Bitcoin (BTC) has embarked on a striking rally, catapulting from $27,000 to an impressive $44,000 since early October. While investors eagerly await the approval of bitcoin exchange-traded funds (ETFs) in the United States, another crucial factor appears to be steering the current bitcoin bull run: the decline in interest rates across major bond markets.

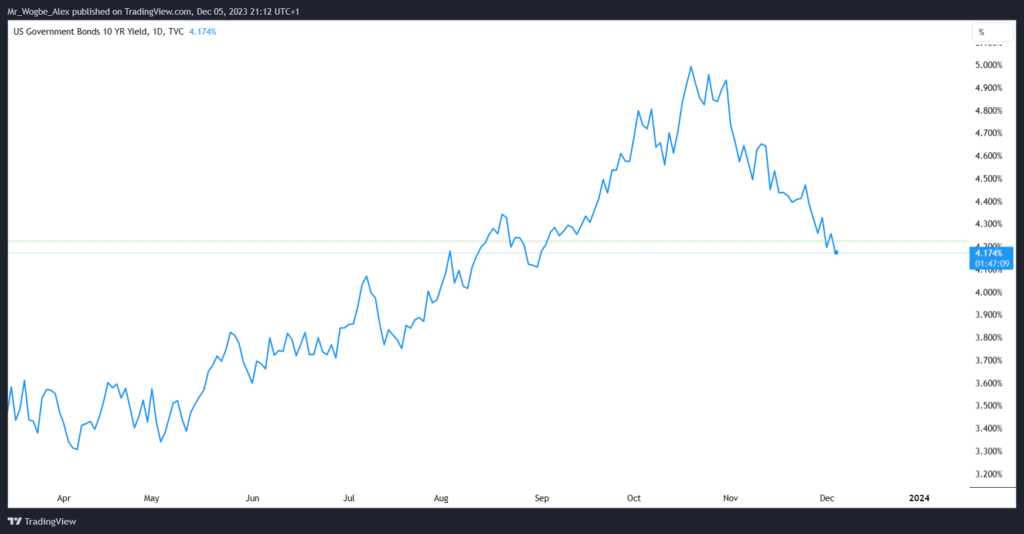

The shift is particularly evident in the U.S. Treasury market, where the yield on the 10-year bond plummeted to 4.171% on Tuesday, marking a significant drop from its 16-year high above 5% in October. Correspondingly, the two-year Treasury yield experienced a dip to 4.60%, down from 5.10% at the start of October.

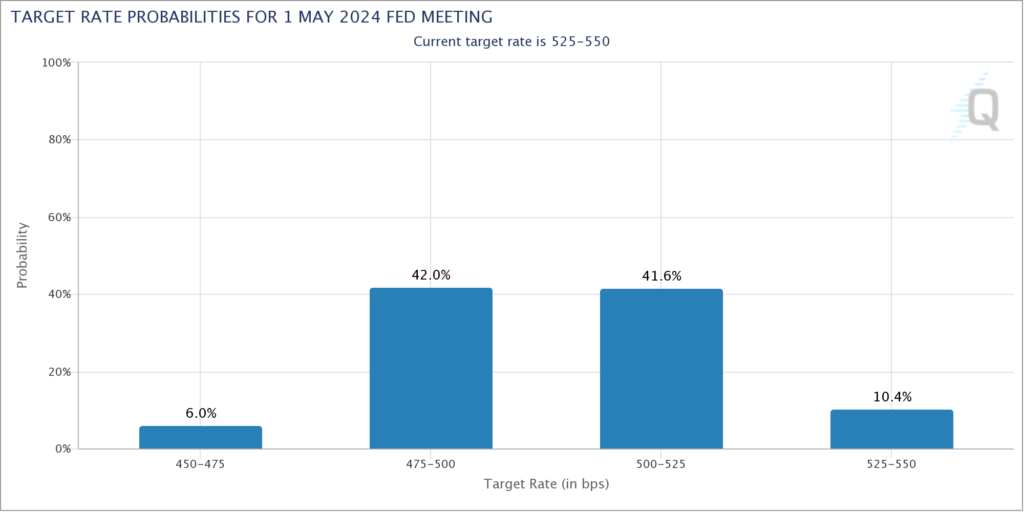

Analysts attribute these declines to the market’s anticipation of a shift in the U.S. Federal Reserve’s monetary policy. There is a growing expectation that the Fed will conclude its 18-month tightening cycle and potentially commence rate cuts as early as the first quarter of 2024. According to the CME FedWatch tool, there is a 55% likelihood of one or more rate cuts by March 2024 and a staggering 90% chance by May 2024.

Lower Interest Rate Expectations in 2024: Pushing Bitcoin Higher

Lower interest rates typically enhance the appeal of riskier assets like stocks and cryptocurrencies, as they reduce the opportunity cost associated with holding them. This shift in sentiment is a stark contrast to 2022 when Bitcoin faced a substantial bear market during the Fed’s aggressive rate hikes. Now, with prospects of a more accommodating policy in 2024, Bitcoin is enjoying a robust recovery.

This positive momentum is not exclusive to Bitcoin; the stock market, as exemplified by the S&P 500, witnessed its 18th-best monthly performance since 1950 in November, delivering an impressive 11% return.

In light of the current landscape, investors are buoyantly optimistic about Bitcoin’s future, fueled by the confluence of potential ETF approvals and the prospect of lower interest rates—factors that have positioned Bitcoin on a bullish trajectory not seen in nearly two years.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.