Ethereum (ETH) has remained the worst performer among the top five cryptocurrencies in 2022. The pioneering DeFi blockchain has plunged below the $1,800 level again amid worsening retail and institutional selling pressure.

Ethereum has strayed by about 63% away from its all-time high of $4,868 recorded in November 2021. Consequently, a large percentage of ETH wallets are in significant losses. On-chain analytics platform Glassnode revealed that only 58% of Ethereum addresses are in profit, the lowest level since July 2020.

That said, the number of dormant ETH addresses has recorded a notable spike following the recent dip in the percentage of profitable wallets and a damaging decline in institutional inflows. Glassnode also noted that the ETH supply that has been active for at least five years has tapped an all-time high of 9.61 million tokens today.

Meanwhile, the most notable development on the Ethereum network in recent weeks was the declining gas fee amid the plummeting number of transactions on the network.

On-chain sentiment analysis platform Santiment detailed in a recent report:

“ETH continues to show extreme low fee levels, indicating very minimal activity and hints of stagnancy and fear. This hibernation behavior also applies to ETH’s often paired stable coin, DAI.”

Key Ethereum Levels to Watch — May 27

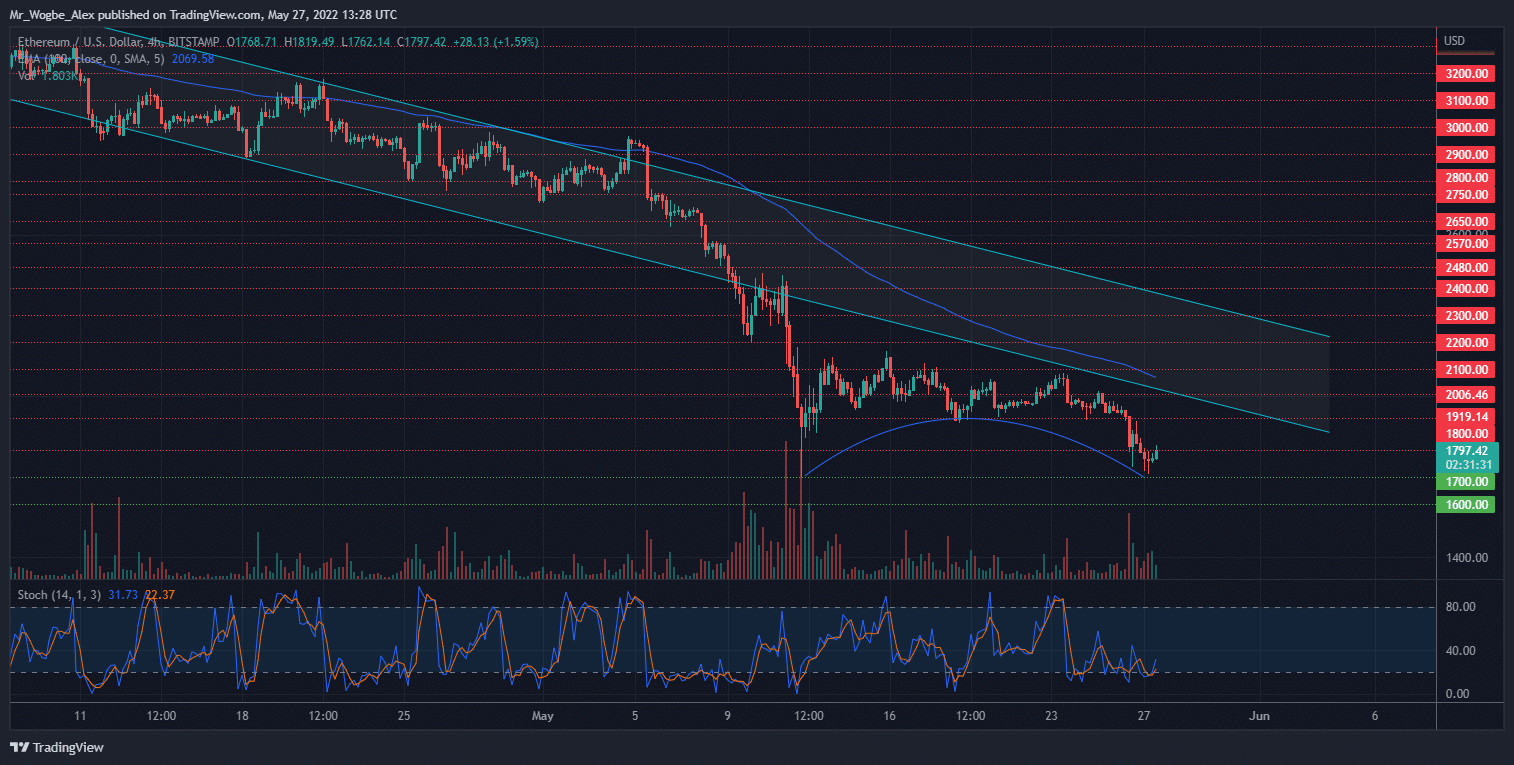

ETH has retested the $1,700 May 12 low yesterday, following a renewed sell pressure in the market. This bearish resumption comes after a prolonged consolidation between the $2,100 and $1,900 levels, as bulls remain subdued and inactive.

While the second-largest cryptocurrency has recorded a mild rebound to the $1,800 mark, we could see a bearish return to fill the wick towards the $1,700 low. That said, we could see a bearish stall over the weekend with a sharp drop in the Asian market open on Sunday.

Meanwhile, my resistance levels are $1,900, $2,000, and $2,100, and my support levels are $1,700, $1,600, and $1,500.

Total Market Capitalization: $1.21 trillion

Ethereum Market Capitalization: $217.9 billion

Ethereum Dominance: 17.9%

Market Rank: #2

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.