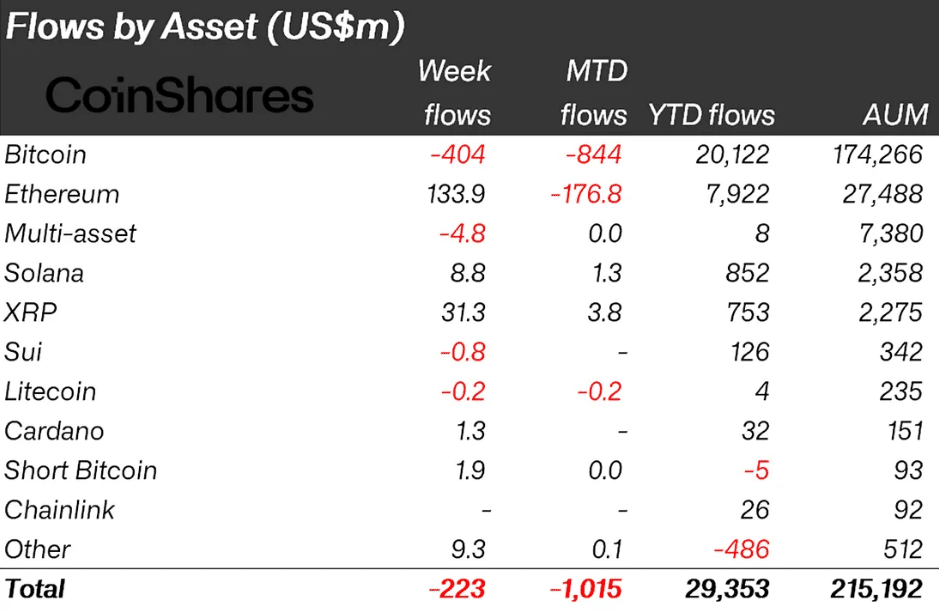

Digital asset investment products experienced significant crypto outflows totaling $223 million last week, marking the first weekly exodus in 15 weeks.

This reversal followed early-week inflows of $883 million, suggesting investors responded quickly to hawkish Federal Reserve signals and stronger-than-expected U.S. economic data.

The outflow pattern reveals how sensitive cryptocurrency markets remain to monetary policy changes. After accumulating $12.2 billion in net inflows over the past 30 days—representing half of 2025’s total inflows—many investors appear to be securing gains from recent rallies.

Bitcoin bore the heaviest selling pressure with $404 million in outflows, though year-to-date inflows still reached $20 billion.

This demonstrates Bitcoin’s particular sensitivity to interest rate expectations, as higher rates typically reduce appetite for risk assets like cryptocurrencies.

Geographic Distribution of Crypto Outflows Shows Broad-Based Selling

The U.S. markets saw the largest outflows by a large margin, with $383 million exiting the market.

Germany recorded $35.5 million in outflows, Sweden saw $33.3 million, and other regions contributed to the global withdrawal pattern. Only a few jurisdictions, including Canada with $12.4 million in inflows, bucked the trend.

Alternative cryptocurrencies showed mixed results. While XRP, Solana, and SEI attracted $31.2 million, $8.8 million, and $5.8 million, respectively, the overall market sentiment remained cautious as investors reassessed positions amid changing monetary policy expectations.

Ethereum ETF Records Historic Single-Day Outflows

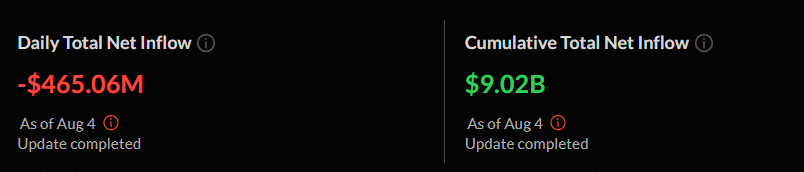

Ethereum exchange-traded funds faced even more dramatic selling, with spot ETFs recording $465.1 million in net outflows on Monday—the largest single-day withdrawal since their launch.

BlackRock’s ETHA led these outflows with $375 million exiting the fund, while Fidelity’s FETH and Grayscale’s products also saw significant redemptions.

Despite Monday’s massive outflows, Ethereum ETFs had posted impressive recent performance with $2.2 billion in inflows during July’s second week and $1.9 billion in the third week.

This suggests the current selling represents profit-taking rather than fundamental rejection of Ethereum exposure.

Market analysts view these outflows as temporary reactions to risk-off sentiment rather than declining institutional interest.

The timing coincided with weak payroll data that triggered broader market sell-offs.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.