If you’ve been looking into managed accounts for forex, then chances are you’ve come across the term ‘managed PAMM accounts’. Not to mention LAMM and MAM (more on that later).

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

PAMM is a way of enabling investors to trade passively, leaving the hard work of buying and selling down to an experienced forex trader. All you have to do is pay for the service, which is usually a pre-agreed commission structure.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Of course, one of the other advantages of this type of account is that you won’t need to be armed to the teeth with knowledge on technical analysis. Likewise, you don’t need to understand historical price data or trends.

The notion of assigning trading endeavours to a third-party is not a new thing. However, these days more and more traders are taking advantage of online investment streams such as managed and automated accounts.

It’s rather rare that financial assets like futures, stocks, commodities, bonds and options will be traded with a PAMM account. However, there are exceptions to this rule. If you’re interested in trading forex with a managed account or an automated system – then a PAMM account might be just what you’ve been searching for.

For any newbie investors – or people who have been out of the game for a while, this guide is going to clarify what a PAMM account is and what to look out for before choosing a provider. Then, we’ll present the best managed PAMM accounts of 2023.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What are Managed PAMM Accounts?

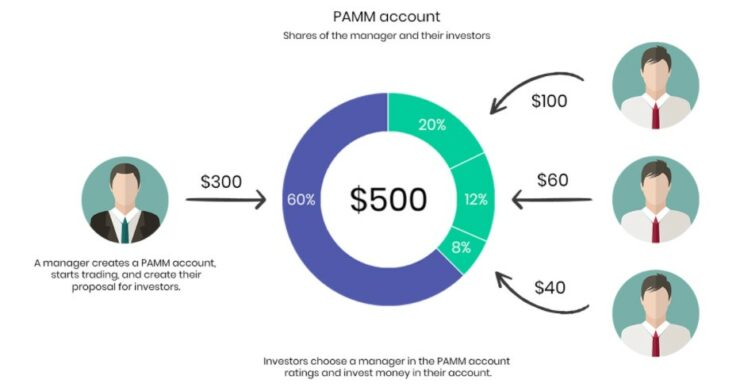

PAMM is an acronym for ‘Percentage Allocation Management Manager’. In a nutshell, this is a managed trading account which enables you to invest your cash in a knowledgeable trader. These investors have a long history in the field and in-depth trading results are available for verification.

This type of account works in a similar way to a mutual fund. The reason being, you are essentially investing your cash with a third-party to trade for you. Furthermore, like a mutual fund, your money is banded together with other investors to make a ‘pot’.

Trading this way enables you to get your foot in the door of the global financial markets. All without acquiring any expertise when it comes to trading. It also permits you to trade on a much bigger scale than you might ordinarily be able to. as a byproduct, you can also increase your potential profit on a bigger scale.

With that being said, PAMM and mutual funds are dissimilar in other ways. With a PAMM account, your funds will be entrusted to a single trader who has an accomplished performance history. This is on the contrary to mutual funds, where a large financial institution will be buying and selling on your behalf.

A PAMM account trader usually focuses on day trading, as opposed to buying assets and holding onto them for months at a time. In addition to this key difference, PAMM account traders will invest their own money into the portfolio. This is a positive aspect of this kind of account as it’s in the best interest of the PAMM trader to trade with a low-risk strategy.

These pro traders make money by means of commission on every profit made. The commission charges will be taken before you or any other investors receive their profits.

In the sections below, we’ve put together a short explanation of the three collaborators involved in the usual managed account procedure.

The Forex Investor

As you have no doubt guessed, the investor is the person who injects funds into the PAMM account. If you are the investor, your main objective is to make financial gains passively, without having to do much. This ‘pool’ could include you and 100 other investors.

This type of account might be particularly well suited to you if you are inexperienced when it comes to the forex markets, or if you know what you’re doing but lack the spare hours in a day.

The Knowledgeable Forex PAMM Trader

Before you can make the most of PAMM accounts, you need to deposit some money to a knowledgeable trader. This will be your fund manager. You will be trusting the aforementioned trader with your investment funds and hopefully, they will make profits on your behalf in the forex market.

