This inflow of capital has assisted Bitcoin to grow by over $800 from its August low of $11,115 set four days ago as it approaches the all-important $12,000 level. Bitcoin has now cleared the strong $11,650 – $11,800 resistance region just today.

Some analysts are now asking if this the beginning of a fresh bull run, which could take BTC to a new YTD high, or if it is just another ploy by whales to precipitate a pump and dump momentum to shake out ‘weak hands.’

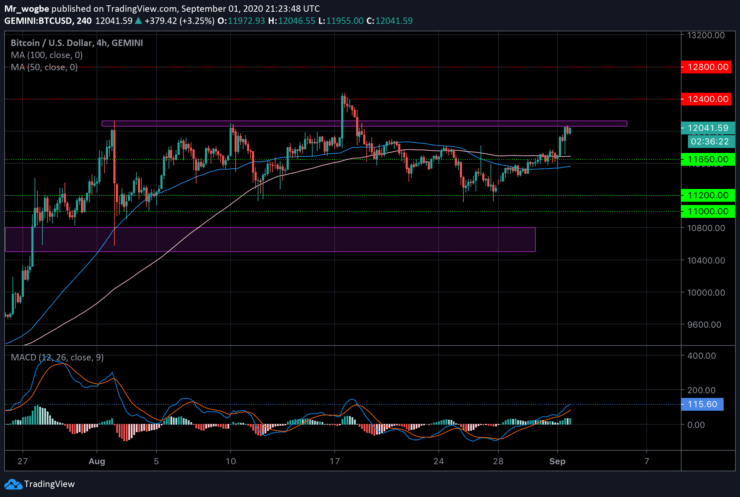

Based on our 4-hour chart, the 50 and 100 Simple Moving Average have intersected, suggesting that bulls are highly favored currently.

The major worry, at press time, is that BTC is now venturing into overbought territories, which could mount pressure on Bitcoin and cause trading bots to dump the market. This could trigger a fresh selloff in Bitcoin.

Key Levels to Watch

Currently, Bitcoin is trapped around the strong $11,995 level which has remained unbroken for a few weeks now. The benchmark cryptocurrency needs to clear this level to open it up to higher hurdles.

If the crypto picks up momentum, the first hurdle to overcome is the $12,056 pivot zone followed by the YTD-high of $12,400, and finally the $12,800 weekly resistance.

That said, if this volatility-rush turns out to be a whale manipulation pattern, then we should expect a sharp correction to the downside ($11,650 and lower)in the near-term. From there, Bitcoin could experience another bout of consolidation before attempting a recovery.

Total market capital: $392 billion

Bitcoin market capital: $222 billion

Bitcoin dominance: 56.6%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.