As of today, MIOTA price has moved up by roughly 8%. And by the looks of its price action, it appears that more price increases may be experienced today in this market.

MIOTA Analysis Data:

IOTAj value now: $0.2523

IOTA market cap: $684.45 million

MIOTA moving supply: 2.78 billion

MIOTA Total Supply: 2.78 million

IOTA Coinmarketcap ranking: #67

Major Price Levels:

Top: $0.2523, $0.2575, $0.2612

Base: $0.2500, $0.2470, $0.2440

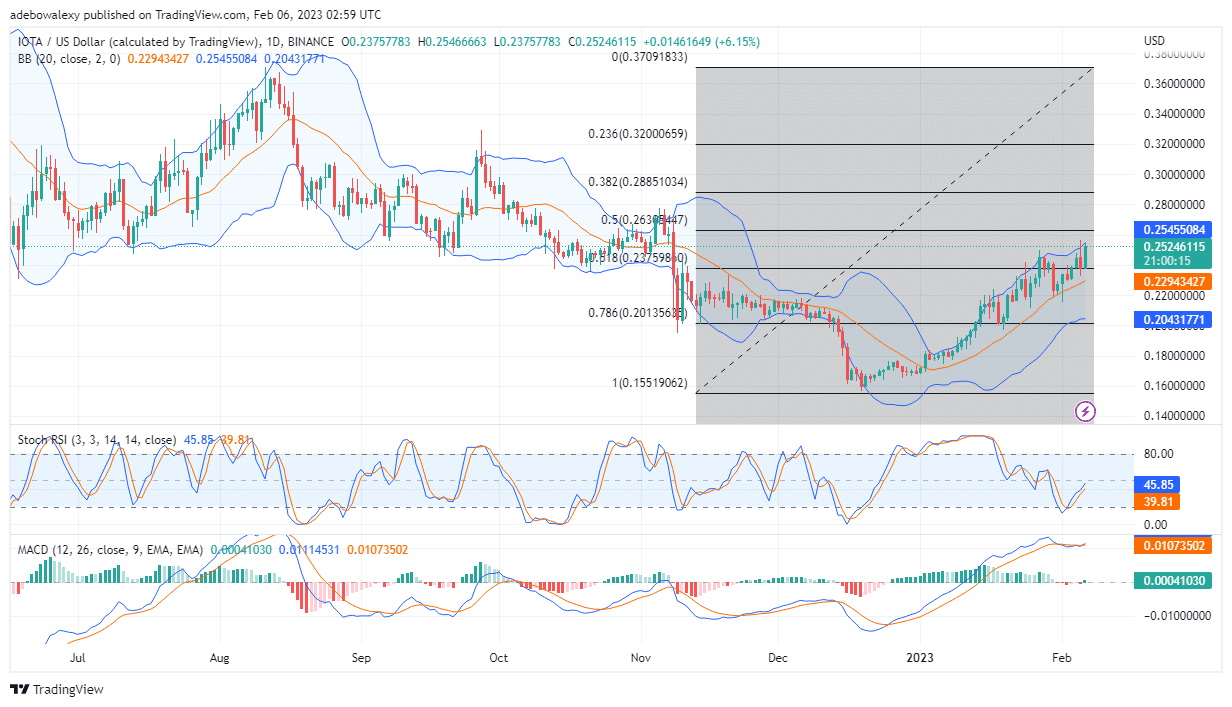

MIOTA May Have Found Support at the 51.80 Fib Level

The daily IOTA/USD market shows that the pair’s price may be aiming to move higher from here. We can see that the price candle for this session seems to be sitting comfortably on the Fibonacci level of 51.80. And at that price may progress higher from here. The MACD lines keep moving upward above the equilibrium level. At the same time, the RSI curves are also trending towards the 50 levels of the indicator. At this point, we can see that it appears that price action is still gaining strength, as all trading indicators remain aligned to predict that price may increase further in this market.

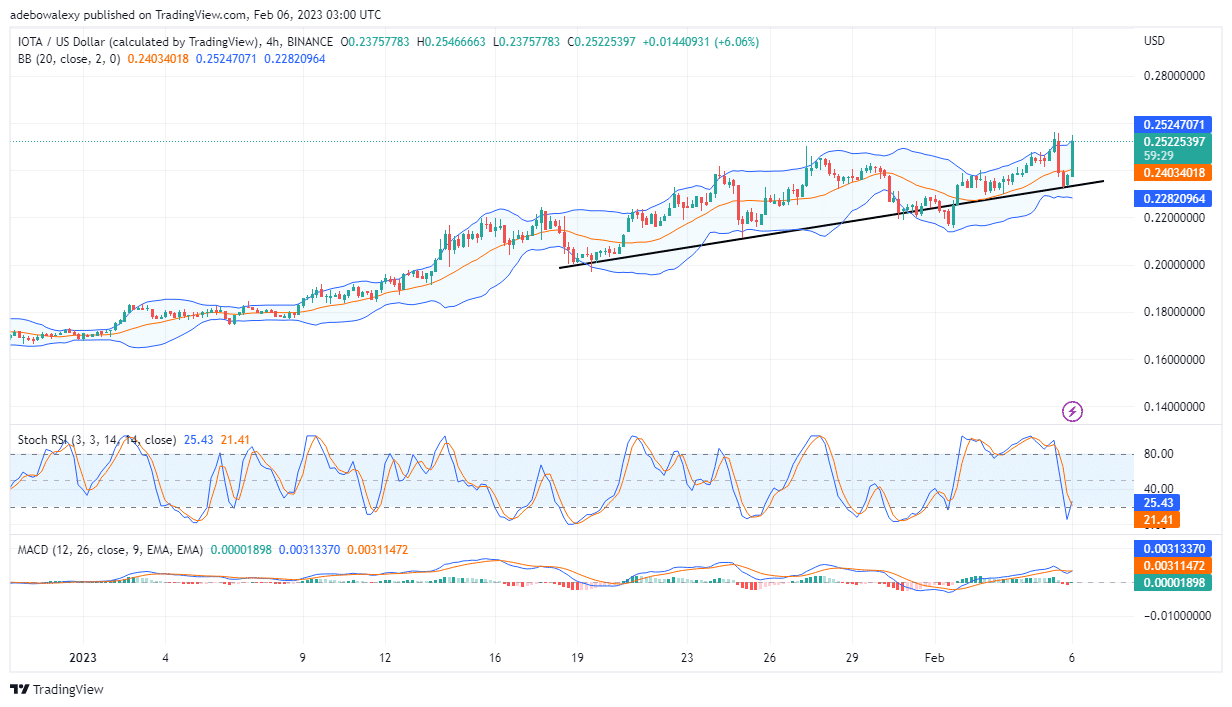

MIOTA May Break the 0.2600 Resistance

The IOTA/USD price appears to have started an upside move. Considering the 4-hour market for this crypto, it could be seen that price action is moving more vigorously upwards. This could be seen as the price candle from two sessions ago can be seen bouncing upward, off the upward-sloping trendline. Also, trading indicators could be seen still at their initial stage of confirming an upside move in price. The MACD lines have just completed an upside crossover, and the RSI indicator lines have also completed an upside crossover. Therefore, traders can predict that the MIOTA price may break the $0.2600 resistance level.

Buy IOTA on eToro.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.