You might wonder how the experienced trader benefits from this setup? For every trade executed on the PAMM account, the trader will charge you and other investors a commission percentage. This is how the trader makes a living. These accounts usually come with a profit-sharing contract. As a result, the trader should theoretically make a bigger profit as capital goes up.

The Brokerage Company

When the experienced forex trader has collected funds from all investors involved, they have to go through a brokerage company. The brokerage firm must enable traders to offer PAMM services.

When relying on a third-party to take care of your money, it’s crucial that certain safety nets are in place such as a ‘Limited Power of Attorney’ agreement.

In a nutshell, this is an agreement which gives the trader permission to trade on your behalf (on a particular brokerage site). Consequently, this means taking full accountability for any potential losses encountered by the trader when buying or selling for you.

How Do Managed PAMM Accounts Work?

Before we get into the framework of a PAMM account, let’s have a look at how the investment process works. Managed PAMM accounts are like a far-reaching portfolio, with many investors holding a portion of the investment – as well as sharing the PAMM account manager (trader).

- Let’s imagine you invest $20,000 into your forex PAMM account.

- Now let’s say another investor injects $20,000 as well.

- Next, the PAMM account trader invests $60,000 from his own pocket.

As you can see from our example above, this particular PAMM portfolio is made up of $100,000 in trading funds. You own 20%, the other investor owns 20% and the PAMM trader owns 60%. As a result of this structure, you will always own 20% of the trader’s account balance.

In another example, let’s assume that in month 1 of trading, your account manager makes a profit totalling 40%, On the $100,000 account used above, this means the profit is $40,000.

The PAMM account manager charged 15% commission, so made gains of $6,000. The leftover $34,000 will be shared out amongst the stakeholders.

- By the end of the first month, the PAMM account value stands at $134,000.

- This means that your 20% stake in the account equates to $26,800.

- The same goes for the other investor – as they also have a 20% stake.

- The PAMM account trader has a 60% stake, which is now worth $80,400.

Essentially, by letting a well-seasoned trader buy and sell forex for you, you’ve managed to increase your investment from $20,000 to $26,800 – all without doing a thing.

Managed PAMM Account Procedures

When it comes to PAMM account procedures, the first thing that springs to mind is the Limited Power of Attorney agreement. You will need to sign one of these to confirm your agreement to allow the experienced trader to trade forex on your behalf.

This means that there are no legal consequences if the trader is unfortunate enough to make a loss. The licenced and regulated broker will look after your account balance and monitor the specifics of any trades being placed.

Managed PAMM Accounts End of Month

Let’s look at an example of how you can assess the performance of your managed PAMM account at the end of each month.

- Let’s say the PAMM trader deals currency pairs all the way through the month of July.

- Imagine the trader has a profitable month, making gains of 40%

- On a PAMM account initially valued at $200,000, this means it is now valued at $280,000.

- On paper, this means that your first investment of $20,000 has grown by 40%.

Nonetheless, as we mentioned, the PAMM trader needs to be rewarded for their profit-making endeavours. As such, they will take their commission on any profits before you or any other stakeholders see any returns.

- The trader made 40% in July which equates to a profit of $80,000.

- By deducting 15% commission, the trader will make an extra $12,000.

After taking the applicable commission there is $68,000 remaining to share amongst all of the investors of the PAMM account.

What if the PAMM Trader has a Losing Month?

In trading, there is no guarantee that the PAMM trader will have a profitable month. So let’s imagine that the trader has had a bad run of results.

- In August the trade makes a 20% loss.

- Let us assume that none of the investors withdrew their gains from July, meaning the PAMM portfolio lost 20% of $280,000.

- With a loss of $56,000, the account balance sits at $224,000.

- Despite your investment in the account being in profit (because it’s higher than the initial $200,000), the trader won’t charge any commission in August.

As is the nature of trading in any market, there is always a chance for the PAMM account manager to experience a bad month.

