In the latest development on the ongoing Ripple Labs vs. SEC lawsuit, Ripple has filed an opposition to the SEC’s letter requesting a two-month extension on the Court-ordered expert discovery deadline, which would drag the case into 2022.

The defendant noted that while it agreed on the deadline for rebuttal expert reports to November 12, an extension on expert discovery should not exceed December 10. The blockchain company asserted that extending expert discovery to January 2022 would “unduly prejudice” it and continue to “freeze” the XRP market in the US.

XRP has suffered an immense price action drawback due to the lingering lawsuit amid massive bullish strides from other cryptos. Ripple suggested that the court consider whether allowing further changes in the schedule at this stage will prejudice the defendants.

The blockchain company explained that every day the case lingers is a day of lost opportunities for it as its US markets remain frozen and that it is “severely prejudicial” to Ripple’s business. The defendant’s arguments read thus:

“The SEC’s claim that its proposed extension “would not prejudice Defendants in any material way” ignores the obvious. The pendency of this lawsuit has significantly hurt the markets for XRP, especially in the United States. Ripple’s cross-border payment product relies on liquid XRP markets. The SEC well knows that within days of it filing its suit, almost 20 exchanges delisted or suspended XRP trading in the United States, and more have since followed suit, critically damaging the market for XRP.”

Key Ripple Levels to Watch — October 20

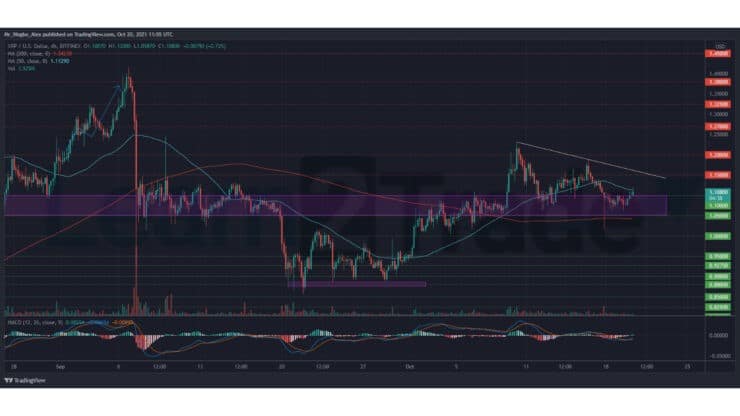

As the lawsuit drags on, XRP has remained incapable of planting a solid footing above the $1.1500 line since September. Instead, the sixth-largest cryptocurrency has posted lower highs on two consecutive upward swings.

With another upswing set to occur shortly, XRP bulls need to force a break above the $1.1500 barrier and our ten-day-long trendline to discontinue the prolonged consolidation around the $1.1000 – $1.0500 pivot zone.

We expect to see a retest of the $1.1500 resistance in the coming days amid the bullish wave racking the Bitcoin market.

Meanwhile, our resistance levels are $1.1500, $1.2000, and 1.2500, and our support levels are $1.1000, $1.0500, and $1.0000.

Total Market Capitalization: $2.55 trillion

Ripple Market Capitalization: $52.3 billion

Ripple Dominance: 2.05%

Market Rank: #6

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.