Monero – Guide, Tips & Insights | Learn 2 Trade (XMR) Price Analysis: March 08

When sellers are putting more pressure on the pair, and the price may slide downwards, the support level of $184 may be penetrated downside and the support levels of $161 and $136 may be the target. Failure to break down the support level of $184 may result in the continuation of the bullish trend towards the $217, $244, and $281

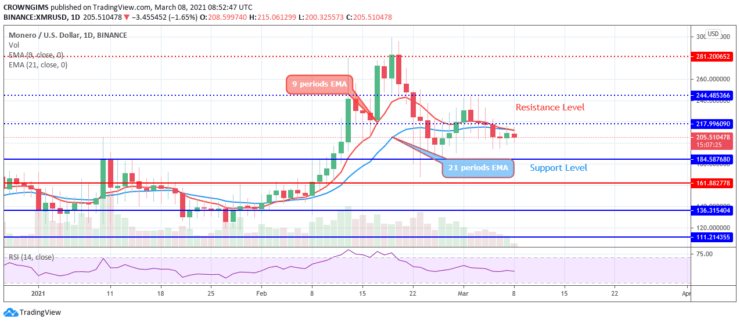

Key Levels:

Resistance Levels: $217, $244, $281

Support Levels: $184, $161, $136

XMRUSD Long-term Trend: Bearish

The bullish momentum pulled back to test the support level of $184 on March 07. The price action on the daily chart has formed a “Head and Shoulder chart pattern. The last leg of the chart is about to be completed. The crypto decreases towards the support level of $184. It may experience a breakout and decreases to test the support level of $161.

The 9-day EMA is trying to cross the 21-day EMA downward on the daily chart with the price trading below the two EMAs. When sellers are putting more pressure on the pair, and the price may slide downwards, the support level of $184 may be penetrated downside and the support levels of $161 and $136 may be the target. Failure to break down the support level of $184 may result in the continuation of the bullish trend towards the $217, $244, and $281

XMRUSD Price Medium-term Trend: Bearish

Monero – Guide, Tips & Insights | Learn 2 Trade on the 4-Hour chart is respecting the resistance level of $217; which indicates that there is a strong barrier at the level. There is a probability for the price to breakdown the support level of $184. Should the bear pushes the coin to break down the mentioned support level, further downtrend movement could be experienced towards the support level of $161.

The 9-day EMA is below the 21-day EMA and the price is trading below the 9-day EMA, suggesting the downward movement this week.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.