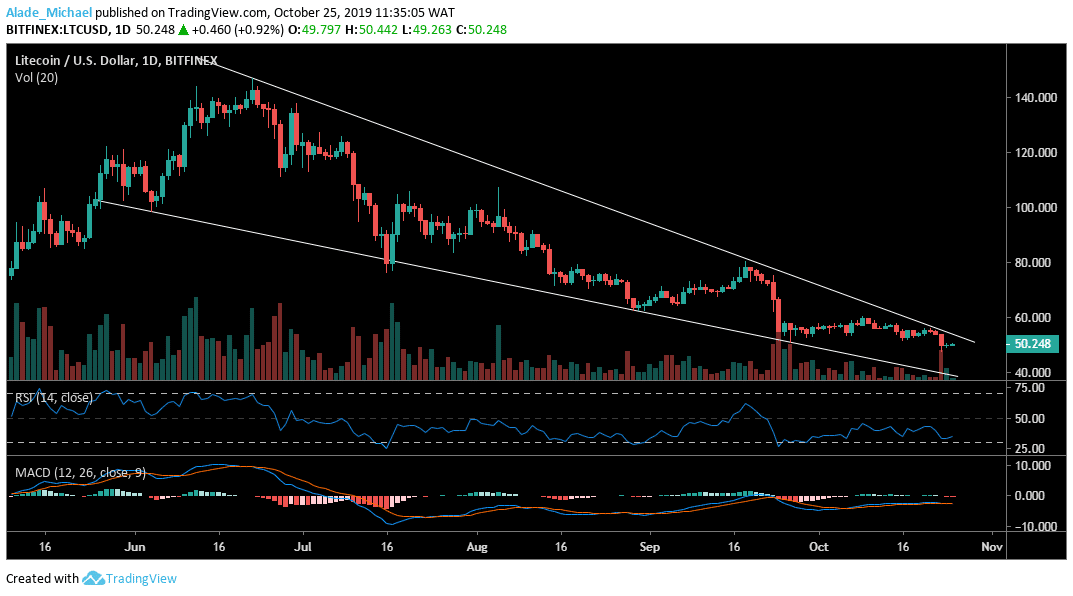

Litecoin (LTC) Price Analysis: Daily Chart – Bearish

Key resistance levels: $55, $60, $78

Key support levels: $47, $43, $40

The daily outlook for Litecoin is dominantly following a bearish bias as the market subdues with price actions. The bears are currently running out of momentum on the intraday trading. Following the October 23 price dump to $47, Litecoin is now recovering towards the wedge’s upper boundary at $55. The market is currently supported by the RSI 50 – correspond with the $47 support.

We may see next support at $45, $43 and $40 if $47 fails to contain selling pressure. Looking at the MACD, the crypto trading signals that the LTC market is still bearish at the moment. A positive cross may trigger a sharp rise above the wedge formation to $60 and $78 in no time. But as of now, the bears are in play.

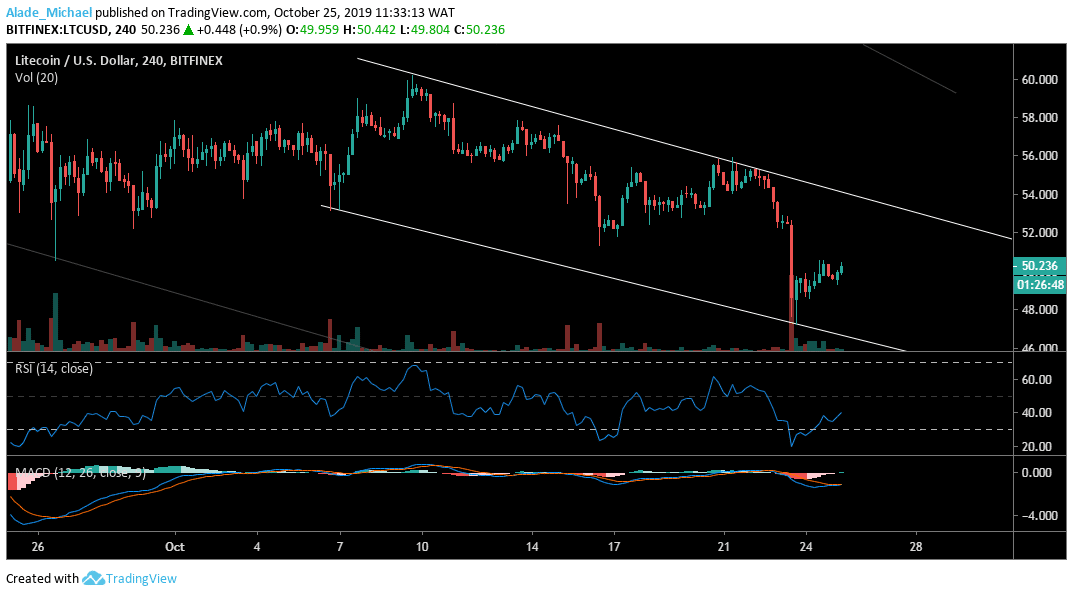

Litecoin (LTC) Price Analysis: 4H Chart – Bearish

Since October 8, Litecoin is maintaining a bearish bias on the 4-hour chart. The price recently fell to the channel’s support $47 after a massive decline but has now bounced off to $50. Despite the slight correction, the bears are still considered to be in control of the market. However, the retracement move is expected to reach the channel’s upper boundary at $52. As we can see, the RSI is rebounding toward the 50 levels.

The MACD has switched to the negative, showing that the bears have assumed control of the market. However, the ongoing price increase has kept the bears in suspense. Resuming pressure might swing the market back to the channel’s support. For now, Litecoin is holding support at $47.

LITECOIN BUY SIGNAL

Buy Entry: $50

TP: $53

SL: $61

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.