Michal first heard about bitcoin in 2014. He had $4,000 in his savings account. Inspired by his programmer friend, a rabid bitcoiner, he went all-in.

“At the time,” he wrote on his Medium page, “I invested my $4k, the price of a bitcoin was about $600. I got 6.55 BTC. I will never forget that number. Over the next half a year, bitcoin’s price kept steadily declining, until it bottomed out at $152, in January 2015. That’s a 75% loss just like that before I knew anything about how investment (or crypto) cycles work!”

But Michal was committed. He held. More importantly, he had other things occupying his time. He was zooming out.

He held. And he kept learning.

Between April and December of 2017, it shot up to $20,000.

He held. And learned more.

And then, it crashed down to $6,000. While most people were panicking, what did Michal do? He bought more.

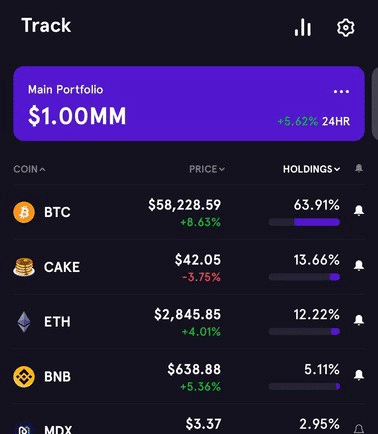

Recently, he began leveraging that crypto in “blockchain banks,” making about $3,000 per month. And now that DeFi is maturing, he’s begun pulling in, on average, $20,000 per month.

His portfolio recently hit the $1 million mark.

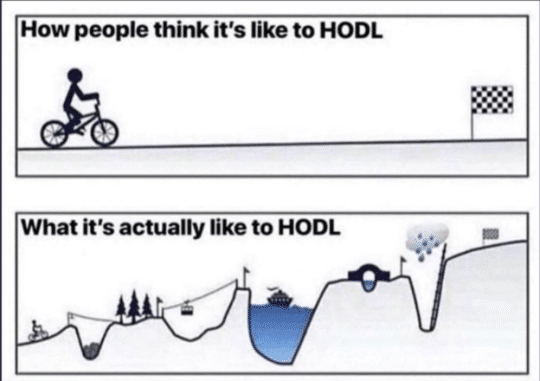

“The reason most people who invest in crypto don’t end up rich is that they can’t hold — or, in the crypto parlance HODL. HODLing is much harder than it sounds.”

Michal offers these three pieces of advice:

ONE

Patience and calm. I watched my holdings dip 75% almost right after I bought them. I held. Then I watched them dip 85% again in 2018. I held. And I bought more. I’m not even counting all the other 20–40% dips in-between.

TWO

Timing is king. Yes, I was lucky that I heard about bitcoin in 2014. But it was my decision to seize the day and not wait a couple of years to see if the technology proves itself. Then again, in 2019, when the price was low, I topped up. It was the right time to do so, even though the returns were far from immediate.

THREE

Less is often more. I know many people who at some point became active traders in crypto. All of them either lost money or made several times smaller gains than they would have if they just held BTC, as I did. The first rule of trading is — don’t lose money. Don’t trade the market if you lack the experience… or the patience to wait for the right opportunities.

But, in the end, those who play to their strengths win out.

Author: Chris Campbell

NB: This article teaches a mighty, real-life lesson. Thank you, Chris C.

“Great investing requires a lot of delayed gratification,” says Charlie Munger. And this quote is also apt for the blockchain industry. Don’t sell your coins. It doesn’t matter if crypto markets undergo seriously protracted bearish trends, which can happen anytime; viable coins will ultimately trend upwards and bring massive returns in the future. Selling your coins is like killing the goose that lays the golden eggs. Rather, you should use serious bearishness as opportunity to buy more coins. This advice is enough for wise investors.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.