Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

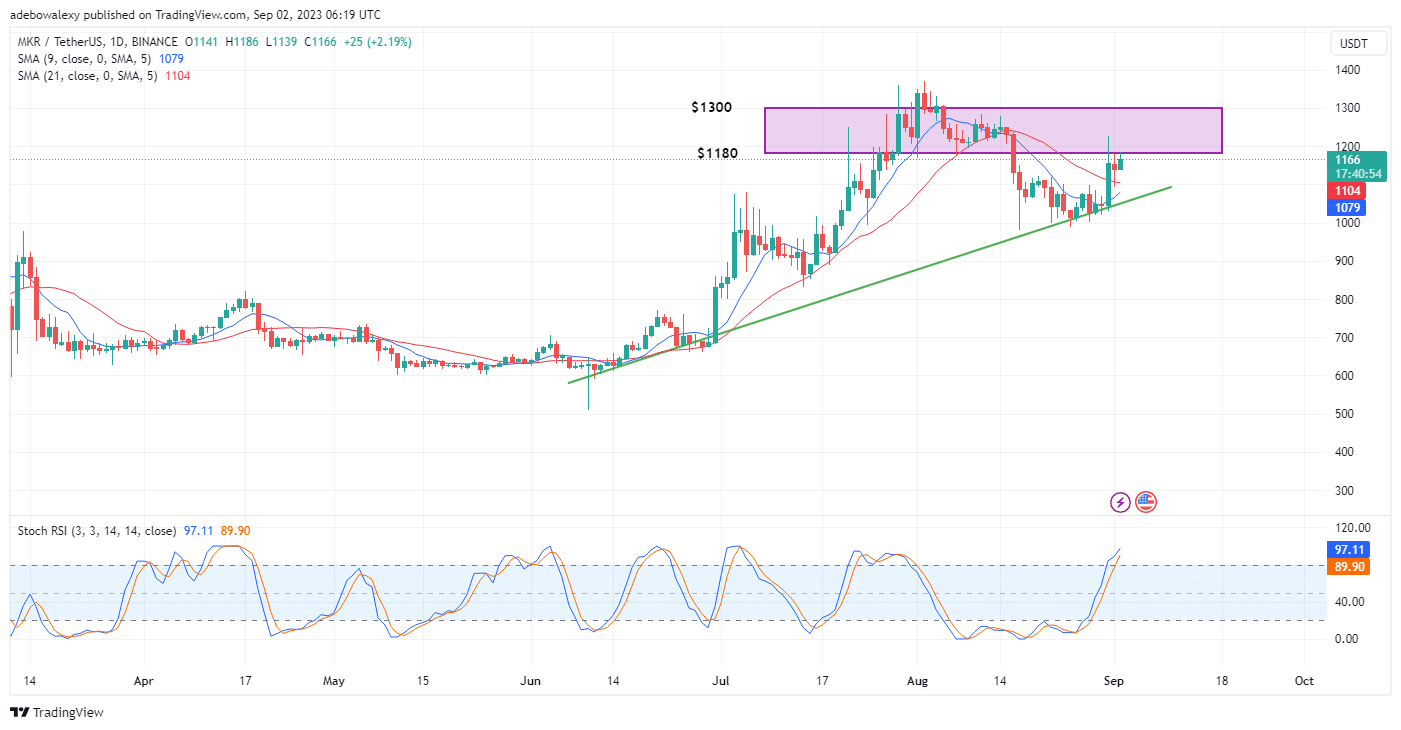

Price action in the MKRUSDT market has extended its upside correction towards the $1,200 resistance price mark. What’s more, technical indicators are more biased toward the opinion that the resistance price mark at $1,200 may be broken. Let’s take a closer look and see the possibilities in this market.

Maker Statistics:

MKR Value Now: $1,166

MKR Market Cap: $1,143,070,430

Maker Circulating Supply: 977,631

Maker Total Supply: 977,631

MKR CoinMarketCap Ranking: 38

Major Price Levels:

Top: $1,166, $1,200, and $1,300

Base: $1,150, $1,100, and $1,000

Maker (MKR) Proceeds Northwards

Price action in the Maker daily market maintains an upside focus after correcting upwards from the drawn upside-sloping trendline on this chart. The mentioned upward correction occurred in the past two trading sessions, and the current session has helped to maintain an upside focus after prices surpassed the $1,100 threshold.