Moreover, you should avoid withdrawing funds from the account, which is going to work in your favour during a month of losses. The reason being that the value of your account will fluctuate. The same applies when investing in mutual funds, as not every month will be profitable.

Managed PAMM Accounts Drawdown Percentage

The PAMM account drawdown percentage is an important factor when selecting a provider. The drawdown is the highest percentage in losses that the PAMM traders have undergone, in correlation to the highest value of the trader’s account.

- For instance, let’s imagine that the PAMM account is valued at $100,000 by the end of the first month.

- By the end of month 2, the account is worth $120,000.

- The peak value of the PAMM account is $120,000 because that’s the most it has been worth so far.

- If for example, the third month ends on a high of $90,000, you can calculate this amount in relation to the peak of $120,000.

- The maximum drawdown on this metaphorical account is now 25%.

Put simply, if in the second month you had invested in the PAMM account, your investment value would be 25% lower by the third month.

The best thing you can do is look for managed PAMM accounts with a low drawdown percentage, ideally over a twelve-month period.

What Does the Broker do?

As previously noted, a forex broker is needed to enable the buy and sell orders of your selected PAMM trader. The brokerage in question also needs to be paid for their services. Because of this, the trader has to pay a variety of commissions and fees.

In light of the fact that you are a stakeholder, these extra costs need to be factored into the trader’s commissions. Namely, it’s not as black and white as simply investing with a knowledgeable forex trader and leaving the trader to select any broker they want.

Conversely, there must be safety precautions in place to make sure that you can authenticate any investments the PAMM manager makes for you. There’s also the assurance that your funds are isolated from the trader. In other words, you won’t need to worry about the PAMM trader moving your money into their own account.

Available Managed PAMM Accounts

In all, there are two ways to utilise PAMM accounts – directly or via a third-party account provider. Let’s explore each option in more detail.

Broker Direct Accounts

There are tonnes of licenced forex brokers in the position to offer PAMM accounts. The first thing you need to do is register for a trading account by signing up and making a deposit.

Next, you need to look for the PAMM account division of the broker platform. Here you will find an extensive list of each available PAMM trader.

Crucially, you need to spend some time evaluating the results of the trader in question. In addition to this, you need to take a look at what assets they trade.

Upon finding a PAMM trader, you usually agree on a commission framework. At this point, you would need to transfer some money to the PAMM account trader so that they are able to trade on your behalf.

One of the main advantages of trading directly with a brokerage is access to the top-performing trading sites. It is important that any platform you choose has a licence from the FCA (Financial Conduct Authority), or the appropriate body for your location. Other well known regulatory bodies are CySEC (Cyprus Securities and Exchange Commission) and ASIC (Australian Securities and Investments Commission).

Third-Party Accounts

Now onto third-party account providers for PAMMs. Put simply, the provider is the middleman between yourself and the brokerage firm.

In the name of comparison, we’re going to briefly explain how a third party PAMM account provider operates.

- Third-party PAMM accounts offer less flexibility but are great if you want a passive income from trading forex, entirely automated.

- When funding your account via a third-party, there generally won’t be any call for you to select your own PAMM trader. In this instance, you wouldn’t be required to negotiate a commission fee either. The third-party platform in this case usually takes care of everything.

- The third-party account option also enables you to use independent traders. These traders often don’t use conventional PAMM brokers.

To reiterate, always make sure any PAMM provider, third-party or not, is using a licensed brokerage firm. If the broker isn’t regulated, then you are essentially putting your money and personal information at risk.

Other Managed Money Systems

When researching managed PAMM accounts, you might have also seen LAMMs and MAMs. Although they sound similar, there are noticeable differences between them.

We’ve put together a brief explanation of each of the forex managed trading systems to highlight the differences. As always, research is key before committing to any type of account.

Managed PAMM Accounts

As you know by now PAMM stands for ‘Percent Allocation Management Module’. If you choose to, you can just allocate a portion of funds to a PAMM, which means you can still copy financial trades from your main account.

