Lucky Block – Guide, Tips & Insights | Learn 2 Trade Market Expectation – September 28

The Lucky Block – Guide, Tips & Insights | Learn 2 Trade market expectation is for the coin to drive upward. However, the market may experience a brief period of consolidation before an upsurge.

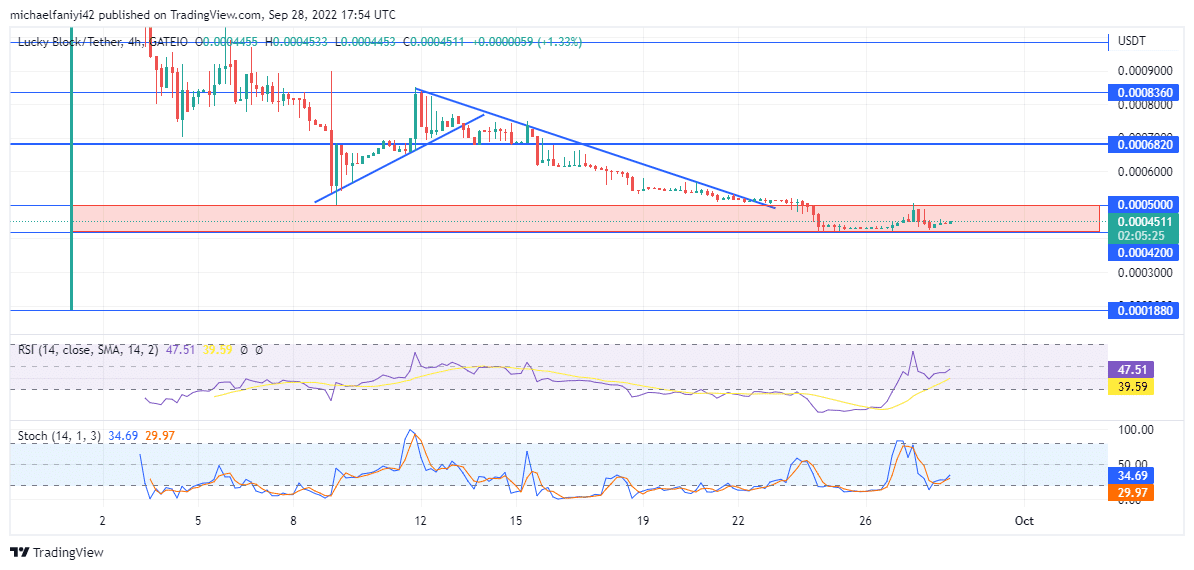

LBLOCK/USD Long-Term Trend: Bullish (4-hours Chart)

Key Levels:

Zones of supply: $0.0008360, $0.0006820

Zones of Demand: $0.0001878, $0.0005060

Lucky Block – Guide, Tips & Insights | Learn 2 Trade Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: LBLOCK/USD Outlook

It has all been part of the plan for Lucky Block – Guide, Tips & Insights | Learn 2 Trade to revive its bullish agenda at a strong key level. No price level gave the required support till the coin dropped into the critical zone between $0.0005000 and $0.0004200.

The buyers have immediately begun work, raising the price from $0.0004200.However, it will take more effort to bypass the limiting level at $0.0005000. Therefore, the price is now recoiling into consolidation before the upsurge.

While the RSI (Relative Strength Index) line has taken a sharp turn and dropped below the zero level, the Stochastic Oscillator lines have dropped right back into the oversold region. An upturn is expected again as the price consolidates.

LBLOCK/USD Medium-Term Trend: Bullish (1-hour chart)

On the 1-hour timeframe, the candlesticks have begun to take an upturn after reaching the $0.0004200 support level. This, in turn, causes the Stochastic Oscillator lines to rise.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.