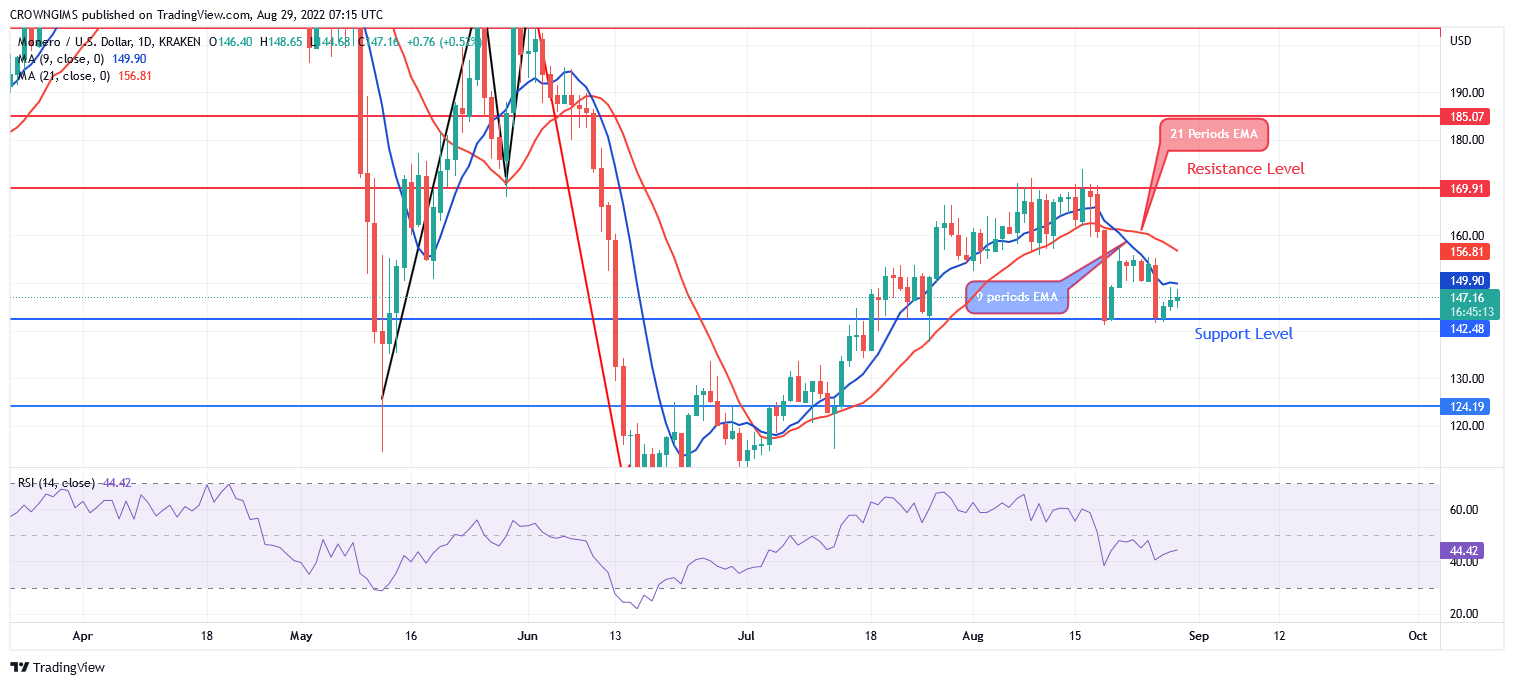

Monero – Guide, Tips & Insights | Learn 2 Trade is bearish on the daily chart. Last week, the bulls and bears were struggling with each other at $169 level. Bears rejected further price increase at the just mentioned level. The bearish momentum pushes XMR towards the $142 level last week, bulls defended the just mentioned support level. The price was dangling within $169 resistance level and $142 support level.

Monero – Guide, Tips & Insights | Learn 2 Trade price is trading below the 9 periods EMA and 21 periods EMA at close contact as a sign of low bearish momentum. In case the bears increase their momentum, the support level of $142 may be penetrated downside, which may extend bearish trend to the low of $124 and $108. When there is a breakup at $169 resistance level, Monero – Guide, Tips & Insights | Learn 2 Trade price will increase towards $185 and $203 levels. However, the relative strength index period 14 is at 45 level with the signal line displaying bullish direction.

XMRUSD Price Medium-term Trend: Bearish

Monero – Guide, Tips & Insights | Learn 2 Trade is on the bearish movement on 4-Hour chart. The bulls’ pressure could not break up the $169 resistance level. The sellers’ pressure is not strong enough to break down the $142 support levels. The bearish movement may continue this week to previous low.

The price is trading around the two EMAs with the 9-day EMA interlock with the 21-day EMA which indicate that ranging movement is in progress. The relative strength index is at 47 levels pointing up to indicate buy signal.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.