Ethereum Classic (ETC) saw a massive bull run last week, recording a +200% increase and triggering a bull market. The ETC began the week with a price of $44 and printed a new record every day leading up to its price peak of $175 on Thursday.

Although this is a positive development for the sixteenth-largest cryptocurrency, many market participants were taken by surprise by the rally and missed out on the rally.

Admittedly, Ethereum Classic has not been a relatively stable or trustworthy cryptocurrency considering its previous price performance. Last year, the Ethereum hard fork saw several 51% dips, which decimated its reliability and triggered a hash rate decline for the cryptocurrency. Consequently, Ethereum Classic lost status across the market, with exchanges requesting thousands of confirmations to acknowledge a deposit.

These reasons explain why investors were skeptical and hesitant about last week’s surge. However, the rally seen in the ETC has been traced to its big brother, Ethereum.

Ethereum recently announced that it would be switching its consensus mechanism to a proof of stake system towards the end of the year. The switch means that Ethereum miners will have to migrate to a different network to continue their activities, and what better network to migrate to than an Ethereum lookalike. That said, the expectation that Ethereum miners would troop into the Ethereum Classic network triggered last week’s rally.

Key ETC Levels to Watch — May 10

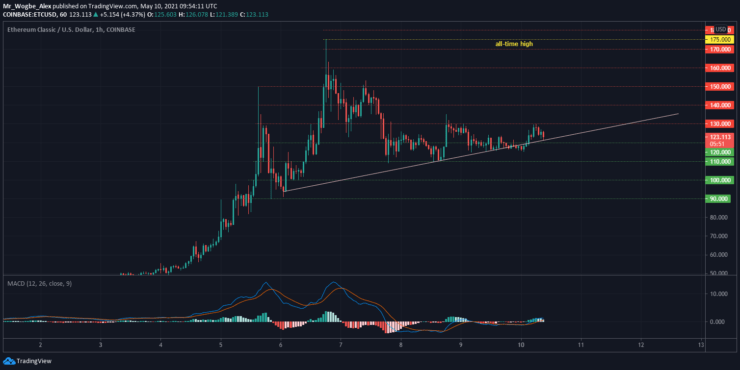

Following its recent peak at $175, ETC has suffered a 30% decline. After bottoming out at $110 three days ago, Ethereum Classic has had difficulty breaking above the $130 resistance. That said, the cryptocurrency is currently trading along an ascending trendline, making a break above the crucial $130 resistance over the coming hours likely.

However, the ETC could fall into consolidation and subsequently correct lower if it falls below the trendline.

Meanwhile, our resistance levels are $130, $140, and $150, and our support levels are $120, $110, and $100.

Total Market Capitalization: $2.47 trillion

Ethereum Classic Market Capitalization: $14.2 billion

Ethereum Classic Dominance: 0.57%

Market Rank: #16

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.