Lucky Block – Guide, Tips & Insights | Learn 2 Trade Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – July 4th, 2025

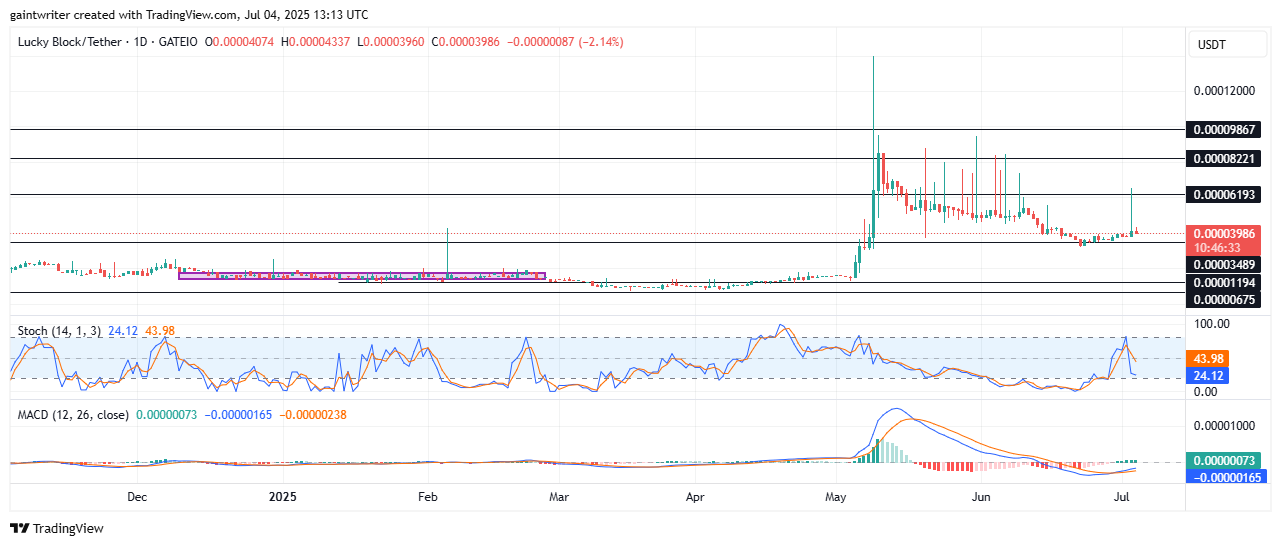

The Lucky Block – Guide, Tips & Insights | Learn 2 Trade price forecast reveals a market in a phase of consolidation following a recent significant price spike.

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Key Levels

Support Levels: 0.000003480, 0.000001190, 0.000000670

Resistance Levels: 0.000006193, 0.000008220, 0.000009860

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Long-Term Trend: Bullish (Daily Chart)

The daily chart for LBLOCK/USD paints a clear picture of a market that experienced a dramatic and sudden surge in mid-May. This has propelled the price from prolonged consolidation around 0.000001194 to test highs near 0.00001200 level . Following this peak, the price entered a sharp corrective phase throughout June.

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – LBLOCKUSD Outlook

Currently, the market is showing signs of stabilizing around the 0.000003986 mark, having bounced from the 0.000003489 support. This support level, which was a significant resistance prior to the mid-May pump, has now proven its role as a crucial demand zone. The overall long-term trend, while having a significant pump, is now characterized by attempts to consolidate at a higher price floor than prior to the pump.

Currently trading at 0.000003986, the LBLOCK/USD price reflects a market that is absorbing recent volatility. As of the snapshot, it is down -2.14%, indicating continued short-term selling pressure or profit-taking after the spike. The strong rejection from the 0.000006193 level highlights that while buyers can drive the price up, significant supply quickly emerges at higher resistance points. The market is now focused on whether the price can establish a new, higher support base above the pre-pump consolidation range.

The Stochastic Oscillator is currently at 41.98, trending downwards from overbought conditions. It indicates that the bullish momentum from the spike has largely faded, and the market is moving into a more neutral or slightly bearish short-term phase.

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Short-Term Trend: Bullish (4-Hour Chart)

The 4-hour chart provides a more granular view of the recent price action, particularly the sharp upward spike and the subsequent retracement. While the price briefly touched 0.000006193 (and even higher wicks), it quickly pulled back and is now consolidating around 0.000003988. This suggests that while there was a strong buying impulse, it was not sustained, and profit-taking ensued. Buyers are currently attempting to establish a floor at the 0.000003489 level, which was a significant resistance-turned-support.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.