Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Price Projection – November 28th

Lucky Block – Guide, Tips & Insights | Learn 2 Trade price forecast highlights a bullish outlook as buyers position themselves for a rebound, leveraging institutional order blocks and liquidity zones to sustain market momentum.

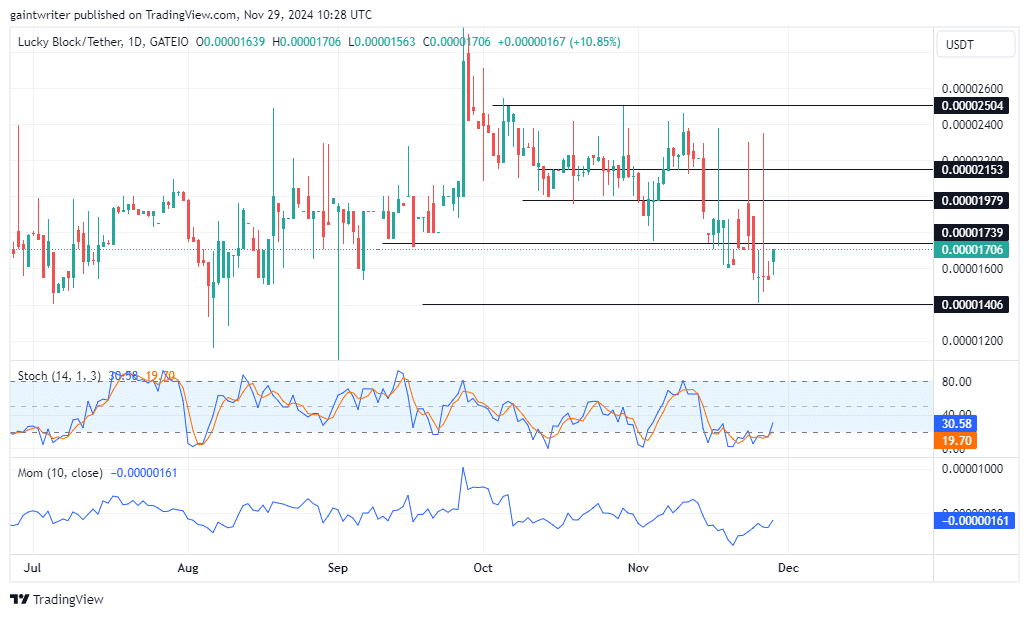

LBLOCKUSD Long-Term Trend: Bullish (Daily Chart)

Bullish Order Block (Support Zones): $0.00001510, $0.00001420

Liquidity Pool (Resistance Zones): $0.00001960, $0.00002410

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – LBLOCKUSD Outlook

The market structure remains bullish, as the price moves to mitigate sell-side inefficiency and approaches the next liquidity pool around the $0.00001960 key area. The Momentum Indicator and Stochastic Oscillator both signal increasing bullish momentum, reinforcing the positive outlook.

The current price is aligned with a bullish mitigation block that formed after last week’s bearish retracement. As buyers regain control, an expansion toward the $0.00002410 resistance level is anticipated. Furthermore, price action reveals bullish imbalances (FVG zones) above the $0.00001900 key level, signaling potential targets for upward movement in upcoming sessions.

If the $0.00001540 support holds, buyers are expected to maintain dominance, with upward targets set at $0.00001970 and $0.00002410. A breakout above these levels could ignite a more substantial bullish rally in the near term, supported by crypto signals indicating increasing market interest.

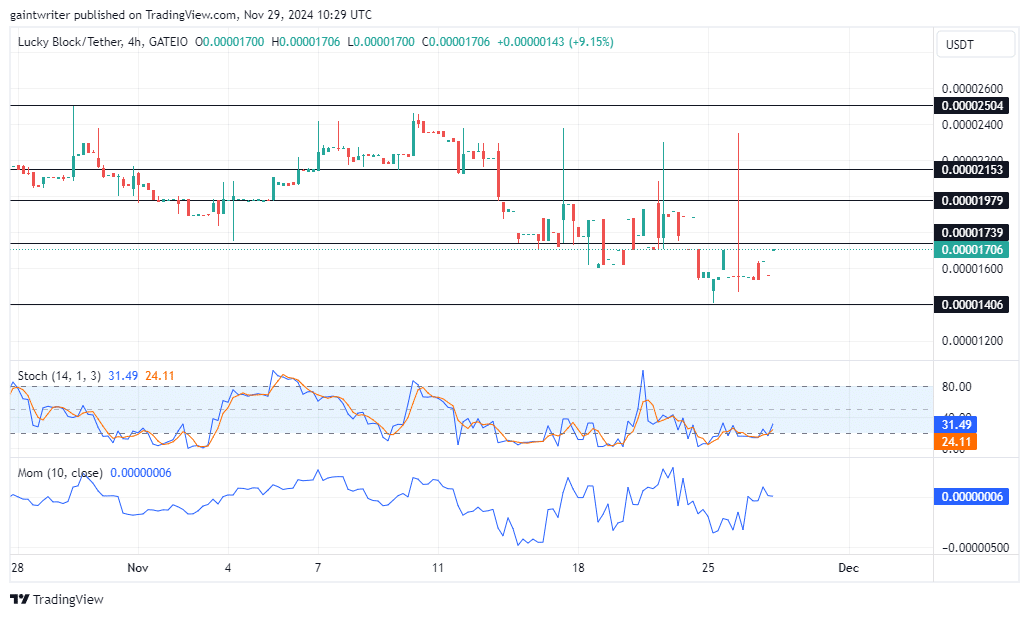

LBLOCKUSD Medium-Term Trend: Bullish (4-hour Chart)

On the 4-hour chart, Lucky Block – Guide, Tips & Insights | Learn 2 Trade is consolidating within a tight range, forming a bullish re-accumulation pattern. Buyers are capitalizing on discounted price levels around the $0.00001540 daily order block. The Stochastic Oscillator indicates rising buy-side pressure, reflecting institutional interest in this zone.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.