Solana (SOL) has suffered some really difficult times in recent times after coming under fire by the crypto community for temporarily halting its operations in May.

This time around, the cryptocurrency company have been accused of taking out illegal profits from its SOL token and being an unregistered security token.

Solana investor Mark Young has filed a lawsuit accusing Solana Labs and other key associates of making misleading statements and selling unregistered securities.

According to the case filed on July 1 in which Young is the lead plaintiff, Solana Foundation, Solana CEO Anatoly Yakovenko, crypto-asset management firm Multicoin Capital and its co-founder Kyle Samani, and crypto exchange FalconX were all labeled in the suit.

The lead plaintiff, standing for all investors who bought SOL tokens from March 2020 to date, argued:

“Defendants made enormous profits through the sale of Solana (SOL) securities to retail investors in the United States, in violation of the registration provisions of federal and state securities laws, and the investors have suffered enormous losses.”

The suit further argued that: “Solana Labs founder Anatoly Yakovenko and Kyle Samani of Multicoin had the power and influence and exercised the same to cause the unlawful offer and sale of SOL securities.”

The suit also noted that the defendants spent notable sums to promote the native token in the US since 2020, which helped the cryptocurrency reach an all-time high of $258 and a market value of $77 billion in November 2021.

Key Solana Levels to Watch — July 8

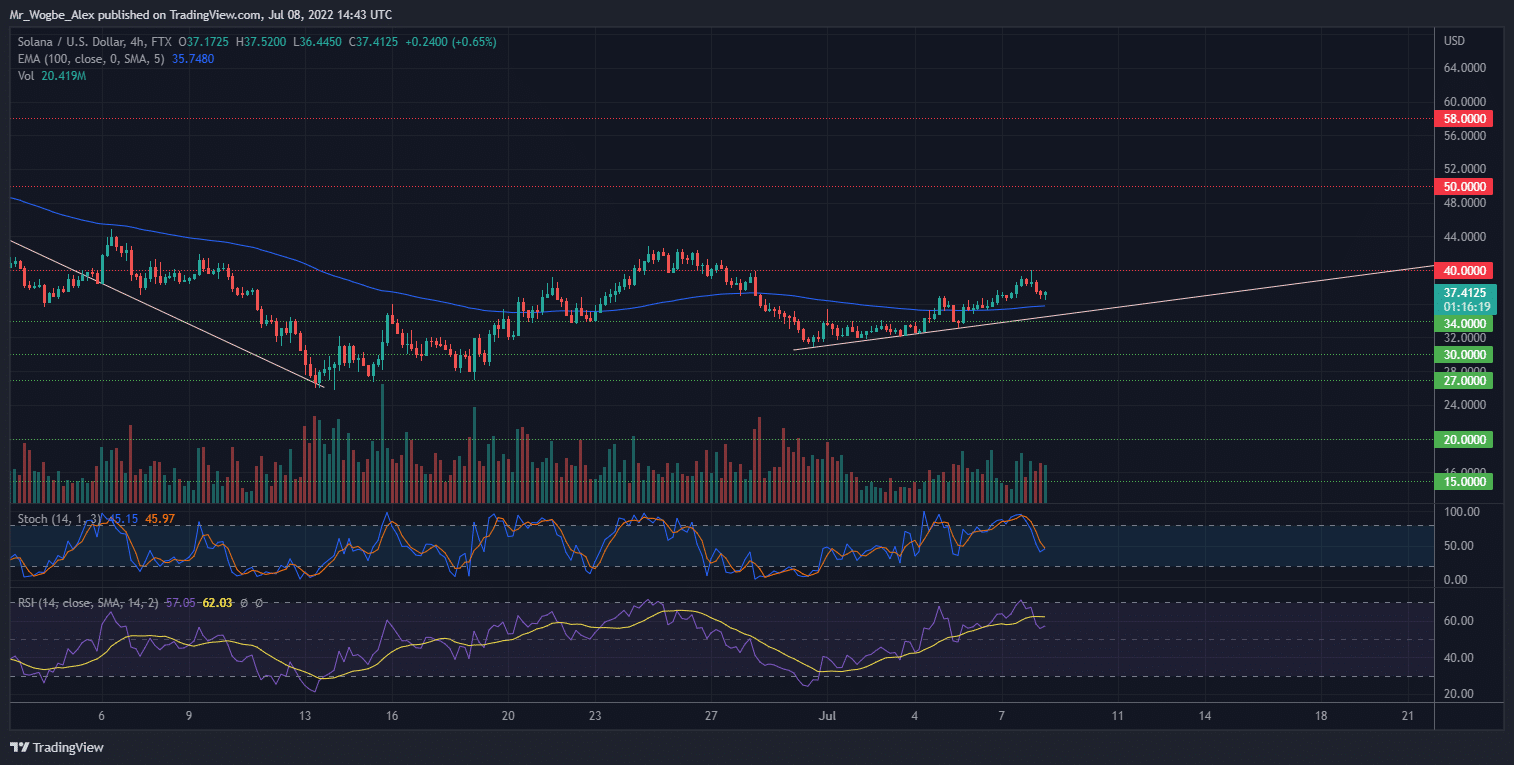

Along with the broader market, SOL recently staged a steady recovery towards the $40.00 mark. However, the cryptocurrency lacked the backing to breach this top and entered a recess towards $35.00, where the 100-day EMA should provide support.

With the prevailing sentiment in the market, we should see a bullish resumption over the coming days, along the trendline highlighted on my 4-hour chart. That said, I do not see a bearish push materializing below the $34.00 support line anytime soon.

Meanwhile, my resistance levels are $40, $50, and $58, and my support levels are $34, $30, and $27.

Total Market Capitalization: $948.8 billion

Solana Market Capitalization: $12.75 billion

Solana Dominance: 1.34%

Market Rank: #9

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.