Managed PAMM accounts allow traders to use more than one account. This means you can allocate a separate percentage of your capital to every trading system. Of course, this can potentially diversify your portfolio.

The trading structure on PAMM accounts is considered to be attractive to money managers, namely because of the variety of options available. Investors are able to pre-select the trading time frame, rollover time and agree on a commission rate. You can monitor your PAMM trades live.

LAMM Account

LAMM stands for ‘Lot Allocation Management Module’ and is the predecessor of PAMM. Unlike PAMMs, LAMMs doesn’t work based on the size of each investor’s account.

Each and every time the LAMM trader buys a standard-sized currency lot, each investor’s account goes up in value by a standard lot as well. If you trade with an above-average amount of capital then LAMMs can be great.

With that said, if you have more trading capital than that of the LAMM manager, it’s not so advantageous. It might be the case that the experienced LAMM trader and yourself have the same size portfolio, in which case, the system works a lot better.

MAM Account

Last but not least another managed forex account option is a MAM, which stands for ‘Multi-Account Manager’. True to its namesake, MAM enables traders to manage multiple trading accounts on one single platform.

The MAM account, in particular, is considered to be most suited to traders who can tolerate a high amount of risk. The reason for this is that MAM managers can apply higher leverage on specified, segregated accounts.

How to Select Suitable Managed PAMM Accounts

From start to finish, one of the most difficult aspects of trading via a PAMM account is selecting the right trustworthy trader for the job.

This is crucial because the PAMM manager will be in charge of making important decisions on your behalf. With that said, allowing a person or an algorithmic trading system to use your funds to buy and sell is common amongst the trading community.

Likewise, it’s also important to ensure that the PAMM trader in question has the experience, in addition to verifiable results trading in the financial markets.

To assist you in reaching this goal, we’ve put together a list of things to consider on your quest to find the perfect PAMM account manager for you.

Minimum Deposit

The vast majority of PAMM account platforms will require a minimum deposit to get started. In other words, the amount you are investing in the PAMM manager’s trading pot.

Some PAMM platforms stipulate a minimum investment of two or three hundred dollars, whereas occasionally this can be significantly more than that. Regardless of how much the minimum deposit is, you should only ever invest as much as you can realistically afford to lose.

Account Diversity

One of the key metrics when looking for managed PAMM accounts is diversification. Using more than one trader immediately improves the diversity of your portfolio.

Let’s say you decide to invest $20,000. Rather than investing in just one PAMM trader, you could invest in five. This means that if one trader is having a month of losses, your portfolio won’t suffer the consequences as much.

Multiple Asset Classes

Managed PAMM accounts offer just about every asset under the sun. Whether it’s gold, currencies, blue-chip stocks or energies – there will be an accomplished trader which suits your needs.

Having said that, it might be worth considering diversifying your portfolio, by means of trading more than one asset, as well as PAMM traders. After all, there is less risk involved when spreading your capital between multiple asset classes.

Commission Framework

Like any seasoned investor, PAMM account traders are looking to make some money. As we talked about earlier, the PAMM trader will make money by means of a commission contract. Bearing in mind that the account manager will only make money when you’re making gains, it’s in their best interest to perform to the best of their ability.

The commission depends highly on the PAMM trader but should reflect the individual’s results, expertise and experience. Put simply, it’s much better to pay 18% commission fees to a successful trader then it is to pay a really low rate and never see any gains.

Before deciding on a suitable PAMM provider, it’s absolutely vital to have a grasp of how the commission framework functions.

Proven Track Record

It’s all well and good finding a PAMM trader who claims to be making gains as much as 80% per month, but unless this claim is verified with results then tread with caution. In fact, it’s advised to avoid those particular providers.

The type of information you should be looking for is what asset classes the PAMM trader buys and sells and crucially – what their monthly returns illustrate. When doing your homework, you should always look at what the drawdown percentage is. More on that subject later.

