The Vice President – Head of Financial Reporting at Amalgamated Bank, Andrew Lokenauth argues that Ripple (XRP) would assume the role of “Public Coin” once Ripple Labs concludes its legal tiff with the US Securities and Exchange Commission (SEC).

Lokenauth has engaged in public commentary on cryptocurrencies for years and has held critical positions at Goldman Sachs, AIG bank, and other top financial institutions. The Goldman Sachs expert noted that:

“Ripple will redefine online payments, and I believe that Ripple XRP will likely IPO and go public once its SEC lawsuit is resolved.”

Lokenauth added that the “main benefits of using the Ripple protocol are speed and reduced risk. XRP is a replacement for SWIFT, which is expensive and slow.”

The Amalgamated Bank executive explained that SWIFT, a 50-year-old interbank settlement system, managed the movement of money across borders. Fiat currencies typically take around 3 to 5 days to travel from one country to another via SWIFT and charge exorbitant transfer fees. Ripple, on the other hand, can facilitate cross-border transactions in 5 seconds and at a cheap rate.

In an interview with Cryptopolitan.com, Lokenauth elucidated that the payment solution provider uses the Ripple protocol and can deliver an even faster and cheaper mechanism for interbank payments. He argued that XRP is the future of cross-border payments.

Key Ripple Levels to Watch — September 15

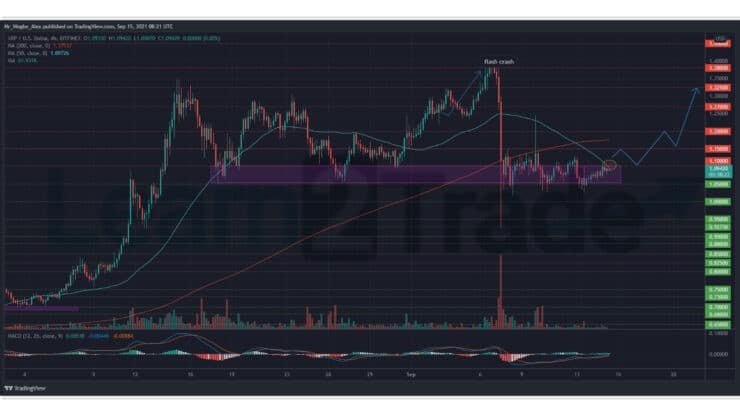

XRPUSD has regained a decent bullish momentum as the price struggles to scale the $1.1000 hurdle. However, the sixth-largest cryptocurrency has spent the last 15 hours battling with that line to no avail.

That said, XRP needs to record a bullish push above the $1.1000 level, where a confluence of technical factors, including the psychological resistance line, the 50-day SMA, and the pivot level. Failure to clear this hurdle could restrict the cryptocurrency in a consolidation range between $1.1000 and $1.0500.

Meanwhile, our resistance levels are $1.1000, $1.1500, and 1.2000, and our support levels are $1.0500, $1.0000, and $0.9500.

Total Market Capitalization: $2.14 trillion

Ripple Market Capitalization: $50.8 billion

Ripple Dominance: 2.38%

Market Rank: #6

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.