GBPJPY Price Analysis – January 8

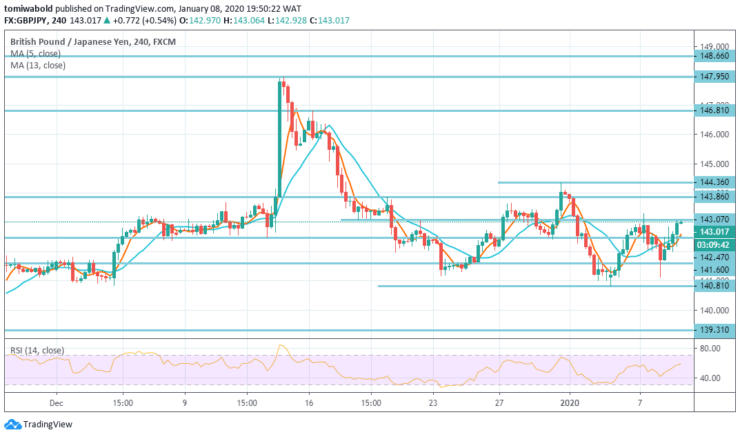

GBPJPY drops to 141.12 level during the Asian session on Wednesday. However, during the American session, it recovered to 143.07 level. The pair stays in the background after the latest news showed that Iran fired several rockets at US targets in Baghdad, after which the FX pair recovered due to the unexpected stability.

Key levels

Resistance Levels: 150.00, 148.66, 147.95

Support Levels: 139.31, 130.49, 126.54

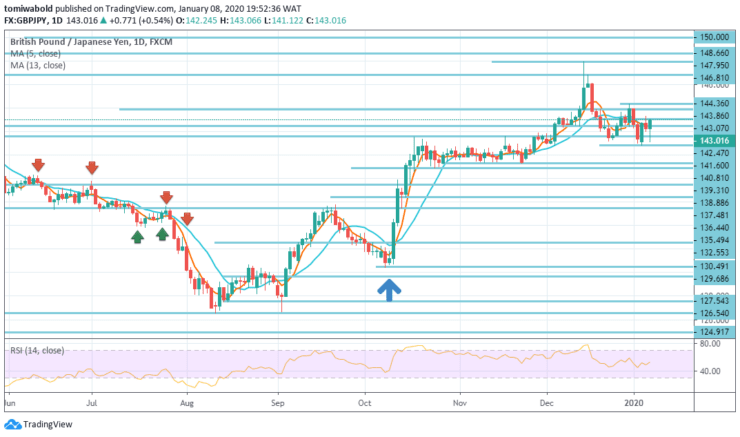

GBPJPY Long term Trend: Bullish

In the larger structure, an increase from the level of 126.54 can be either the next consolidation model from the low or the start of a new uptrend. In any case, a continuous rally is expected as long as the level of 139.31 is held in the resistance zone of 148.66 / 150.

The reaction from there may indicate in which scenario it should be. However, a steady breakthrough in the level at 139.31 may weaken this scenario and change the long-term neutral outlook in the first place.

GBPJPY Short term Trend: Ranging

GBPJPY intraday bias stays neutral at the moment. In case of another decline, we expect support from the level of 139.31 (a partial recovery of the level from 126.54 to 147.95 at 140.81) to bring a rebound.

On the other hand, overcoming the level of 144.36 may lead to repeated testing of the resistance level of 147.95. Nevertheless, a steady breakthrough of the level at 139.31 can pave the way to the restoration of the level at the level of 138.88.

Instrument: GBPJPY

Order: Buy

Entry price: 143.07

Stop: 140.81

Target: 147.95

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.