Ethereum Classic (ETC) and two other cryptocurrencies have made it to the Grayscale Investments trust basket. The largest digital asset manager recently added the Ethereum Classic Trust, Bitcoin Cash Trust, and Litecoin Trust to its list of SEC reporting products, bringing the total number of this basket to six.

The announcement came from the firm’s CEO, Michael Sonnenshein, in an interview with Forbes. Sonnenshein revealed that the new funds comprised the Grayscale Bitcoin Cash Trust (BCHG), the Grayscale Ethereum Classic Trust (ETCG), and the Grayscale Litecoin Trust (LTCN). The chief executive officer added that:

“This is something that investors not only have expressed wanting but something that we feel they deserve.”

The introduction of SEC reporting companies has “opened Grayscale to a wider audience of investors who are typically used to seeing that [type of reporting] when they think about making investments.”

That said, Grayscale has an instituted lock-up period for its investments, and only recently, the firm reduced this lock-up period from twelve to six months. The company’s first three trusts include the Bitcoin Trust, the Ethereum Trust, and the Digital Large Cap Fund.

Meanwhile, Grayscale’s AUM has surged significantly over the past few years. As of September 9, the firm had a total AUM of $43 billion, with the Bitcoin Trust (GBTC) accounting for over $30 billion.

Key Ethereum Classic Levels to Watch — September 10

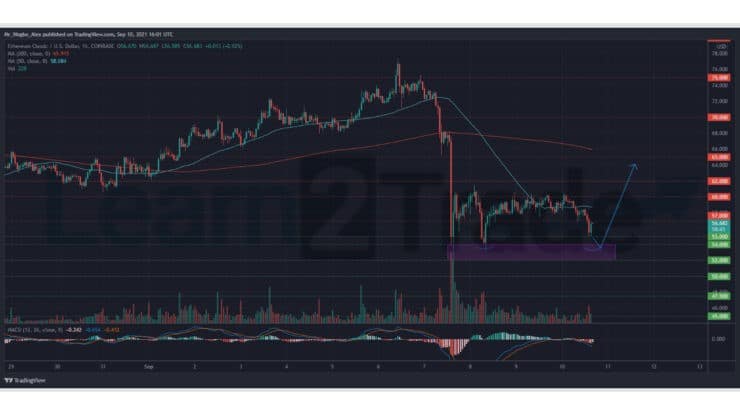

Following the recent flash crash, which affected most of the crypto market, ETC fell into a sideways bias between $60 and $57. However, this prolonged consolidation in the twenty-sixth-largest cryptocurrency appears to have given way to more bearish price action as ETC dropped to the $55 mark earlier today, a 5.29% intraday decline.

That said, we expect the bearish movement to end the $54 mark, where a double-bottom pattern would emerge on our hourly chart and could facilitate a significant rebound to the $65 area. However, a sustained drop below the $54 mark could open the doors to $50.

Meanwhile, our resistance levels are $57.00, $59.00, and $60.00, and our support levels are $55.00, $54.00, and $52.00.

Total Market Capitalization: $2.06 trillion

Ethereum Classic Market Capitalization: $7.35 billion

Ethereum Classic Dominance: 0.35%

Market Rank: #26

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.