Trading volume for Dogecoin (DOGE) grew by 13 fold in the second quarter of 2021, almost recording $1 billion in daily trading volume.

According to a report by Coinbase reported by Business Insider, the DOGE trading volume spiked by over 1,250% between April and June, with an average of $995 million worth of coins exchanging hands daily. For context, the average trading volume for Dogecoin in Q1 was a measly $74 million on average.

DOGE began the year at $0.004 and recorded the start of its ascent in early February, following a 50% jump in prices when billionaire CEO Elon Musk started campaigning for the meme-coin on Twitter. A massive bull run followed after Musk’s campaigns and culminated in a massive 18,000% price growth since the start of the year.

While many crypto community members have attributed the meteoric rise seen in Dogecoin to Musk’s Twitter-shilling, Business Insider asserts that the cryptocurrency’s thrilling performance would not have occurred without the increased listing of DOGE on top exchanges seen in Q2.

According to the Coinbase report, Q2 also saw global cryptocurrency trading volume spike by 32% overall, recording a daily average of $19 billion. The report also revealed that DOGE accounted for over 5% of the combined crypto volume in Q2.

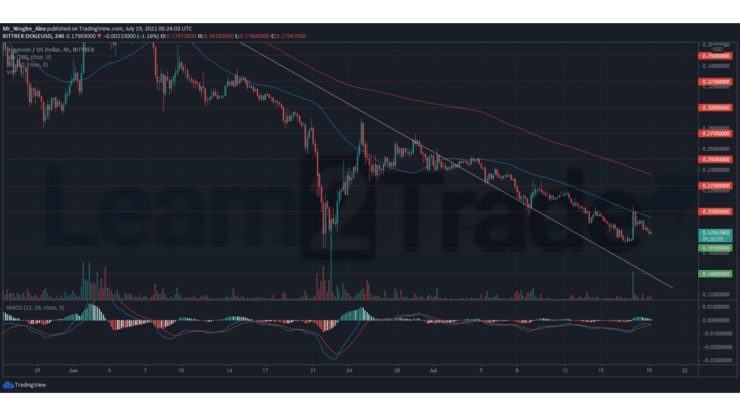

Key Dogecoin Levels to Watch — July 19

Dogecoin remains under intense bearish pressure under the critical $0.2000 resistance as the crypto market remains in a sideways momentum. The eighth-largest cryptocurrency moved above the $0.2000 resistance following an Elon Musk-induced bullish breakout but got immediately rejected by bears and the 50 SMA.

DOGE needs a break above the $0.2000 level to reestablish a modest bullish momentum. The coming hours and days would be very crucial for the cryptocurrency and the crypto market at large.

Meanwhile, our resistance levels are $0.2000, $0.2250, and $0.2500, and our support levels are $0.1650, $0.1500, and $0.1400.

Total Market Capitalization: $1.29 trillion

Dogecoin Market Capitalization: $23.4 billion

Dogecoin Dominance: 1.8%

Market Rank: #8

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.