Regulated Brokerage Platform

Choosing a regulated brokerage platform is of utmost importance. For example, UK Brokers are legally obliged to obtain a licence from the FCA (Financial Conduct Authority). Other tier-one regulatory bodies include ASIC (Australian Securities and Investments Commission) and CySEC (Cyprus Securities and Exchange Commission).

By only entrusting your money with licenced brokers, you can be sure that your personal information and money is protected. Not only that, but investors are guaranteed fund protection. This means that your funds will be segregated from that of the brokerage company. Your hard-earned money can’t be taken as debt if a firm goes into liquidation, neither can it be transferred into the account of the PAMM account manager.

Redemption Policy

For traders who frequently withdraw from a trading account, managed PAMMs won’t be as beneficial. Instead, the PAMM account should be viewed as a long term investment strategy.

Of course, there could be a time in your life when you need to access your PAMM investment funds. It is for this reason that it’s crucial to have a coherent understanding of what the PAMM provider’s redemption policy is.

For example, some require a redemption period of 6 months from your deposit, meaning you won’t be able to withdraw your funds during that period of time.

Payment Options

When it comes to payment options, each site will differ. Either way, in order to begin investing with this kind of account you need to deposit some funds. Most platforms enable typical payment types such as debit/credit cards and bank transfers.

Some PAMM providers offer options such as e-wallets and cryptocurrencies. Always check the terms and conditions as well as the fee table before committing to any one provider.

Best Managed PAMM Accounts for Forex 2023

By this point, we’ve gone through everything you need to know about managed PAMM accounts for forex. Consequently, you’re probably eager to get started.

The first thing you need to do is find a reputable PAMM account provider. There are hundreds of providers out there to choose from, so it can be hard to filter out the good from the bad.

When it comes to managed PAMM accounts for forex, to save you a lot of time and effort we’ve put together a list of the very best providers.

1. World Markets - End-to-End Pamm Account Services via a Single Platform

World Markets has a lot to offer when it comes to trading accounts. This includes everything from PAMM accounts to AI systems. This platform is directly connected to HYCM (a well-established brokerage). As a result, you will have access to thousands of financial instruments in the markets.

This Investing platform provides a full end-to-end PAMM account service. World Markets offers 3 different account options. The first option is the 'Trial Account', which allows you to take advantage of the site's PAMM services. Please note, however, that the minimum deposit required to use this account is €2,500.

Moving on to the 'Standard Account', the minimum deposit for this one is €5,000. This comes with a 20% commission-sharing agreement. This means that if the PAMM trader makes profits of €1,000 in the first month, World Market retains €200. In this instance, you're left with €800 profit from the trade.

Even though the fee might seem a little pricey, you need to look at the profits share based on the final results. Besides the commission fee, you will also be required to pay an annual maintenance fee of 1%.

This PAMM provider doesn't add a markup cost to it's spread. It's important to note that you will only be able to take funds from your PAMM account at the month-end. The platform doesn't charge anything extra for depositing or withdrawing funds - unless you do so with a credit card.

Next, onto the third and final account on offer - the 'Gold Premier Account'. When it comes to this account, World Markets only charge 10% for performance commission. In addition, there are no yearly maintenance costs to pay.

As you might expect with a higher value account, there are extra benefits. For example, the Gold Premier Account offers full access to a safety deposit box (free of charge), weekend customer support and a variety of bonuses. An important factor to consider is the minimum deposit which is €25,000. If you don't have that kind of balance in your account, then you won't qualify for this account option.

- 30-day free trial account - with €2,500 minimum deposit

- World Markets are transparent about the profit share structure between 10% and 20%

- No mark-ups on pips or spread

- €5,000 minimum deposit on standard account

2. FX Pig - Middleman Between you and Independent Forex Traders

FX Pig is an online PAMM account service provider. This platform not only provides account services to Average Joe investors, but also joins forces with multiple verified forex pros. This provider acts as the middleman between you and the PAMM trader. The 4 most recognised partners are Onda, True Move, FXTitan and Vola.

Nevertheless, it's crucial that you dedicate some of your time to researching each and every PAMM trader. It's important to be clued up on what kind of leverage (if any) the trader uses, which financial assets the trader focuses on, and their verified trading results.

