The cryptocurrency appears to have benefited from the recent bearishness in the US dollar (DXY). This has sent both gold and Bitcoin, as well as the equity markets, flying.

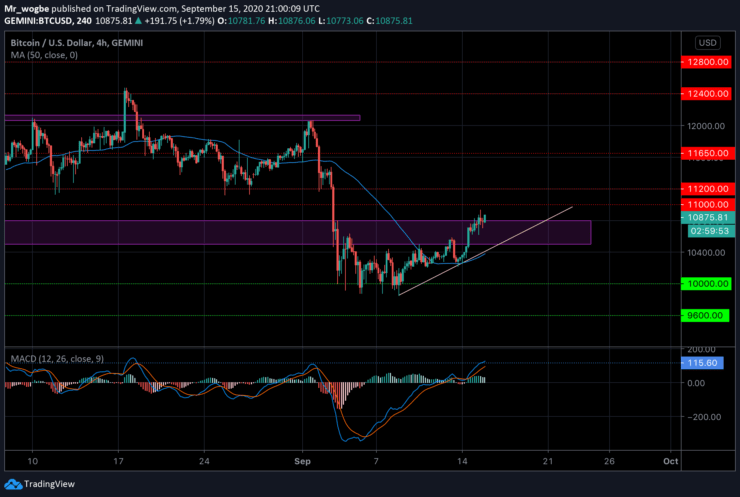

Today’s price action, coupled with yesterday’s, is beneficial for the cryptocurrency’s near-term outlook. However, it is worth mentioning that BTC is yet to break above the $11,000 key resistance.

An analyst has cited that BTC is currently trading under a key technical resistance line and that its reaction to this level will establish a near-term trend.

Meanwhile, some fundamental factors are acting against BTC, including the discovery that many traders are selling their BTC at a loss rather than with a profit. This could be an indication that recent top buyers are using this rally to offload their holdings.

Some analysts are hopeful that BTC will continue to scale more highs as technical and fundamental factors suggest further upside gains are imminent.

Key BTC Levels Watch

Based on sights from our chart, it is clear that BTC’s recent price action is tilting towards the upside.

At press time, Bitcoin is trading up at 1.8% at its current price of $10,875, the highest point for the cryptocurrency in over a week. This marks a significant rise from its recent $9,880 low, however, it is still far from its $12,400 YTD-high.

The ascending trendline is expected to strongly support Bitcoin against any drop in the near-term. There’s a confluence of indicators ($10,500 support line, ascending trendline, and 50 SMA) at the $10,500 price point, suggesting that a drop below that level might be unlikely in the near-term.

Total market capital: $348 billion

Bitcoin market capital: $200 billion

Bitcoin dominance: 57.4%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.