The drawn-out battle between Ripple Labs and the United States Securities and Exchange Commission (SEC) has taken another interesting turn.

Yesterday, the defendants filed its Sur-Reply on the financial watchdog’s motion to strike the Fair Notice Affirmative Defence. This move was taken to oppose “the SEC’s inappropriate request” for judicial notice and to tackle the Commission’s “misleading characterization of its prior enforcement actions.”

Earlier today, popular attorney James K. Filan took to Twitter to update his followers on the ongoing lawsuit. The tweet detailed that Ripple Labs filed a Letter Motion to compel the SEC to turn over specific notes concerning a 2018 meeting between Ripple CEO Brad Garlinghouse and former SEC executive Elad L. Roisman. However, the plaintiff has refused to grant the order, claiming that “they were privileged.”

The document in question contained a set of “attorney notes” that reflected the meetings between the two executives.

Moving on, Defendant counsel Matthew Solomon recently stated:

“Notes are not privileged and should be disclosed. Notes taken by SEC staff in the context of fact-gathering with third parties do not fall within the scope of the DPP. Even if the information gathered may later be relied on for future policymaking.”

That said, the financial regulator had asserted that the sought-after documents were protected by the deliberative process privilege (DPP).

Key Ripple Levels to Watch — February 11

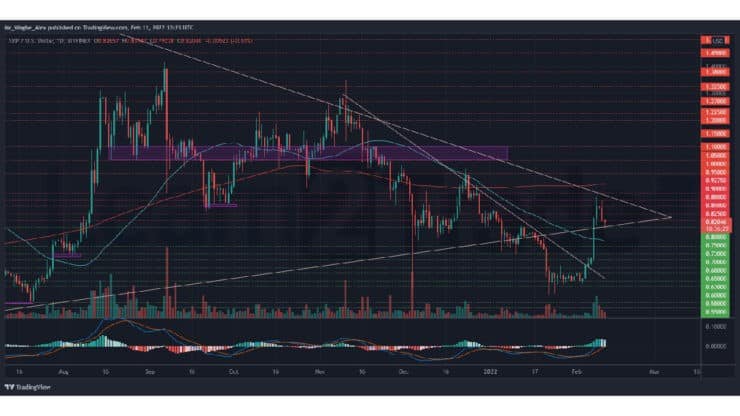

After rallying by over 50% between last Friday and Wednesday, XRP has fallen into a bearish pattern since then. This trend change comes after the sixth-largest cryptocurrency peaked at $0.9275, which, unsurprisingly, coincided with the upper end of my long-lasting wedge pattern.

That said, the bearish trend appears to have lost steam at the $0.8000 support, which coincides with the lower end of my wedge pattern, indicating a possible bullish charge to the $0.9000 level (wedge top) over the coming days. It goes without saying that bulls need to defend the $0.8000 support to see this bullish rebound to fruition.

Meanwhile, my resistance levels are $0.8250, $0.8500, and $0.8800, and my support levels are $0.8000, $0.7500, and $0.7300.

Total Market Capitalization: $1.98 trillion

Ripple Market Capitalization: $39.4 billion

Ripple Dominance: 1.98%

Market Rank: #6

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.