When you reach a point where you've decided on a trader, FX Pig will take care of the PAMM account procedure. First, you will need to fund your PAMM account with a minimum of $500. Payment options available on this platform are bank wire transfer, debit and credit card and e-wallets such as Neteller and Skrill.

Forex account traders such as FXTitan do have a more expensive minimum, which stands at $2,000. This trader also has a pretty hefty performance fee of 35% All being said, FXTitan, in particular, has superb trading credentials. This trader has an 8.8% drawdown, which is impressive.

- Provdes access to varified forex traders

- Minimum deposit $500

- Pre-vetted PAMM account traders

- 35% profit share commission rate

3. Insta Forex - PAMM Account Direct With the Broker

Insta Forex is a broker offering the trading comminity a variety of assets such as options, silver, gold, 100+ currency pairs and nearly 90 CFD stocks.

This online broker company differs from the aforementioned platforms. The reason for this is that Insta Forex is is a fully-fledged broker firm rather than an independent PAMM account manager.

In this instance, you will be required to sign up with the broker directly and deposit your funds there. When you have done that you can browse the available PAMM account traders and select one to 'copy'. This provider enables you to spread out your capital across a range of traders. This is helpful if you want to diversify your portfolio.

When it comes to commission fees, this will largely depend on the type of account you have and the specific assets the trader in question focuses on. Insta Forex, like any broker we recommend, is fully licenced and regulated by the appropriate bodies. In this case, that's the FSC (BVI). Popular payment methods are available on this platform, including credit/debit cards, bank transfers and e-wallets.

- First hand contact with a reputable broker

- Competitive minimum deposit with a standard account

- Licenced by FSC and CySEC

- Vague on PAMM account commission structure

4. Alpari - Flexible PAMM Account Agreements

Online brokerage company Alpari offers traders direct access to managed PAMM accounts. Similarly to Insta Forex, you are able to select traders for yourself. To find the best traders you will need to research their trading preferences and track record.

Many of the PAMM traders on this platform have nearly a decade of experience, which puts you in better sted for success. When you've found a trader you want to invest in, you can begin the process of ironing out commission rates and trading strategies.

Each and every PAMM account manager has to fund their account upfront. This should give you peace of mind that the account trader has the motivation to make low-risk trades, with the view of making you (and them) the best profit possible. Alpari is licenced by CySEC, meaning the platform is fully regulated.

- Fully regulated by the Cyprus Securities and Exchange Commission

- Access to experienced and verified PAMM traders

- Traders usually fund their portfolio with 40% of their capital

- Negotiating your own commission contracts

Final Thoughts

Managed PAMM accounts offer traders full access to the global forex market. Best of all, you don’t need to be a pro trader to get involved.

Benjamin Franklin once said, “An investment in knowledge pays the best interest”. However, some traders simply don’t have the time to learn the ins and outs of forex, to the extent needed to be successful. If that sounds like you, then it might be worth considering managed PAMM accounts for your forex trading ventures.

There are also traders who are very experienced in the forex market, but who simply lack the time to keep an eye on financial and economic news, let alone charts. PAMM account providers allow for the kind of passive trading some investors crave.

In the same way, if you are a newbie trader, managed PAMM accounts give you opportunities to trade in the most liquid market in the world. When it comes to trading knowledge, if your level is little to none, it doesn’t matter. As long as you have funds to invest, the PAMM trader will do it all for you.

The framework of managed PAMM accounts can be difficult to grasp at first. After all, there are 3 stakeholders taking part in the same contract – the trader, the brokerage firm, and the investor. All play an important role.

With that said, we’ve covered everything you need to know about PAMM accounts for forex. As a result, you should be about ready to find a PAMM account provider which suits your needs.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

What is PAMM an acronym of?

What is the minimum deposit for a PAMM account broker?

What does drawdown percentage mean on my PAMM account?

Can I make a profit with a PAMM account?

What is the difference between PAMM, LAMM and MAM?