At this point, the 9- and 21-day Smooth Moving Average (SMA) lines seem to be approaching a bullish crossover right below recent price activity. Also, the Stochastic Relative Strength Index (RSI) indicator lines continue to rise upwards towards the 120 mark. Consequently, this shows that buyers may be ready to push through nearby resistance marks.

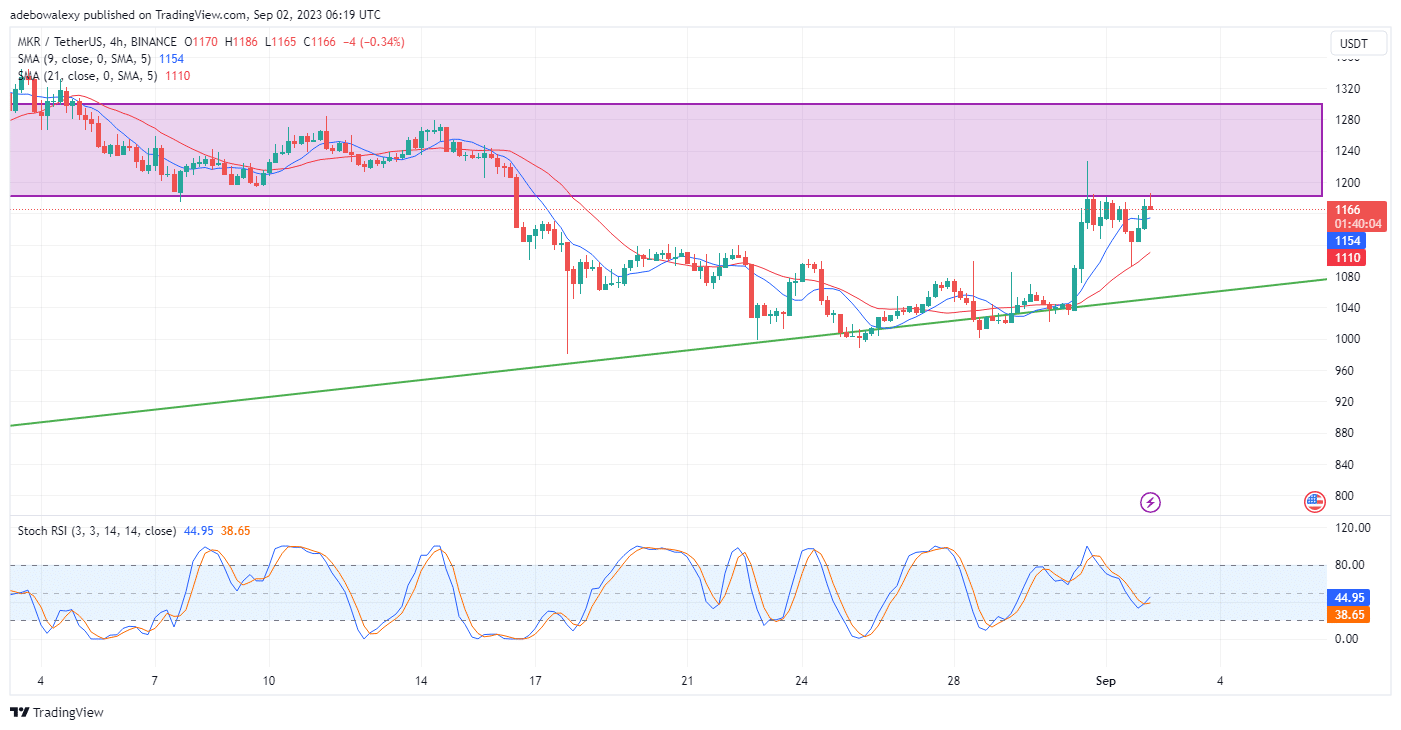

MKR Faces Opposition From Headwinds

While Maker’s price action on the 4-hour market remains largely on an upward course, it could be seen that bears may be presenting some challenges along the way. Here, a red-price candle has just shown up, which represents the ongoing session. This has presented a minimal downward correction.

Nevertheless, price action remains above the MA lines, while the RSI just delivered a bullish crossover around the 40 level of the indicator. As a result, traders may anticipate that price action may receive additional thrust, which will propel price action into regions between the $1,200 and $1,300 mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.