With a central bank-issued euro becoming a medium-term possibility, analysts have said Ripple (XRP) could be dramatically affected.

Olli Rehn, a policymaker at the European Central Bank (ECB), explained in a speech today that the ongoing feasibility study for a digital euro will be concluded in October 2023. Rehn added that following this investigation phase, his organization will then decide whether to forge ahead with the creation of a digital euro or not.

Central bank digital currencies (CBDCs) like the digital euro will serve as a digital alternative for payment settlements. Analysts expect the ECB to push for large-scale adoption of this token if it ever becomes a reality. That said, a digital euro will be in direct competition with cryptocurrencies like XRP, which is used for institution-grade cross-border payment settlements by Ripple.

A digital euro campaign by the ECB will undoubtedly cost Ripple numerous vendors and partners and impinge on its growth and expansion plans. A decline in the growth prospects of Ripple will hurt the price of its native token, XRP.

Meanwhile, analysts also claim that Eurozone authorities are likely to announce a total ban on dollar-pegged Stablecoins, including Tether (USDT) and USD Coin (USDC). Analysts have warned that a ban on Stablecoins in Europe will have a far-reaching negative effect on the general crypto industry.

Key Ripple Levels to Watch — August 24

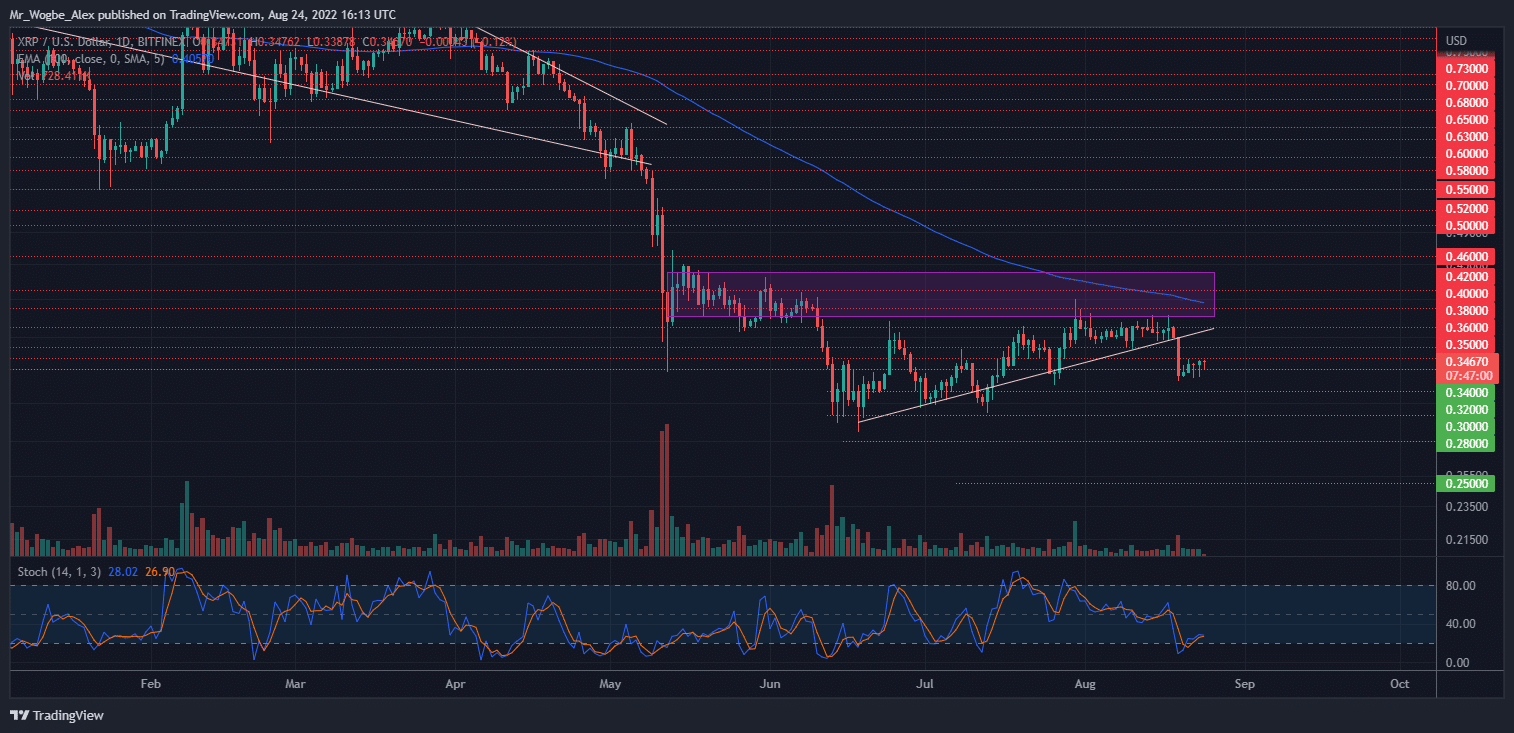

Ripple remains incapable of reclaiming the $0.3500 mark as the broader crypto market continues to struggle with a bearish sentiment. The cross-border payment cryptocurrency needs to return above my ascending trendline before the prevailing bearish sentiment can be lifted.

At this point, everyone is looking to the upcoming Ethereum Merge to usher in some sustained bullish price movements, thereby flipping the market sentiment. However, the question on some lips is: “will the event boost market sentiment,” or has a rally already been priced-in?

Meanwhile, my resistance levels are $0.3500, $0.3600, and $0.3700, and my support levels are $0.3400, $0.3200, and $0.3000.

Total Market Capitalization: $1.04 trillion

Ripple Market Capitalization: $17.1 billion

Ripple Dominance: 1.64%

Market Rank: #7

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.