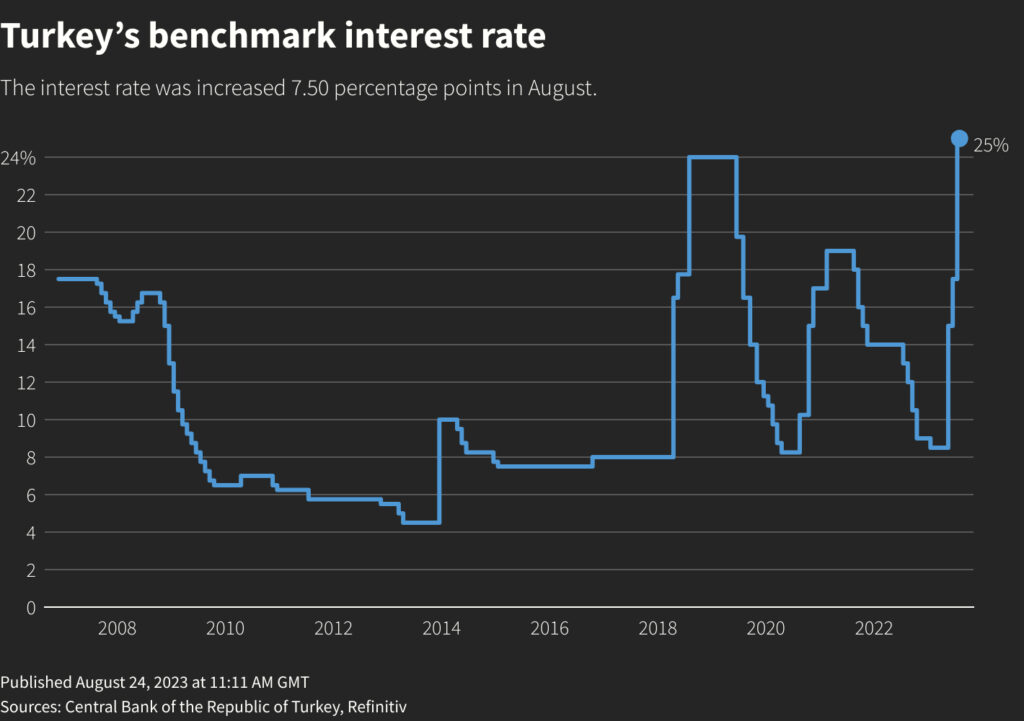

In a move that has taken both experts and markets by surprise, Turkey’s central bank has announced a substantial increase in its key interest rate, raising it by an impressive 7.5% to reach the new level of 25%. This unexpected decision has led to a remarkable resurgence of the Turkish lira, signaling a renewed commitment to addressing the challenge of mounting inflation and underlining a significant shift in the country’s economic strategy.

This daring step places the policy rate at its loftiest point since 2019 and has catapulted the Turkish currency to its most robust position since the middle of July. Over the preceding months, the central bank has consistently lifted its one-week repo rate by a staggering 16.5%, which underscores the bank’s unwavering resolve to confront pressing economic issues head-on.

The bank’s policy committee, now featuring three new members known for their proactive stance, has reiterated its pledge to apply tightening measures “as required, in a timely and gradual manner.” This approach seeks to tackle the soaring inflation rate, which surged dramatically to a concerning 48% just last month.

Economic analysts have hailed this move as a pivotal moment, signifying a departure from unconventional economic policies that had been pursued during the tenure of President Tayyip Erdogan. This strategic shift is anticipated to have a positive impact on quelling the prevailing inflationary concerns that have cast a shadow over the economy.

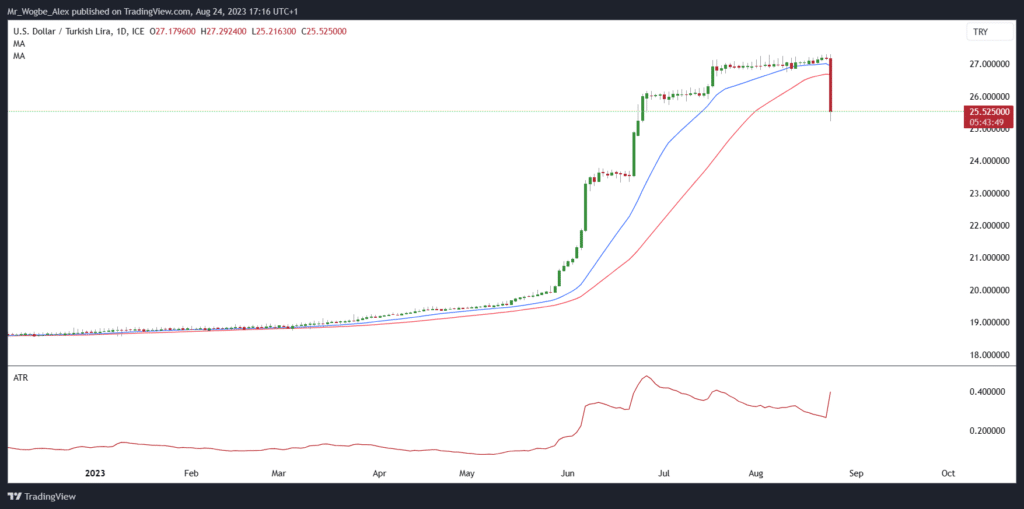

Lira Jumps By 7% Against Dollar

Notably, the Turkish lira had experienced a series of record lows in the weeks leading up to this announcement, with the currency even hitting new lows mere moments before the unveiling of the central bank’s decision. However, the ensuing announcement sparked a rapid recovery, resulting in the lira surging by more than 6% against the dollar.

Earlier today, the USD/TRY forex pair dropped to its lowest point in almost nine weeks at 25.21 TRY, a whopping 7.22% drop. Traders will now be looking to see if the lira can sustain its newfound strength in the coming weeks and months and possibly return to its previous lows near 19 TRY.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.