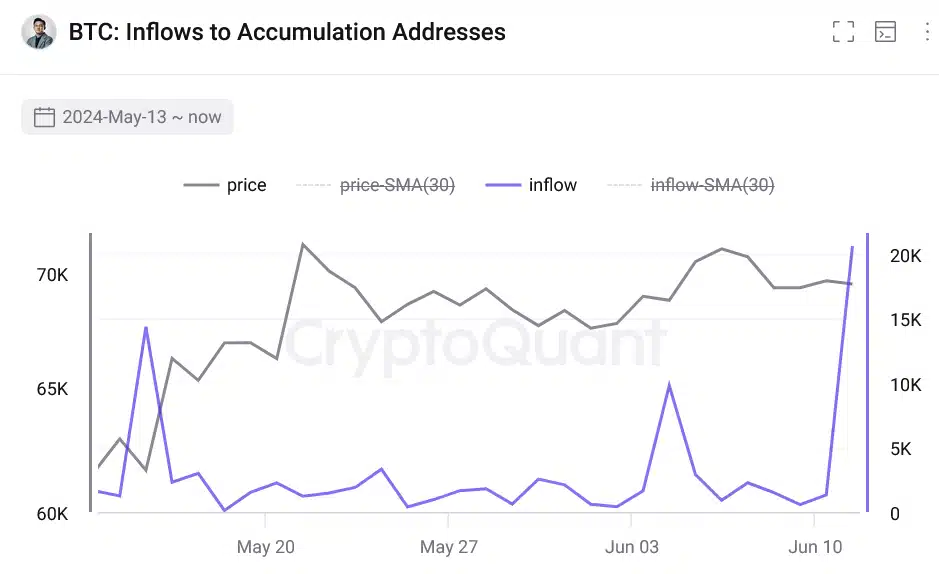

Bitcoin prices remained weak on Thursday as the market reeled from the recent CPI report and Fed comments. Amid this bearish undertone, Bitcoin whales took the opportunity to buy the dip, accumulating a staggering 20,600 BTC worth approximately $1.4 billion in just 24 hours on June 11. This represents the largest single-day Bitcoin buying spree by whales since February.

The Bitcoin buying frenzy occurred as the cryptocurrency’s price fell from highs near $72,000 in early June to below $67,000.

However, the increased whale activity, combined with a decrease in the supply of Bitcoin on exchanges to levels not seen since December 2021, suggests that large investors remain bullish on the digital asset’s long-term prospects. Historically, falling exchange reserves have correlated with strengthening Bitcoin prices.

😎 Bitcoin’s supply on exchanges has now dropped to its lowest level since December, 2021 (~942K coins). Meanwhile, Ethereum and Tether are moving back on. Historically, there is less drop-off risk for all of crypto while $BTC‘s available supply to be sold is limited. pic.twitter.com/vGv0q6esxx

— Santiment (@santimentfeed) June 13, 2024

Despite the recent volatility, Bitcoin continues to hold its head above water and is currently trading around $66,500. While still down about 9.5% from its all-time high set in March, many analysts believe the current consolidation is setting the stage for a significant rally in the coming months.

MicroStrategy Proposes Convertible Note Offering to Acquire More Bitcoin

Bitcoin’s resilience in the face of short-term price fluctuations demonstrates its growing maturity as an asset class. Institutional investors and corporations continue to increase their exposure to Bitcoin, viewing it as a hedge against inflation and a potential store of value.

For example, business intelligence firm MicroStrategy recently proposed a $500 million convertible note offering to acquire even more Bitcoin, adding to its existing holdings of over 214,000 BTC.

MicroStrategy Announces Proposed Private Offering of $500 Million of Convertible Senior Notes $MSTR https://t.co/5K8TqAi1D7

— Michael Saylor⚡️ (@saylor) June 13, 2024

As mainstream adoption of cryptocurrencies continues to grow, Bitcoin remains the market leader and the gateway for many new investors entering the space. The recent whale accumulation during the dip suggests that savvy investors are confident in Bitcoin’s future and are using price pullbacks as buying opportunities.

While short-term volatility is expected in the cryptocurrency markets, Bitcoin’s underlying fundamentals remain strong. With increasing institutional support, a robust network, and a finite supply, many believe that Bitcoin is well-positioned for significant growth in the years ahead.

As always, investors should do their own research and exercise caution when investing in any cryptocurrency.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.